Crypto News

ADA’s Daring Comeback: A Tale of Bulls and Market Theatre

This peculiar cohesion, though fleeting as a summer romance, suggests an inexorable tide of confidence near ADA’s accumulation zone. Retail optimism, steadfast as a landed baronet’s resolve, persists, yet the truly magnanimous (and wealthy) smart-money crowd wield their influence with far greater precision. Did you know that a timely shift in liquidity is but a whispered invitation for fortunes to pivot? 😏

Ripple Backs Openeden Because Even Crypto Bros Need Adult Supervision 😏

On Dec. 1, Openeden announced it convinced Ripple, Lightspeed Faction, and Gate Ventures (among others) to throw money at its “real-world asset” tokenization dreams. Because if there’s one thing Wall Street loves, it’s slapping the word “tokenized” on old-school financial products and calling it innovation. 🚀

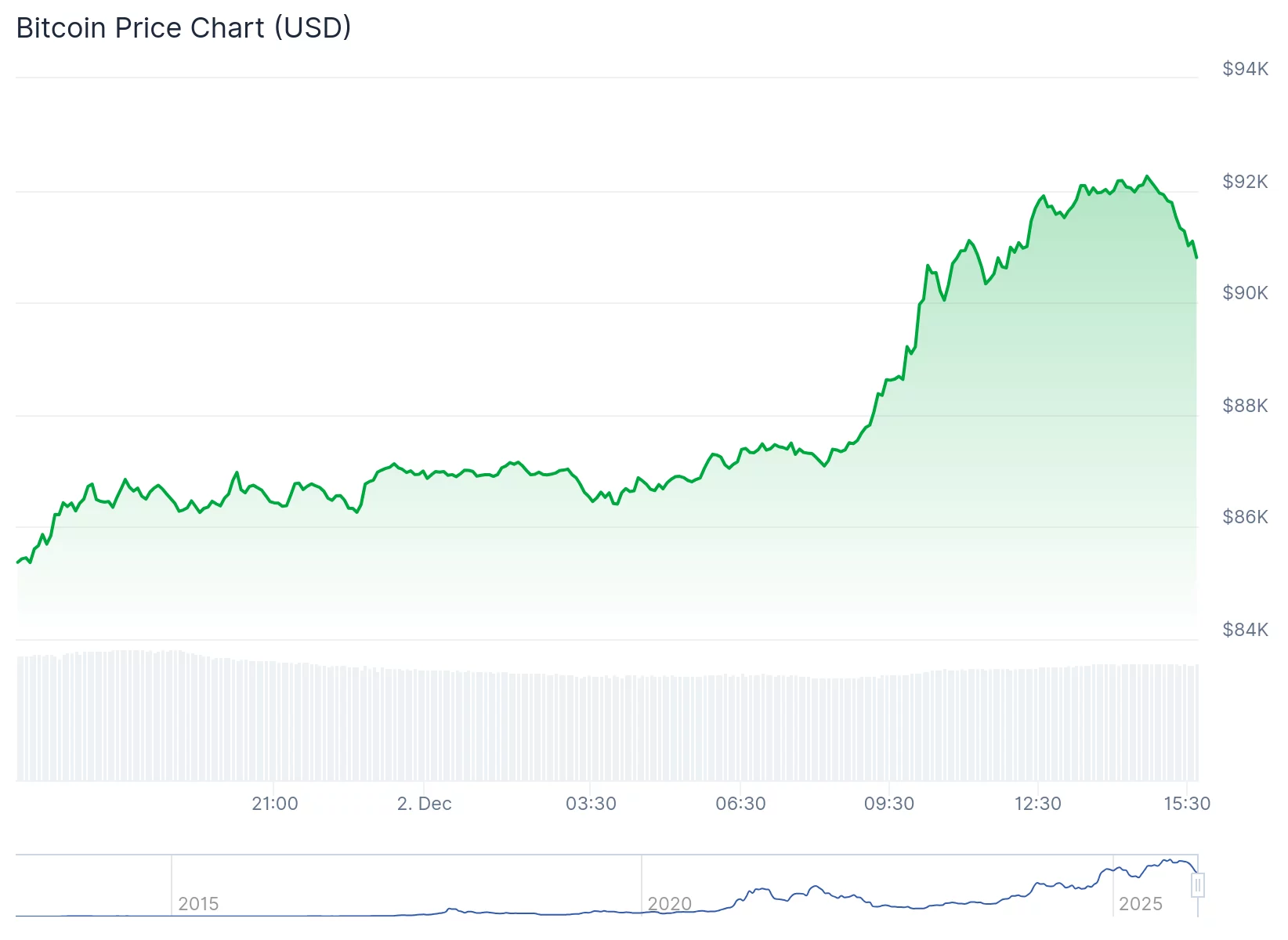

Bitcoin Skyrockets to $93K-Is $100K the New Black?👀

“This is what you’d want to see. [Bitcoin] coming back up again, after a weird move down on the 1st of this month,” said Michaël van de Poppe, because apparently, even crypto geniuses need a good old-fashioned shrug. Maybe he’s just relieved there’s still some life in this digital junk drawer? 💸

Ethereum’s Big Makeover Tomorrow! 💸✨ Will It Save Crypto or Just Confuse Us More?

Brace yourselves, crypto folks! On Dec 3, 2025, at 21:49:11 UTC, Ethereum will officially enter its “next era” with Fusaka – a fancy name for a pile of upgrades that nodes are probably doing cartwheels over. 🤸♂️

Bitcoin’s 30% Dip: A Tragicomedy in the Making, or Just Another Tuesday? 🚀💸

In the grand theater of finance, this latest tumble is but a minor act, a fleeting flaw in the star-studded saga of cryptocurrency. Since the dawn of 2010, Bitcoin has undergone nearly fifty such downward duels, averaging a 30% fall-hardly tragic, more like a city-wide picnic in comparison. And yet, here we stand, trading above the $90,000 mark, as if nothing untoward has happened.

