Why Bitcoin’s Latest Plunge is the Most Dramatic Drama Since Your Last Family Reunion

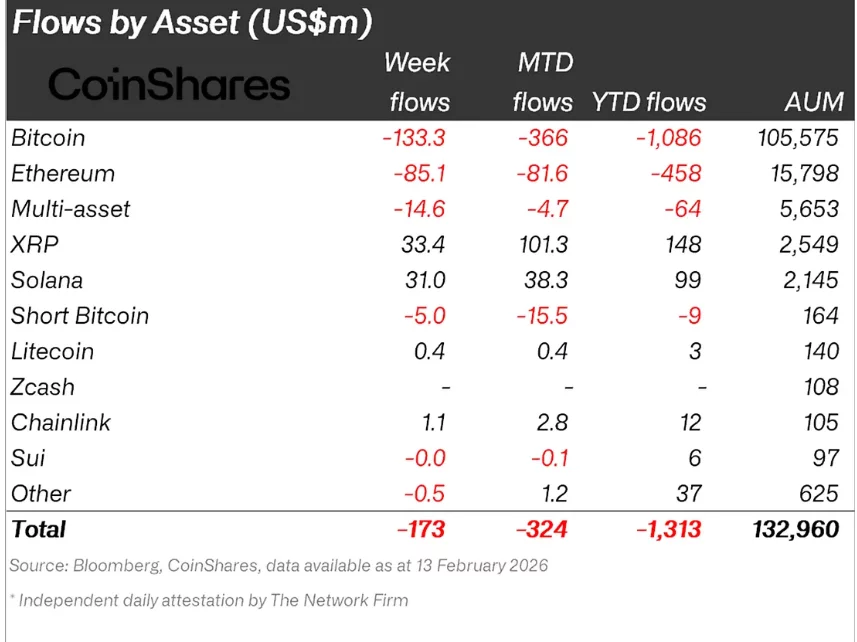

According to some hot gossip from X (which I’m pretty sure is just Twitter wearing a new outfit), analyst Maartunn from CryptoQuant has spilled the tea on this latest trend. This illustrious metric, as the name suggests, is supposed to tell us whether the cryptocurrency market is feeling bullish or bear-ish. Spoiler alert: it’s not feeling great.