The “Cancel Netflix” campaign is new – it’s only been running for a few days – but Wall Street is already reacting strongly, as reflected in Netflix’s stock prices. This movement, encouraged by Elon Musk and conservative voices on X, is quickly decreasing Netflix’s company value, which is concerning for Hollywood. In comparison, the recent controversy surrounding Disney and Jimmy Kimmel had very little impact on financial markets.

This comparison clearly shows that boycotts aren’t all the same. While campaigns fueled by progressive anger frequently grab attention, they seldom have a real impact on a company’s worth. Conservative-led boycotts, however, have demonstrably harmed brands, caused sales to plummet, and resulted in significant financial losses for investors. This serves as a stark reminder of the differing effectiveness of these tactics. It’s important to note that these are broad generalizations and results can vary.

Netflix’s Billions Vanish Overnight

Reports from Anadolu and other financial news sources indicate that Netflix’s market value dropped by over $15 billion in just 36 hours after the “Cancel Netflix” campaign began. The company’s stock price fell more than 4% right away, making this one of the most significant responses to a boycott we’ve observed recently. It was a very swift and substantial reaction.

On October 3, 2025, Netflix (NFLX) was trading at approximately $1,162.53 USD, a decrease of over 0.7% during the day, and continued to face selling pressure. Investors are paying attention. While Netflix remains a major player with almost 300 million subscribers, Wall Street reacts to changes in market direction-particularly when those changes could impact the consistent income that supports the stock’s future performance.

Netflix is deliberately choosing to pay people to create sexualized content for children.

Look, I’m a big believer in free speech, absolutely. But this feels different – this is paid speech. Netflix isn’t just letting something happen organically; they’re actively promoting it, and they’re putting their money where their mouth is. They’re really reaching into their wallets to push this content, and that changes the whole dynamic, you know?

— Elon Musk (@elonmusk) October 3, 2025

This campaign gained traction because of the debate surrounding children’s TV shows. Critics claim Netflix has gone too far with content like boys dressing in women’s clothing in Cocomelon Lane and shows for very young children that focus on identity. When Elon Musk shared these concerns with his 180 million followers, it led to a huge wave of people canceling their subscriptions and caused concern in the financial markets.

