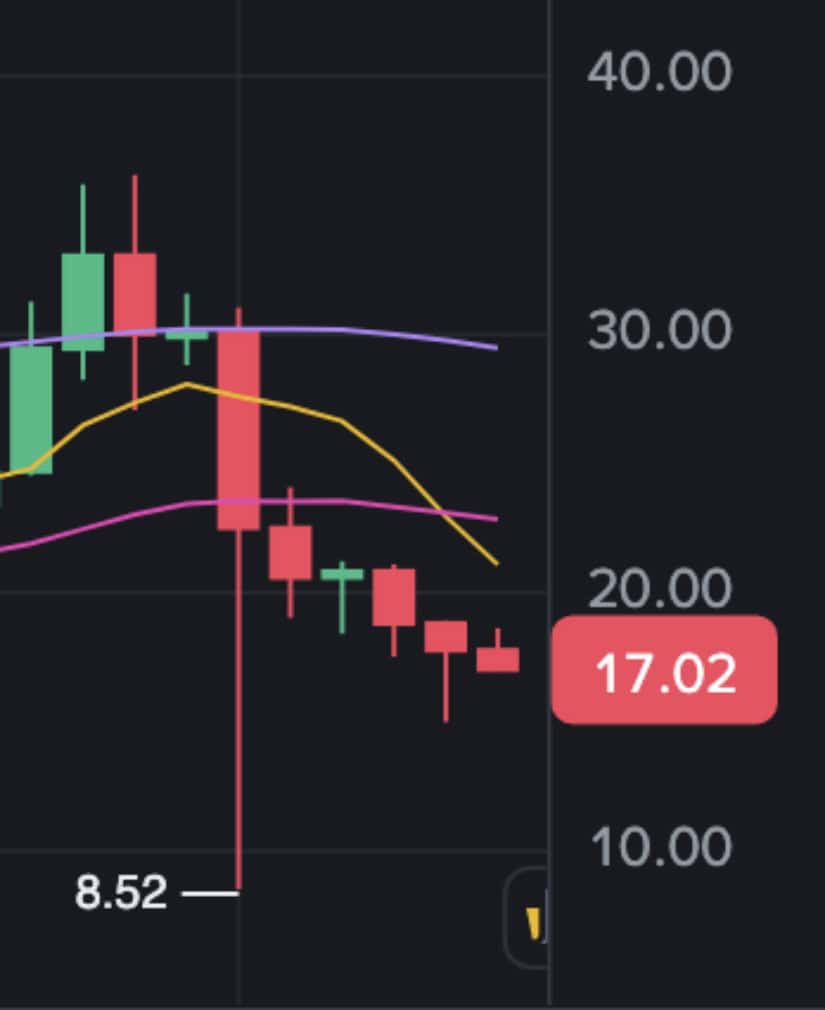

🐱👤 POPCAT Purrs Chaos: Hyperliquid’s $4.9M Meow-nipulation Fiasco

On a Wednesday that shall live in infamy, the decentralized perpetuals exchange Hyperliquid was beset by a tempest of its own making, a deliberate assault upon the fragile edifice of trust by a trader wielding the memecoin POPCAT as a weapon of financial sabotage. 🤑