Chainlink & SBI: A Revolutionary Leap or Just Digital Hype? 🤔💥

issue, settle, trade – all neatly packaged like a financial bento box. 🍱💸

issue, settle, trade – all neatly packaged like a financial bento box. 🍱💸

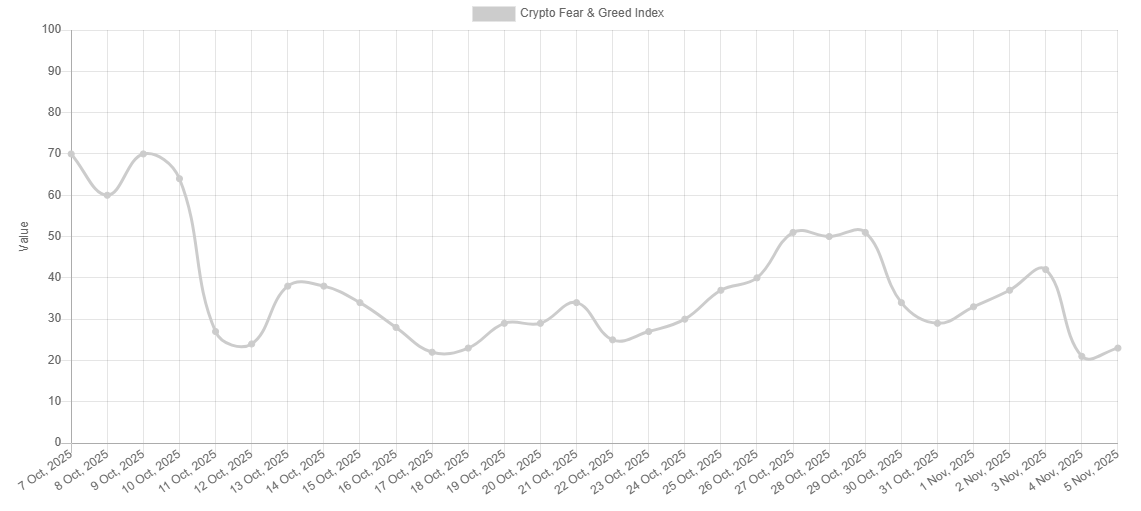

When queried by Fox Business this past Wednesday on whether he was “concerned” about Bitcoin (BTC) dipping beneath the lofty $100,000 mark-a calamity that left much of the crypto market in a state of collective distress over the preceding week-the Mayor, ever the crypto enthusiast, responded with unwavering composure. 😌

Behold! The dreaded Death Cross has arrived for Dogecoin, like an uninvited guest at a party who eats all the snacks and then complains about the music. When the 50-day average crosses below the 200-day average, even your grandma’s cat knows it’s time to panic-sell 🐱💸.

Tokenized equities leader Dinari announced a significant collaboration with Chainlink and S&P Dow Jones Indices (S&P DJI). The companies are jointly creating the S&P Digital Markets 50 Index as one of the first indices that can verifiably run on a blockchain. Specifically, the tokenized index will launch in the fourth quarter of 2025. 🧛♂️💸

Alex Thorn, Galaxy’s resident oracle, dubs this epoch Bitcoin’s “maturity era.” 🧓✨ Institutional funds, he claims, have transformed our dear Bitcoin into a sedate gentleman, more gold than tech stock. “Passive investment dominates,” he quips on X, “but slower gains are the price of elegance.” 🕶️💎

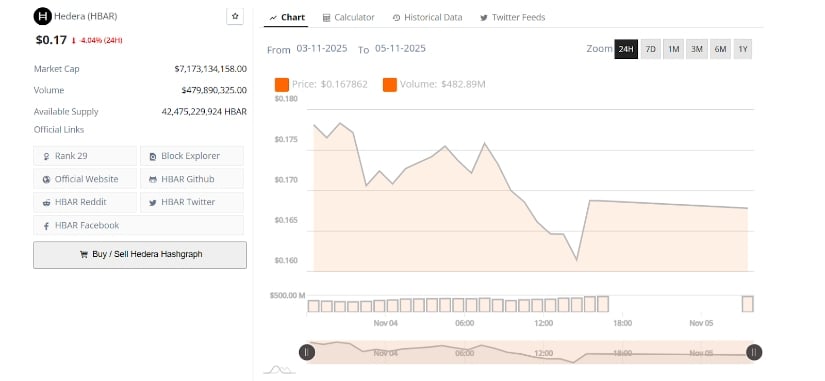

Hedera Hashgraph clings to the $0.17 mark like a drunkard to a lamppost, teetering on the edge of despair after a 4% plunge. It opened near $0.175, only for sellers to crash the party, dragging it down to $0.16. A feeble recovery to $0.168 followed, but the dance remains a slow-motion waltz with gravity. 🌀

And what of the U.S. equities? They too have succumbed to the fear of the artificial intelligence bubble, a modern-day Frankenstein monster of our own making. Bitcoin, once the darling of the financial world, now clings to a meager 8% gain this year, outshone even by the ancient, steadfast gold. 🏆✨

According to a press release dated Nov. 5-a date that shall henceforth be known as “The Day the Blockchain Stood Still”-Dinari has joined forces with Chainlink and S&P Dow Jones Indices to bring the S&P Digital Markets 50 Index onchain later this year. One can only imagine the champagne corks popping in boardrooms across the globe. 🍾

The leading digital asset, our dear BTC, has been on a downward spiral more tragic than a Shakespearean hero. A 10% plunge in a week? Why, yes! And on November 4th, it dipped to $99,000, a price so pitiful it could make a goldfish weep. But if you’re curious about the melodrama behind this crash, do peruse our dedicated article-it’s thrilling stuff. 🎭