The Bitcoin Ballad: A Whimsical Woe in the Crypto Circus 🎪

Traders, caught between a mirage of hope and the cold grip of capitulation, watch as BTC dips back to its yearly opening gambit-a boring yet cruel déjà vu. 😒

Traders, caught between a mirage of hope and the cold grip of capitulation, watch as BTC dips back to its yearly opening gambit-a boring yet cruel déjà vu. 😒

So here we are, folks-Zcash (ZEC) is making waves as its trading volume takes a serious leap. On November 17, the coin hit over $700, after a small dip to $598 earlier in the week. And voilà-it’s now the third-largest altcoin by trading volume, hitting $4.38 billion. Not too shabby when you’re trailing behind Ethereum ($35.48 billion) and Solana ($5.29 billion). This shows that more people are getting serious about their privacy. 🕵️♂️

Cardano’s ecosystem resembles a delicate soufflé-low TVL, fragile stablecoin supply, and a penchant for struggling under its own weight. Truly, a spectacle of resilience-if resilience means faltering in the face of liquidity crises.

The Facts (or the bits of the story that make sense)

Which altcoins are about to face the financial guillotine? And what bizarre factors are at play? Let’s dive in, shall we? 🕵️♂️🔍

During a recent colloquy with Grant Cardone (a man whose enthusiasm for sales could power a small nation), Saylor, with the air of a chess grandmaster explaining checkmate to a toddler, outlined a balance sheet so robust it could outlast a particularly aggressive fern in the Amazon. “Should Bitcoin plummet 90%, we’d merely dilute the equity-because nothing says ‘confidence’ like handing shareholders a free holiday in Equity-ville, population: zero.”

In a recent tête-à-tête with the Financial Times, Mr. Sleijpen issued a cautionary tale, as grave as a governess scolding her charges. He declared that these dollar-pegged stablecoins, growing at a pace most indecent, could soon become systemically relevant to our delicate financial ecosystem. Imagine, if you will, a ball where the music suddenly stops, and all are left in disarray! 🎶🩰

You might say the technical fairies sprinkled a bit too much bearish dust. The MACD line (you know, the thing that resembles those jittery caterpillar from Alice in Wonderland headfirst toward the signal line) showed little trace of upwelling pumpkins. Similarly, dear RSI, lounging peacefully at a mellow 41, lounges in a neutral-to-bearish zone. Needless to say, the bears hold the cards and the wool, or should we say, the candle wicks!

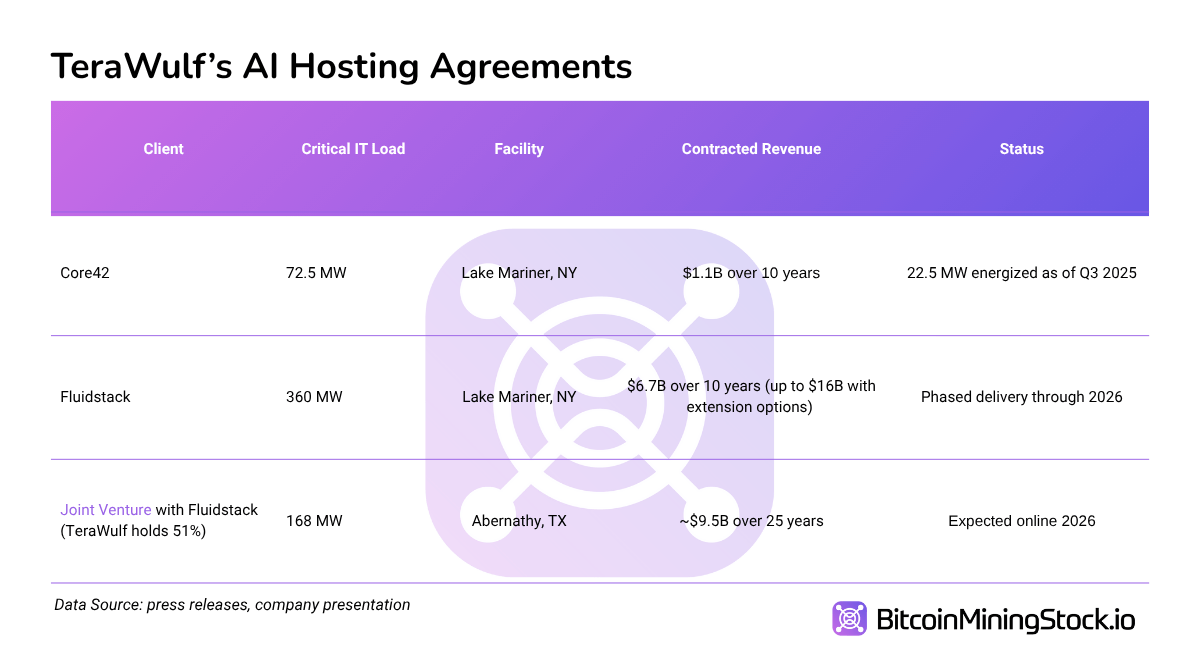

It’s earnings season once again, and while many companies had their usual corporate banter, TeraWulf’s Q3 2025 call somehow managed to pierce through the monotony. Not for the earnings numbers (yawn), but for subtly revealing a blueprint that might just etch Bitcoin miners into the annals of energy-infrastructure providers for the AI era. Oh, joy. 🤓

His somewhat pointed remark? Should everyone suddenly decide to rush to redeem stablecoins backed by U.S. Treasuries-as if they’re launching a new fad-things could get racy fast. We’re talking quick sell-offs, a rush hour of financial panic, and a 19th-century melodrama unfolding in modern finance. All in all, not exactly the sort of fête you’d want to host, unless you’re keen on chaos and confusion. 🎭