In a world where the sun sets on the crypto markets, veteran trader Peter Brandt stands tall, his eyes fixed on the distant horizon of $200,000, as if it were a magical castle in a fairy tale. 🧙♂️💎

Bearish Slide Fuels Capitulation 🐻💸

Veteran futures trader Peter Brandt has affirmed his long-term bullish stance on bitcoin ( BTC), stating he is unfazed by the current price slide, which has erased all of the cryptocurrency’s 2025 gains. In a Nov. 21 post on X, Brandt declared that the current “dumping is the best thing that could happen to bitcoin,” and he projects the cryptocurrency to eventually reach $200,000 sometime in the third quarter of 2029. 🌀🔮

Brandt’s bullish reaffirmation comes amid a prevailing bearish sentiment that has driven BTC’s price down significantly in recent weeks. The slide has fueled fears that the bull rally has run its course, prompting many investors, including long-term holders, to liquidate their holdings. 🧛♂️📉

As reported by Bitcoin.com News, BTC tumbled to $80,537 on Nov. 21 as the sell-off continued, pushing the cryptocurrency down over 10% for the week and reducing its market capitalization to $1.67 trillion. Analysts attribute the decline to factors such as massive outflows from spot Bitcoin ETFs and the collapse of the macro narrative that had sustained its rally this year. 🧠💸

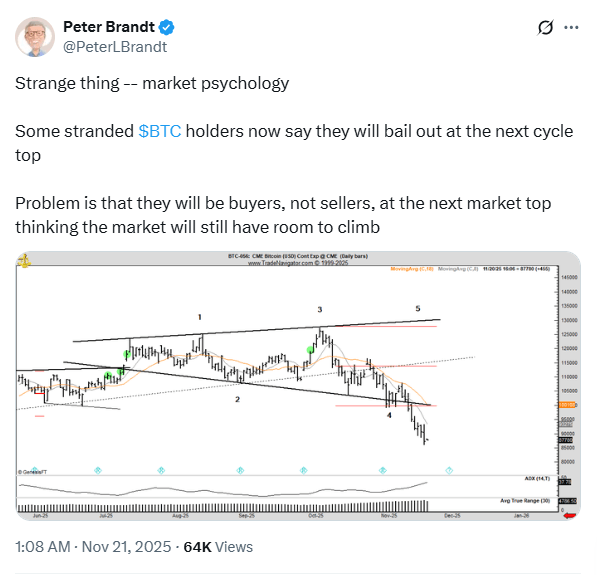

With BTC now more than 30% below its Oct. 6 peak of $126,080, panicking holders are adding to the selling pressure. Brandt, however, questioned the logic of “bailing out” only to wait for the next market top: 🤯

“Strange thing – market psychology. Some stranded BTC holders now say they will bail out at the next cycle top. [The] problem is that they will be buyers, not sellers, at the next market top, thinking the market will still have room to climb,” Brandt explained.

Criticism of Michael Saylor 🎭

The veteran trader also reiterated his long-standing criticisms of Michael Saylor and his company’s (Strategy, MSTR) BTC accumulation model. Brandt argued that if BTC continues to slide, MSTR could be forced to offload its holdings, which would likely create “some selling pressure.” 🧨

When challenged by an X user regarding the unlikelihood of “liquidation” due to MSTR having no margin loans backed by BTC, Brandt pointed to the company’s debt levels versus its asset holdings:

“MSTR has debt to own assets. Assets are wealth. Wealth can only be turned into money when sold. His debt and BTCs represent huge supply over the market. Don’t be fooled,” the veteran trader said. 🧠💣

FAQ 💡

- What is Peter Brandt’s BTC forecast? He projects bitcoin could reach $200,000 by Q3 2029. 🎯

- How is BTC performing now? BTC fell to $80,537 on Nov. 21, down over 30% from its October peak. 📉

- What factors drove the recent sell-off? Analysts cite ETF outflows and the collapse of the macro narrative. 🧨

- What criticism did Brandt make of MSTR? He warned its debt and BTC holdings could add selling pressure if prices slide. 🚨

Read More

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- MNT PREDICTION. MNT cryptocurrency

- ‘Stranger Things’ Creators Break Down Why Finale Had No Demogorgons

2025-11-22 01:28