Well, I say, old bean, it appears that Michael Burry, the chap who foresaw the 2008 financial kerfuffle with remarkable aplomb, has now turned his eagle eye to the world of Bitcoin. And what a gloomy forecast he’s serving up! The fellow warns that the current Bitcoin tumble could leave crypto miners in a right old mess and companies clutching BTC in a most unenviable spot.

Apparently, Burry reckons the price might plummet to a mere $50K, which would be enough to send a shiver down the spine of even the most hardened investor. Heavy losses? Bankruptcies? Good heavens, it’s enough to make one spill one’s tea!

Bitcoin: The Safe Haven That Wasn’t

In a recent Substack post-yes, the man’s gone all modern on us-Burry declared that Bitcoin has utterly failed to live up to its billing as a safe haven asset. Gold and silver, he notes, have been having a jolly good time, while Bitcoin has been sliding down the banister like a naughty schoolboy. “Purely speculative,” he calls it, driven by market hype rather than any solid foundation. One can almost hear the tut-tutting.

And what’s more, Bitcoin hasn’t even bothered to react to the usual market shenanigans like a weak dollar or geopolitical jitters. Instead, it’s been cosying up to the S&P 500 like a tech stock at a cocktail party. Burry points out that the correlation has hit a whopping 0.50, which is all very well if you’re a tech stock, but rather disappointing if you’re supposed to be the next gold.

Burry’s $50K Prophecy: Miners in a Cold Sweat

Since October, Bitcoin has already taken a 40% nosedive from its lofty $126,000 peak, and Burry insists the worst may yet be to come. Recently, it dipped below $73,000, its lowest point in over a year, thanks to lacklustre demand and dwindling liquidity. One can almost hear the miners wailing into their hankies.

Burry also took a swipe at Bitcoin ETFs, which have been hemorrhaging funds like a punctured balloon. “Increased speculation,” he grumbles, “and sharper price swings.” It’s all enough to make one long for the simplicity of a good old-fashioned stock.

So, if Bitcoin does indeed slide toward $50,000, miners and crypto-tied firms will be in a proper pickle. One can only imagine the boardroom dramas and the frantic calls to accountants.

BTC-Holding Firms: Walking a Tightrope

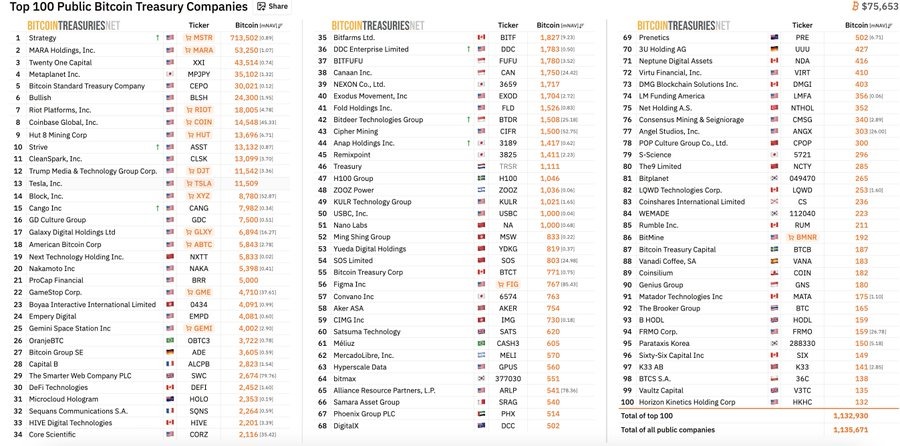

But Burry’s most dire warnings are reserved for companies holding Bitcoin on their balance sheets. Take Strategy Inc., for instance, one of the biggest corporate Bitcoin holders. If Bitcoin drops another 10%, they could be looking at losses in the billions. Raising new funds? Good luck with that, old sport.

And the miners? Well, they’re in an even tighter spot. With their profits tied to high Bitcoin prices, a deeper crash could spell the end of their business models. Bankruptcy looms like a particularly menacing storm cloud on the horizon.

So there you have it, folks. Michael Burry’s latest prognostications are enough to make even the most bullish investor pause for thought. Whether you’re a miner, a BTC-holding firm, or just a casual observer, it’s clear that the Bitcoin rollercoaster is far from over. Fasten your seatbelts, and mind the gaps!

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Mario Tennis Fever Review: Game, Set, Match

- EUR INR PREDICTION

- Train Dreams Is an Argument Against Complicity

- 2026 Upcoming Games Release Schedule

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

2026-02-04 12:36