The creature known as Bitcoin, a beast of capricious and fickle temperament, has once again risen beyond the enticing threshold of $97,000, as if to mock the weary souls who have long negotiated the labyrinthine corridors of its volatility. The markets, that great assemblage of hope and despair, have been stirred from their stupor by this feeble rebound, while analysts-those intrepid scribes of uncertainty-hasten to assert that such a rally is but a flickering candle in the encroaching fog of doom for 2026. Ah, but let us not dismiss the candle’s glow just yet!

Yet, lo! This ascent is not solely the work of price strength, however tantalizing such ambition may be. A certain CryptoQuant oracle, possessing the wisdom of a thousand crypto-haunted nights, whispers of a deeper truth: Bitcoin’s conquest of the $94,200 resistance is but a prelude to its valiant gallop toward $97,500. The on-chain data, those cold and calculating archivists, reveal a tale of old coins sleeping in their vaults while newer ones stumble into the fray-a dance of youth and folly.

Among these sacred scrolls is the Value Days Destroyed (VDD), a metric as enlightening as it is perplexing. In layman’s terms, it is the alchemist’s grimoire that distinguishes between the patient hoarders of Bitcoin and the reckless spenders. By January 2026, VDD hovers at a meager 0.53, a number so small it seems to whisper, “Fear not, for the old coins slumber still!” The long-term holders, those paragons of patience and fortitude, remain shackled to their hoards, and thus the price ascends, like a ghostly ship buoyed by spectral winds.

The onlookers squabble-does this surge signal a phoenix’s rebirth or merely the dying gasp of a bullish delusion? To this question, the VDD provides no clear answer, only the faintest suggestion that the market’s architects are not yet busy at their desks, selling into the strength. One might call it a fragile harmony between buyers and sellers, as delicate as a teetering tower of casino chips.

Long-Term Holders: A Fortress of Frugality

Enter now the estimable Carmelo Alemán, a self-styled “Verified On-Chain Analyst” (one suspects the title is forged in the fires of his own vanity), who proclaims that the long-term holders remain “largely inactive.” A curious choice of words! One might tremble at the thought of such inertial wealth lingering in darkness, but behold! This inertia is not a betrayal of destiny but a testament to faith. These veterans of Bitcoin’s cycles, having weathered tempests and tranquil seas, now cling to their holdings as if to say, “This is not my moment to weep gold into the void.”

To the unknowledgeable, this may seem a bleak monotony, but history, that merciless lad, teaches us this: when VDD clings to the shadows and old coins remain in crypts, the price ascends unburdened by the cries of panic. Such phases are not mere accidents but the quiet revolutions of markets in thrall to logic rather than lunacy. Perhaps this current surge is but one such revolution-minor in the grand cosmic sense, but mighty in the eyes of the HODlers.

Yet let us not mistake inertia for immortality! Should VDD awaken from its lethargy, it shall loom like the Leviathan, trailing tendrils of selling pressure that even Prometheus might envy. The rally, like the raven, perches on the bough temporarily, but the storm may yet make it fly.

