Bitcoin, darling of the cryptoverse, is currently trading at $117,276 on Sept. 18, 2025-still sipping tea from the bottom of its recovery cup. Its market cap of $2.33 trillion and 24-hour volume of $58.34 billion suggest a modest party, though the intraday range of $114,940-$117,815 hints at a mood swing or two. 💸🤷♂️

Bitcoin

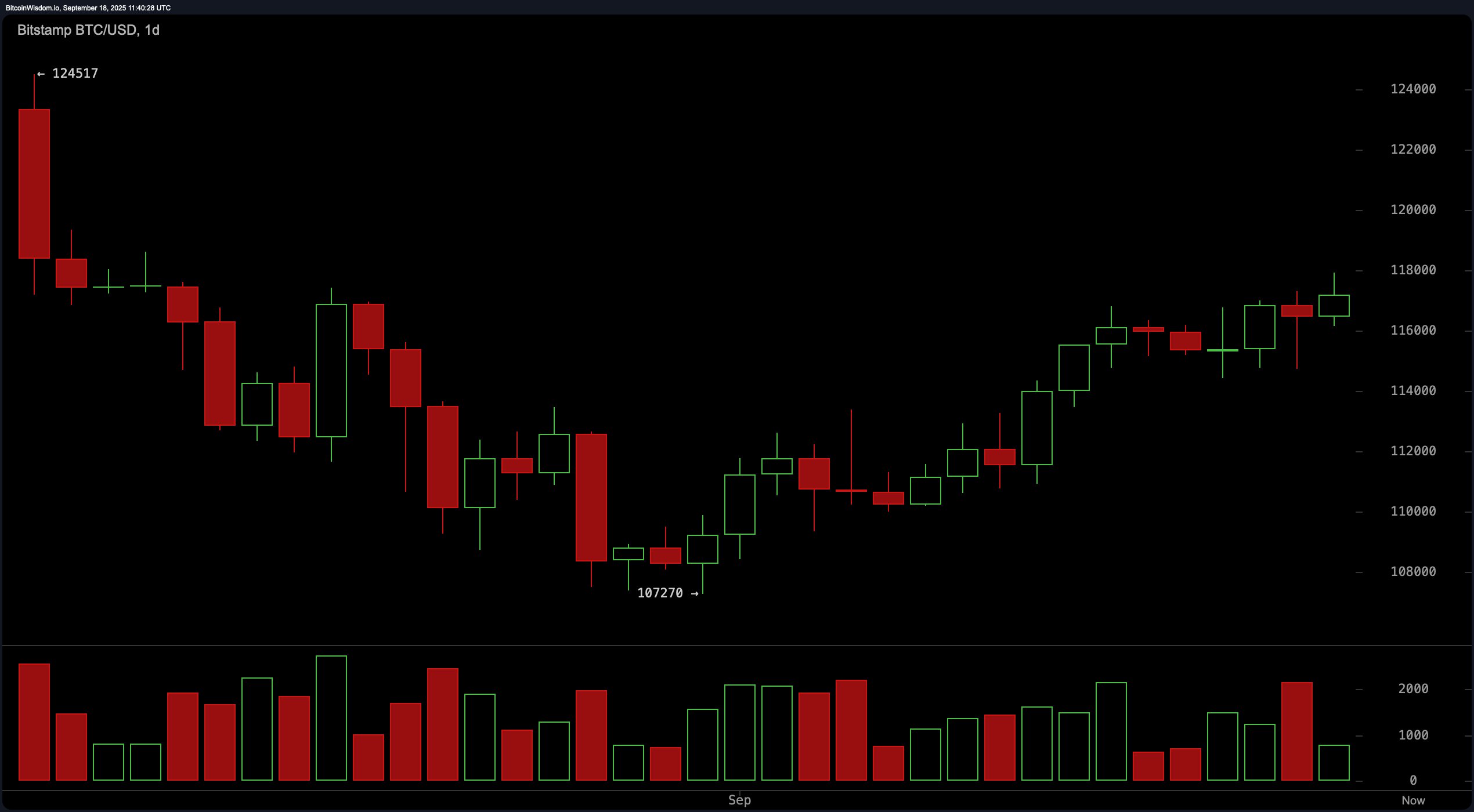

On the daily chart, bitcoin has executed a “rounded bottom” pattern-graceful, if a tad dramatic-to confirm its recovery from the local low of $107,270. This structure whispers of a potential trend reversal, but volume data, that fickle friend, offers a cautionary glance: rising prices paired with dwindling volume often signal a waning momentum. 👀

The price now stalls just below $118,000, an area that might serve as a “fashionable address” for exits or partial profits. A break above this threshold could lead to a grand ball at $120,000, but only if volume returns to the dance. For now, the daily chart suggests a “relief rally”-a charming little jaunt, perhaps, but without follow-through, it may prove as fleeting as a summer romance. 🎩