Stablecoin Rules Dropping Sooner Than Your Ex’s Texts After Midnight 🍿

Reports say this initial proposal is all about the “application framework”-basically, the bureaucratic red tape, disclosures, and standards firms need to jump through to get approved. 📑 Think of it as the DMV of stablecoins, but with more at stake than your driver’s license photo.

Bitcoin and Gold Face Off: The Market’s Most Dramatic Plot Twist Yet! 🚨💰

Bitcoin and gold are playing a game of “Who’s the Real Safe Haven?” the charts say they’re squishing together tighter than a squirrel in a nut scarcity. Tony “The Bull” Severino-who, I am told, has a name that sounds like he’s either a bull rider or a 1960s jazz band-points out that Bitcoin is hanging on the lower Bollinger band, which sounds like a fitness trend but is actually a fancy chart thing. If Bitcoin closes below it, it’s like giving the market a green flag to go dash off into the sunset-or, more likely, into a bear hug from a bear.

Fed Chair’s George Shultz Tribute: Economy? Not Today! 😒📉 #PowellPokerFace

Economists were left more confused than a chimp with a calculator on Monday evening after Fed Chairman Jerome Powell delivered his tribute to late Reagan-era diplomat and economist George Shultz at Stanford University’s Hoover Institution. Markets were bracing for any additional hints about the direction of interest rates ahead of the central bank’s Federal Open Market Committee (FOMC) meeting next week. But Powell was mum on the issue and made it abundantly clear from the outset that no hints were coming. Because nothing says “I care about the economy” like a 45-minute eulogy for a man who’s been dead for 10 years. 💀📈

Altcoins Rise Like Phoenixes-But Bitcoin Still Rules the Roost! 🚀

Behold! Fresh scrolls from the oracle Santiment revealed that social media, that grand puppeteer of sentiment, yanked the strings from “panic” to “hope” with all the subtlety of a drunken puppeteer. Analysts, scratching their heads, declared it a “crowd-driven reversal”-as if the crowd hadn’t just collectively misplaced their keys. 🔑