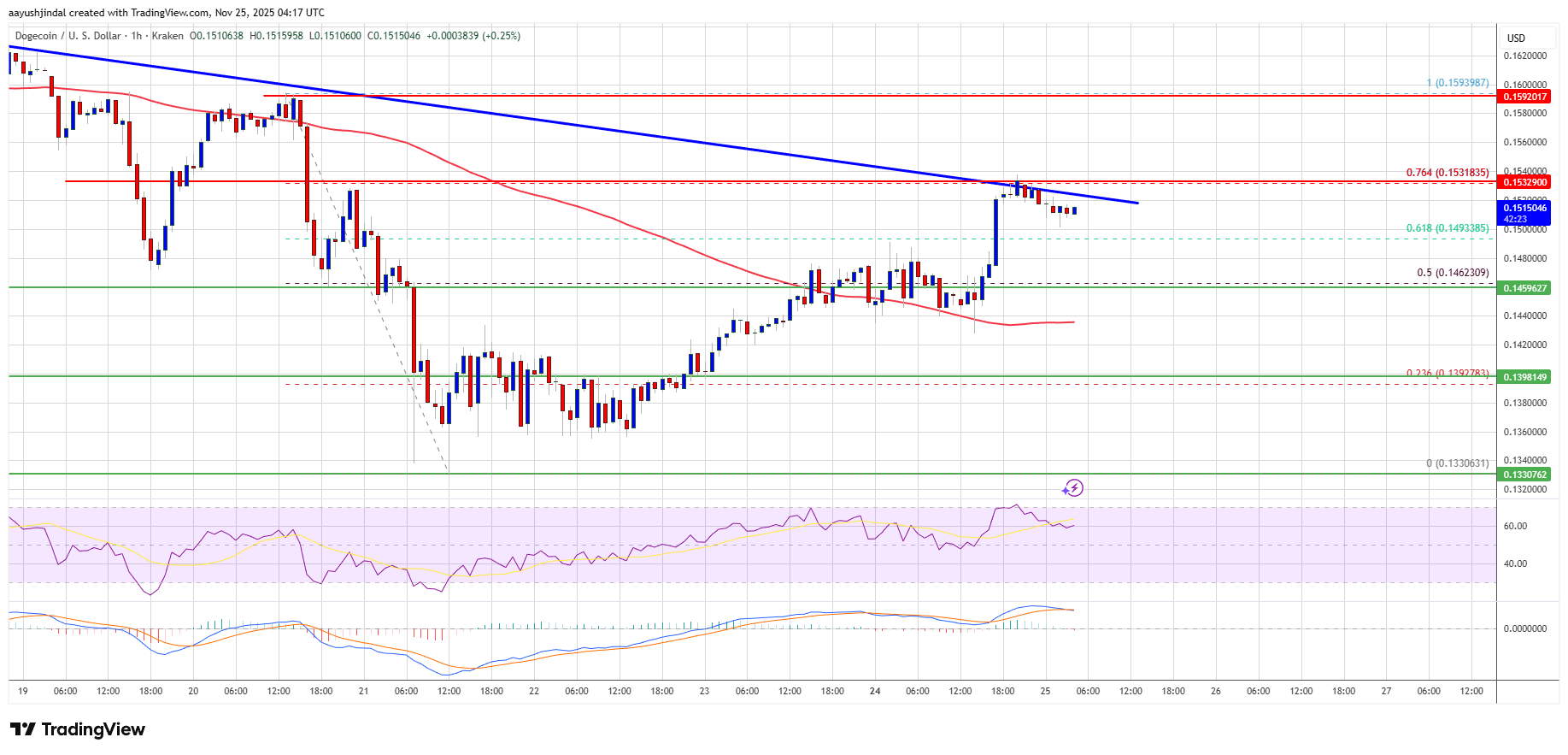

Dogecoin’s Descent: $0.1540’s Cold Embrace 🐕💔

Dogecoin’s recovery wave, born from the $0.1330 pit, mirrored the fickle whims of Bitcoin and Ethereum. It climbed, triumphant, above $0.1320 and $0.140, yet the bears, those shadowy figures, gathered near $0.1530, their whispers echoing like a funeral dirge.