Ah, Bitcoin. That most modern of speculative bubbles, dressed in the language of technology and promising fortunes to the bold – and occasionally, leaving a trail of lamentations in its wake. After a momentary flirtation with the almost mythical $126,198, it has, as one might say, settled itself… somewhat. One detects a certain fragility in its composure, a clinging to support as a drowning man to a splintered mast. But, truly, who can predict the whims of the digital multitudes?

A Hesitant Respite

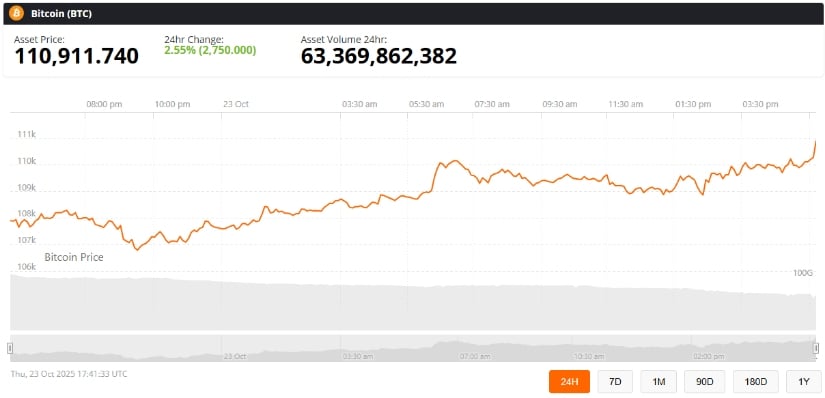

The market, those discerning arbiters of value, appear to be giving Bitcoin a small breathing space around $103,000 – $104,000. Yesterday, October 24th, 2025, it managed a modest upward twitch, reaching $109,474, a 1.8% gain, one presumes, celebrated with much glee by those who bought high and hoped for higher. This followed a rather more assertive 13% fall from that dizzying peak, a fall perhaps unnoticed by those who are already counting their hypothetical gains. 🙄

Young Mr. Kamran Asghar, a fellow who tweets for a living, observes, with what one suspects is a carefully constructed air of wisdom, that the “Support Zone” is holding. He sees a path to $116,000. CoinMetrics – an assemblage of numbers and algorithms – suggests that, historically, such supports have been followed by rallies of 5-10%. A comforting thought, isn’t it? Though history, as any student of life knows, is rarely so obliging.

A Delicate Balance

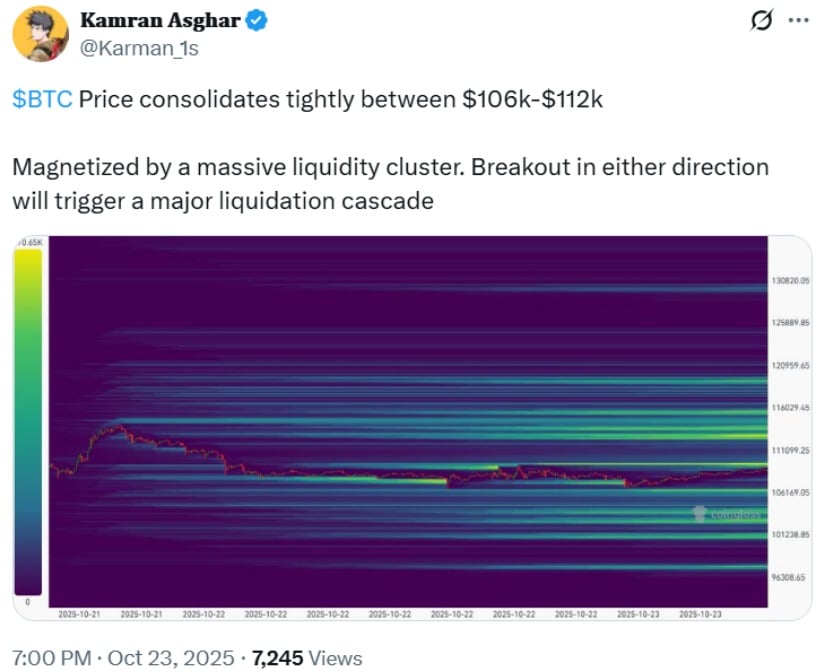

The price, poor thing, is caught in a rather tedious tug-of-war between $106,000 and $112,000, drawn toward those nebulous “liquidity clusters” – areas where large sums lie in wait. One imagines these clusters as particularly avaricious magnets, eager to draw the price one way or the other. 💰

Asghar, ever the prophet of potential doom (or glory!), warns of a “liquidation cascade” should it break down. And indeed, on October 10th and 11th, a similar descent resulted in a rather undignified $19 billion vanishing act, attributable, naturally, to escalating tensions between the United States and China. Because, of course, everything is attributable to something.

This delicate dance suggests volatility. A good time, perhaps, to take a nap. Or, if one insists on participating, to tread with the utmost caution.

Whispers of a Pattern

Certain technical gentlemen, those devoted to the study of charts and lines, are perceiving a “triple lower low” forming. It sounds rather ominous, doesn’t it? BTC, it seems, has stumbled three times this autumnal season. One Mr. BitBull, a crypto commentator of some renown (or perhaps merely persistent enthusiasm) predicts, with an air worthy of a fortune teller, a swift ascent to a “new ATH” – an all-time high, for the uninitiated. 🙏

Apparently, such patterns have, in the past, heralded upward surges. A 50% jump followed a dip in April, a fact which, one can only assume, fills current holders with a quiet, reassuring confidence. These patterns, we are told, align with “cycle lows” and “halving multiples.” It’s all very scientific, really.

A Word of Caution (Because Someone Must)

But let us not be carried away by technical fantasies. Macroeconomic realities, those stubborn things, still loom. Trade hostilities, American interest rate deliberations, and global economic whims – all cast a long shadow. A shadow, one might add, that is particularly threatening to speculative bubbles. 🙅

Analysts, those prudent souls, recommend caution and “risk management strategies.” A sensible suggestion. Understanding how this “Bitcoin mining” works and how liquidity events may affect the price movements is also, they say, important. Naturally.

The Question Remains…

As of this moment, Bitcoin lingers around $109,700, attempting to recover from its recent troubles. If support holds, and those liquidity clusters prove benevolent rather than treacherous, perhaps it will revisit $116,000. But then again, perhaps not. The future, like the price of Bitcoin, is a fickle and uncertain thing.

For those who observe Bitcoin from a safe distance, it offers a curious spectacle: a blend of hope, speculation, and inherent instability. The market holds its breath, awaiting the next twitch, the next tremor, the inevitable revelation of whether Bitcoin can indeed continue its upward climb or succumb to the gravity of reality. And as always, one wonders, is this a genuine revolution or merely another cleverly marketed delusion? 🤔

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- NBA 2K26 Season 5 Adds College Themed Content

- Mario Tennis Fever Review: Game, Set, Match

- Train Dreams Is an Argument Against Complicity

- EUR INR PREDICTION

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- Pokemon LeafGreen and FireRed listed for February 27 release on Nintendo Switch

2025-10-24 04:15