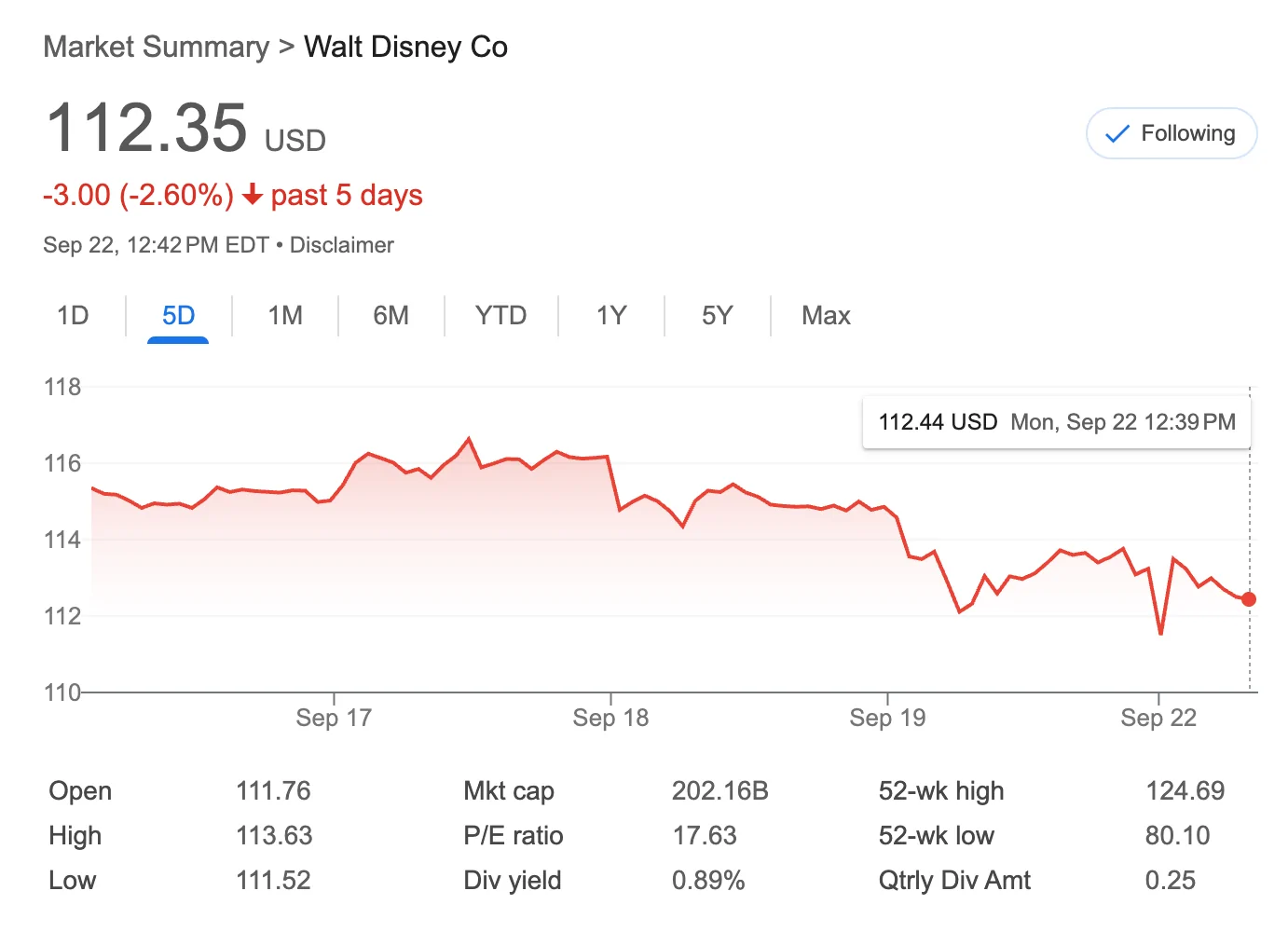

Disney’s Kimmel Suspension Fallout

Let’s compare that to Disney. In mid-September, the company briefly suspended Jimmy Kimmel following criticism of comments he made on his late-night show. Although the suspension only lasted for under a week, it led to calls for people to stop subscribing to Disney+, watching ABC, and supporting the entire Walt Disney Company.

Did Wall Street flinch? Barely.

Recent reports indicate that Disney’s stock fell approximately 3.3% during the last five trading days, resulting in valuation losses estimated between $3.8 billion and $6.4 billion at its lowest point. However, the decrease was more gradual, not as dramatic, and didn’t last as long as some might have expected.

One more thing that wasn’t considered: Disney increased the price of Disney+ at the same time. Price increases always cause some customers to cancel their subscriptions, so many of the cancellations linked to Kimmel’s suspension were probably just people responding to the higher costs. Basically, the supposed “progressive boycott” likely played a very small role in the actual loss of subscribers. Wall Street understood this, which explains why Disney’s stock didn’t react with the same level of panic we’re now seeing with Netflix.

Progressive Boycotts Rarely Leave a Mark

Despite the intense online backlash often created by progressive campaigns, data indicates these efforts seldom harm the companies they aim to influence. A recent illustration of this occurred earlier this year with American Eagle’s “Great Jeans” campaign, which starred Sydney Sweeney. Progressive activists urged a boycott, claiming both the actress and the ad’s message were “problematic.”

And the outcome? Sales dramatically increased. The heightened visibility only helped American Eagle’s stock and strengthened its brand. What began as a supposed customer protest actually became a successful marketing strategy.

A similar situation happened with the suspension of Jimmy Kimmel at Disney. While social media was full of strong reactions, the actual financial results demonstrate that criticism from progressive groups didn’t really impact Disney’s bottom line in a significant way.