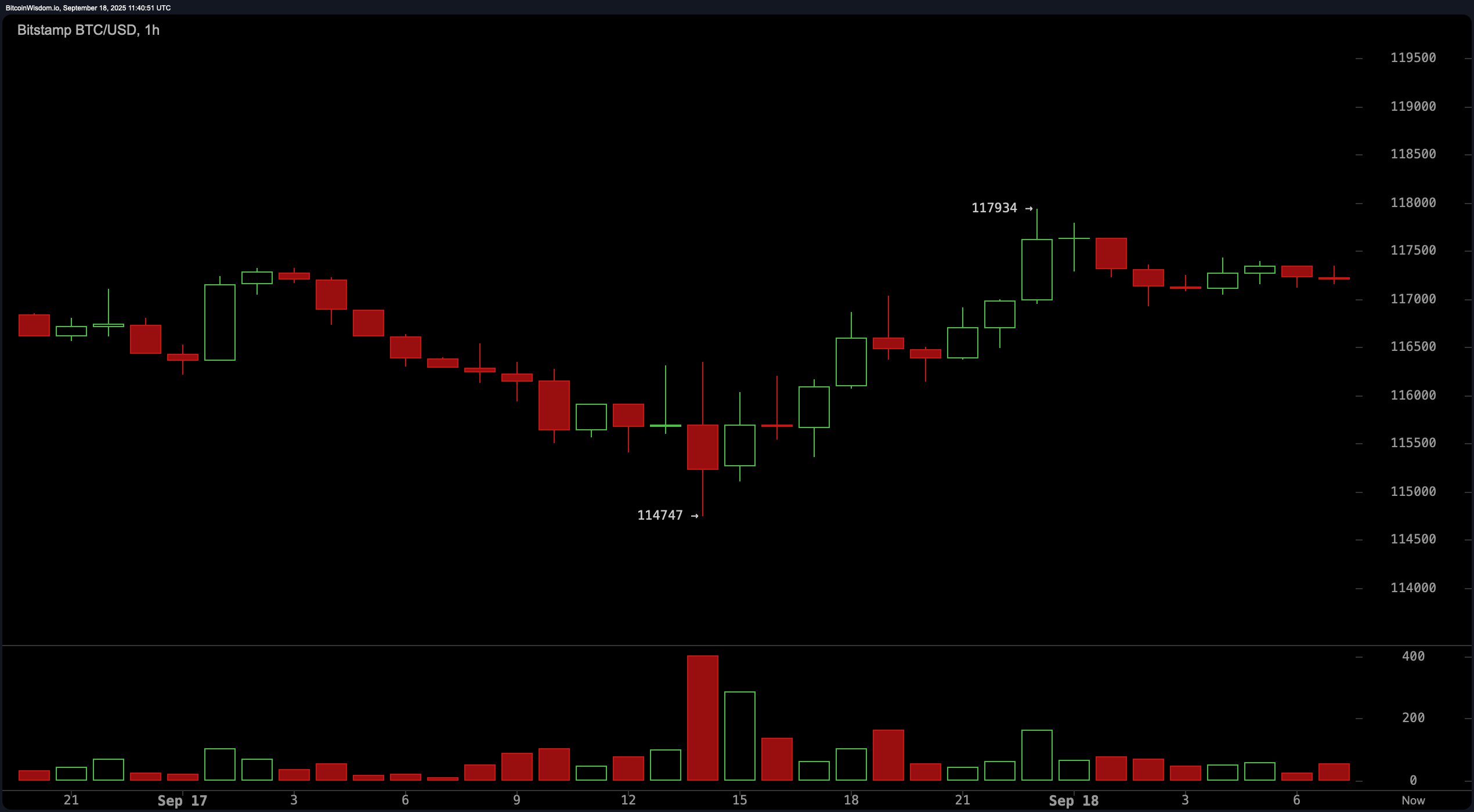

The 4-hour chart reveals bitcoin has been hosting a tea party between Sept. 13-16, consolidating before a Sept. 17 breakout to $117,934. The volume spike was a welcome guest, but now the price lingers around $117,000, sipping tea and contemplating its next move. Should it revisit $116,000-$116,500 and hold, that might be a “rehearsal” for a grand entrance. Failure to breach $118K, however, could prompt a dramatic exit. 🍵🧘♂️

The 1-hour chart boasts a “cup and handle” pattern-charming, if a touch whimsical-that culminated in a breakout near $117,934. Now, the price consolidates in a tight bull flag or pennant, a delicate dance of patience and volume. An entry at $117,000 has passed, but a re-entry above $117,800-$118,000 could be a “comeback” worth attending. Should it dip below $116,500, the curtain may fall on this bullish act. 🫖🎭

Oscillators offer a mixed company: RSI at 61, Stochastic at 92, and CCI at 114 all whisper “neutral.” The ADX at 18 sighs about weak momentum, while the Awesome oscillator (2,914) and MACD (921) play the role of cautious optimists. The momentum indicator, at 5,105, however, raises a skeptical eyebrow-perhaps a sign the uptrend is tiring. 🦉

Moving averages sing a bullish chorus across all periods. The 10-day EMA/SMA at $115,387/$115,435 suggest a “bullish opportunity,” and even the 200-day EMA/SMA ($105,631/$103,088) echo long-term optimism. Yet, the chart remains a delicate balancing act-resistance must fall for the rally to continue. 🚨

//www.binance.com/en/price/bitcoin”>bitcoin

’s short-term stance is bullish but fragile. Traders should watch $118K like a hawk-volume and oscillators urge caution, especially for those with a taste for high-stakes drama. A decisive break above resistance could spark a grand finale at $120K, while a stumble below $116K might invite a retest of the lower decks. 🦅

Bull Verdict:

Should bitcoin break and hold above $118K with volume, the bullish case becomes a “charming little pattern” worth following. Chart structures and moving averages all cheer for a continuation toward $120K and beyond. A confirmed breakout would be a standing ovation for this rally. 🎩

Bear Verdict:

If bitcoin falters at $118K or dips below $116,500, the current rally may prove a “midlife crisis” rather than a revolution. Waning momentum and neutral-to-bearish indicators hint at a temporary bounce, with a deeper pullback to $114K-$112K lurking in the wings. 🤡

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- NBA 2K26 Season 5 Adds College Themed Content

- Mario Tennis Fever Review: Game, Set, Match

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- All Poppy Playtime Chapter 5 Characters

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- EUR INR PREDICTION

2025-09-18 16:28