The Resistance Conundrum: A Game of Inches

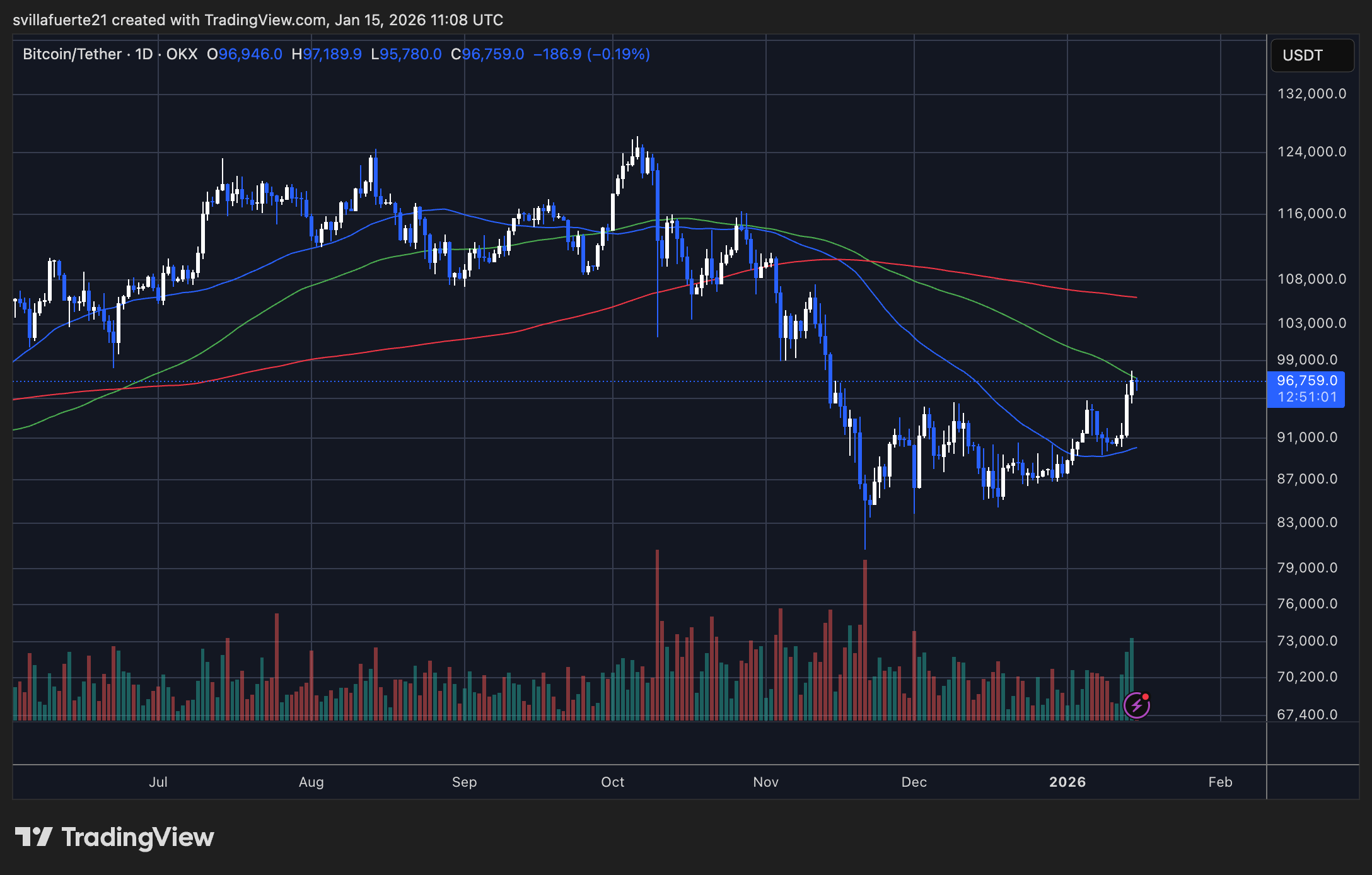

Behold now the chart of BTC, which reclaims the $96,000-$97,000 zone-a number so seductive it might tempt even the most pious crypto monk to loosen his belt. Yet let us not forget the December fiasco, when Bitcoin tumbled from November’s highs, a beauty queen cast aside by the fickle mob. Is this new ascent a resurrection or merely a cosplay of recovery?

The technical analysts, those prophets occasionally tripping over their own sashes of self-importance, declare BTC is now “printing higher lows”-a phrase so clinical it hurts. The 50-day moving average, which once loomed as a barbed-wire wall, now appears as a doppelgänger of weak resistance. Should the price linger here too long, it risks becoming a plaything in the hands of bears-those grumpy imps of greed.

But lo! Ambitions beckon higher! The 100-day and 200-day moving averages lie in wait like dragons hoarding treasure. Should the price fail at these, the downtrodden market shall retrench toward the $92,000-$94,000 support, a purgatory of red-inked trades. The volume tale is one of modest participation-buyers and sellers clashing in a tea-stained tavern of moderation. To call it robust would be a lie; to call it an omen? Perhaps.

In the end, Bitcoin’s fate rests on whether it ascends beyond $97,000 and dances near $100,000’s psychological throne. Until then, we remain in the realm of “potential,” a place where hopes evaporate like mist and those who overestimate their wit are devoured by the market’s solemn irony. Fortunes may yet rise, but never forget-the crypto god is a fickle master, and his devotion is paid in sleepless nights.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- NBA 2K26 Season 5 Adds College Themed Content

- Mario Tennis Fever Review: Game, Set, Match

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- Every Death In The Night Agent Season 3 Explained

- Train Dreams Is an Argument Against Complicity

2026-01-16 05:15