Conservative Boycotts Pack the Punch

As a film and entertainment fan, I’ve been watching something really interesting happen lately. It’s become clear to me that when conservative groups launch campaigns, the financial impact on companies can be huge. We’ve seen it repeatedly – billions wiped off stock values and major shifts in how brands operate. Think about what happened with Bud Light, the Pride merchandise issues at Target, the negative reaction to Jaguar’s choices, and now the recent, significant drop in Netflix’s stock price. It really demonstrates that when conservatives mobilize, companies often end up paying a high price.

Here’s why the movement to Cancel Netflix is grabbing the attention of investors. Unlike temporary online protests that quickly fade away without much impact, these campaigns repeatedly demonstrate their ability to negatively affect a company’s financial performance, the number of subscribers, and investors’ trust-all at the same time.

The Stock Market Tells the Story

Let’s put the numbers side by side:

- Netflix (Cancel Netflix): Down over 4% in less than two days, wiping out $15 billion in market cap.

- Disney (Cancel Disney+ over Kimmel): Down 3.3% over five days, roughly $3–6 billion lost, quickly stabilized.

In short, Netflix’s struggles were more severe and had a bigger impact than Disney’s. The Cancel Netflix movement gained momentum much quicker, with greater force, and achieved more definitive results than anything Disney experienced when Kimmel was suspended.

That’s why Wall Street is reacting so differently to these two situations. Disney has many different businesses – including theme parks, films, and merchandise – which protects it if streaming isn’t doing well. However, Netflix completely relies on subscriptions. A significant number of conservative families canceling their subscriptions isn’t just bad publicity; it directly impacts the company’s main source of income. More details here. This is a critical difference.

The Power of Influence

One of the most striking elements of this contrast is the influence behind each movement.

When Elon Musk publicly criticized Netflix, things changed dramatically and quickly. After his posts on X (formerly Twitter), the campaign against Netflix became a global trend, investors paid close attention, and Netflix’s market value dropped by billions of dollars. This demonstrates the significant impact that a well-known person with a large online following can have when they support widespread public dissatisfaction.

In contrast, consider the “Cancel Disney+” campaign. When Jimmy Kimmel was suspended, a large number of Hollywood celebrities quickly voiced their support for canceling the service. Social media became saturated with hashtags, interviews, and statements from industry professionals encouraging people to stop subscribing to Disney+. However, the campaign had very little noticeable effect on Disney’s finances. Disney’s stock price experienced a small drop, but quickly recovered and continued its previous trend. The celebrity-driven effort generated a lot of attention, but it didn’t actually cause any significant financial harm to the company.

The situation reflects what happened in the 2024 election. Almost all of Hollywood publicly supported Kamala Harris, investing significant time, money, and attention in her campaign. Elon Musk, on the other hand, leveraged his platforms and influence to promote Donald Trump. Ultimately, Trump won decisively, even with the entertainment industry strongly backing Harris. It’s a clear indication of the shifting power dynamics.

The message is simple: recommending products just because a famous person does it isn’t as effective as it used to be. Tech leaders and unconventional personalities like Musk are changing how influence works, and consumers are noticing.

The Broader Message for Hollywood

Simply put, campaigns expressing liberal anger don’t impact stock prices as much as those from conservative groups do.

Both Hollywood and large companies should pay attention to this situation, or they could face negative consequences. While Netflix might see the Cancel Netflix campaign as just a short-term issue, investors are already worried. The stock performance clearly shows this isn’t just noise-it’s a real concern. The chart doesn’t mislead.

At the same time, Disney handling Kimmel’s suspension with only a minor setback highlights a clear pattern: while progressive “cancel culture” gets a lot of attention, it’s boycotts led by conservatives that truly cause significant financial damage. This suggests that conservative boycotts have a more powerful impact on a company’s bottom line. These actions are proving to be more effective than attempts at canceling someone.

Business leaders need to be watching what’s happening with Netflix stock. If the issues with Bud Light and Target didn’t already demonstrate it, Netflix is now another clear sign that upsetting conservative customers isn’t just a public relations problem-it negatively impacts a company’s financial performance.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- NBA 2K26 Season 5 Adds College Themed Content

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- Every Death In The Night Agent Season 3 Explained

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- Pokemon LeafGreen and FireRed listed for February 27 release on Nintendo Switch

2025-10-03 18:53