Ethereum’s Price: A Most Unsettling Drama! 💸

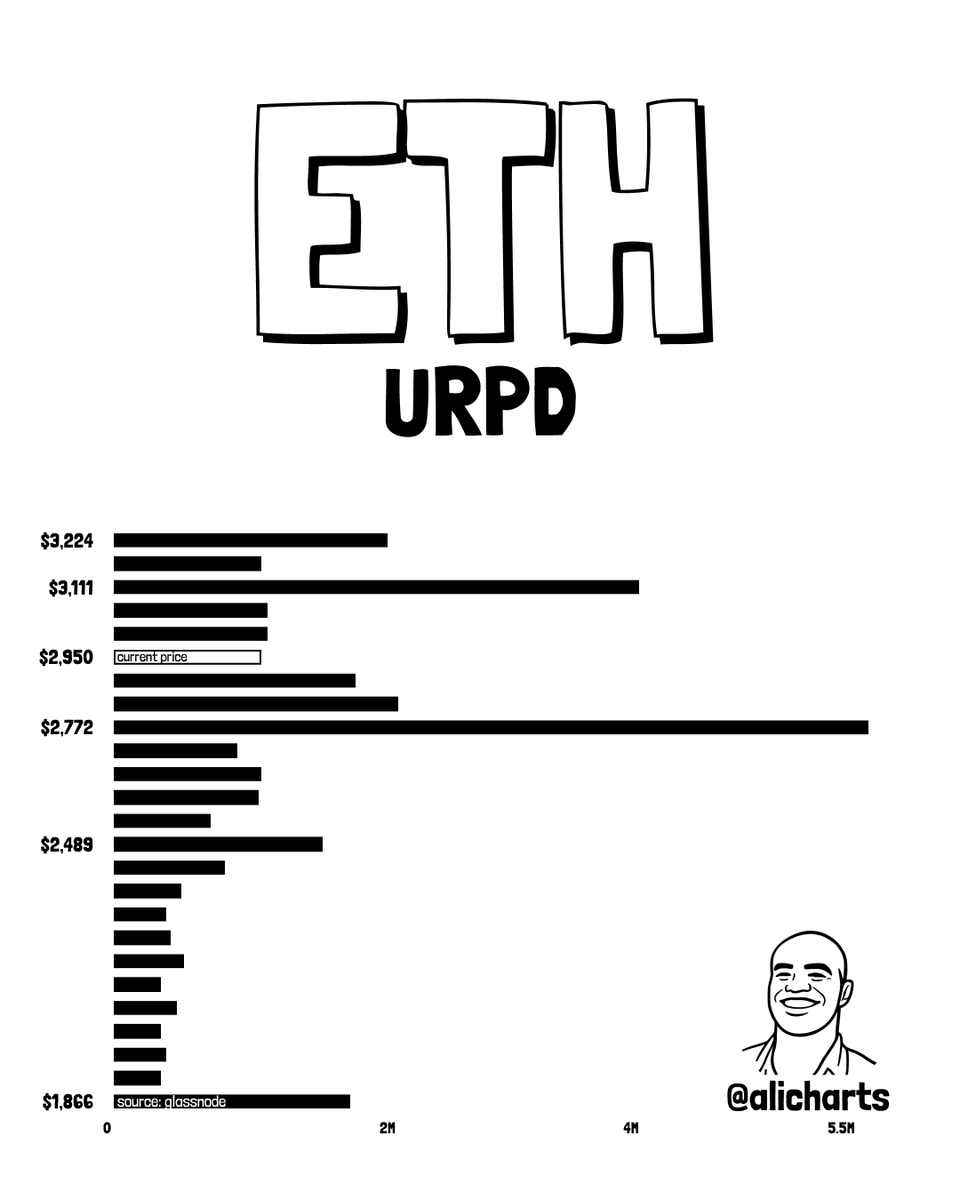

Now, however, the price has retreated some forty percent from that peak, causing many a nervous investor to clutch their pearls. Mr. Ali Martinez, a gentleman of some repute in these financial circles, has kindly provided his observations, highlighting certain price levels upon which the hopes of the bullish speculators now rest. One wonders if such prognostications are worth the paper they are written on… or, rather, the digital space they occupy.