Cardano’s Rollercoaster: Is Profit-Taking About to Spoil the Fun?

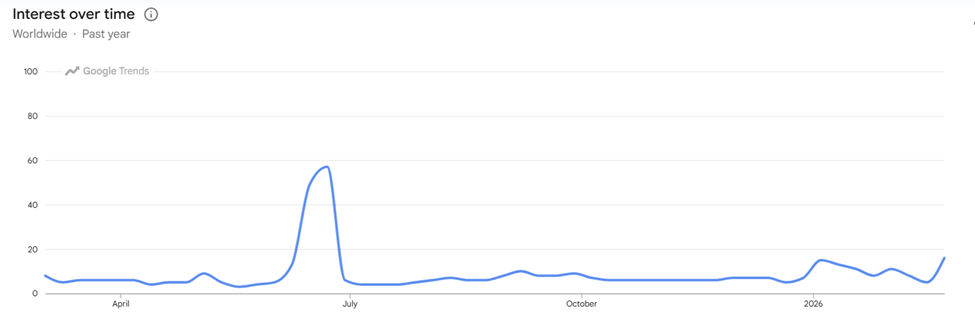

As I write this, ADA is sitting right in the middle of these key support and resistance levels-like Goldilocks, not too hot and not too cold. Trading volume decided to join the party over a rather volatile weekend, probably because it heard about the exciting news from the 25th of February.