Ah, dear readers! It appears that our friends at BlackRock have embarked on a most audacious escapade, acquiring a staggering 9,619 Bitcoins, or as the muses of finance would have it, BTC worth a princely sum of $89,864. 🤑

Lo and behold, their treasure chest is now burdened with a weighty $878 million and an additional trove of 46,851 Ether (or should we say ETH, worth $3,092). The combined total, if one were to tally such frivolities, stands dashing at nearly $1.03 billion-not bad for three days’ work, I must say! 🎩

But what is this? These acquisitions occurred not amidst a market jubilation, but rather during a time of weakness, which surely adds a twist to our tale! 📉

On the fateful day of January 6, our daring BlackRock gathered 3,948 Bitcoins valued at about $371.9 million along with 31,737 Ether, translating to another $100.2 million. Such numbers could make a poor poet weep! 😅

Even the wise LookOnChain declared: “BlackRock has been accumulating $BTC and $ETH for 3 consecutive days!” Truly, they are the modern-day merchants of Venice! 🏦

As I pen these words, Bitcoin merrily dances around the $90,212 mark, while Ether frolics near $3,118. Alas, both seem to be suffering a minor existential crisis today! 📉

And let us not forget, during the holiday revelries, our illustrious BlackRock transferred 1,134 Bitcoins and 7,255 Ethers to Coinbase Prime. Oh, the intrigue! This caused quite the stir among us villagers, raising fears of a sell-off, yet the market remained stubbornly heavy. 🥳

ETF Flows Meet a Reset Market

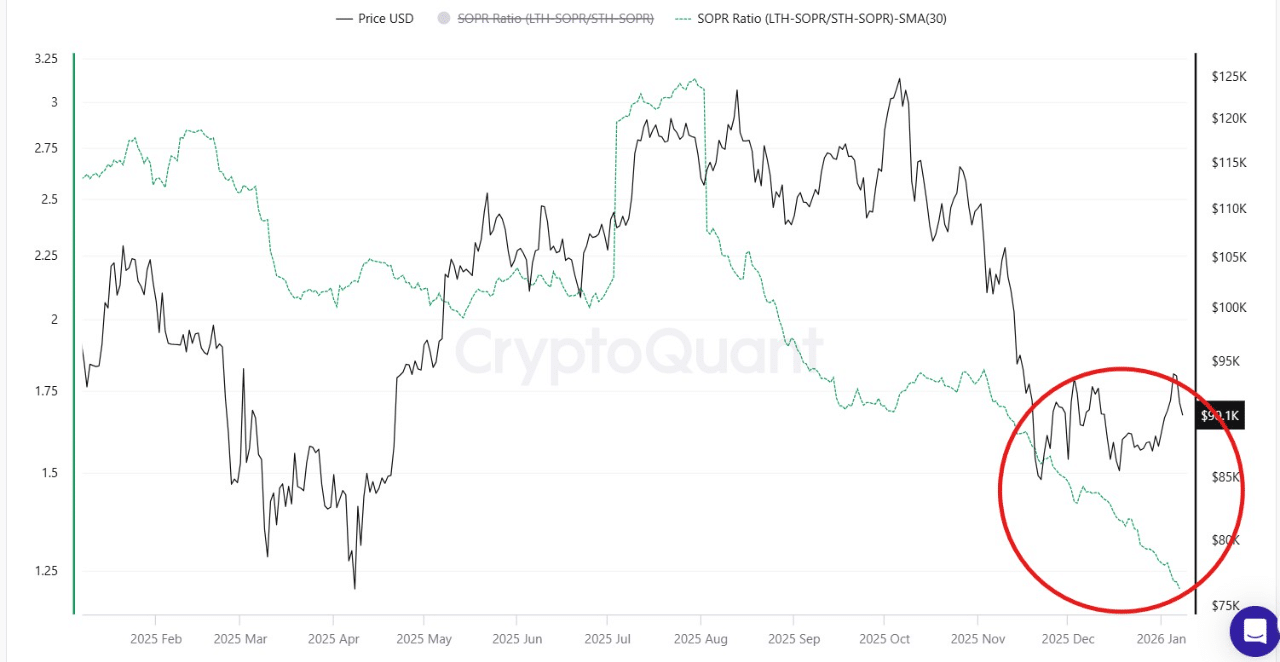

Bitcoin waltzed into the year 2026, having just retreated from the dizzying heights of $110,000-$120,000 down to the more modest low $90,000s. Ah, the fickle fate of fortune! On-chain data reveals the SOPR ratio nearing exhaustion-perhaps a sign that our market players are feeling a bit weary? 🎭

While short-term holders clasped their losses tightly through December, the long-term sages retained their profits, a classic case of strong versus weak hands-how delightful! 🤔

Bitcoin SOPR Ratio. | Source: CryptoQuant

Should our beloved Bitcoin maintain its grip above the current $90K threshold, the lofty realms of $100,000-$110,000 remain tantalizingly within reach. Yet, beware! A slip below $88,000 could lead us into treacherous waters toward $80,000. 🚨

Indeed, Glassnode has found clarity amidst the chaos; over 45% of options open interest has evaporated like morning mist. Futures interest has risen anew, and ETF flows have resurfaced after a hasty retreat. 🎉

“The early-January breakout reflects a market that has effectively reset its profit-taking pressure,” wisely notes Glassnode. A fine observation, indeed! 📈

For now, Bitcoin’s support holds steady near $90,000, while overhead supplies linger between $95,000 and $104,000. With options flow now favoring calls and volatility taking a nap, one can only hope that Glassnode’s optimistic portrait holds true for our future! 🌟

Read More

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- My Favorite Coen Brothers Movie Is Probably Their Most Overlooked, And It’s The Only One That Has Won The Palme d’Or!

- Crypto prices today (18 Nov): BTC breaks $90K floor, ETH, SOL, XRP bleed as liquidations top $1B

- Games of December 2025. We end the year with two Japanese gems and an old-school platformer

- Travis And Jason Kelce Revealed Where The Life Of A Showgirl Ended Up In Their Spotify Wrapped (And They Kept It 100)

- World of Warcraft Decor Treasure Hunt riddle answers & locations

- Decoding Cause and Effect: AI Predicts Traffic with Human-Like Reasoning

- Will there be a Wicked 3? Wicked for Good stars have conflicting opinions

- Hell Let Loose: Vietnam Gameplay Trailer Released

2026-01-08 17:58