BlackRock, the financial behemoth, is playing keep-away with Bitcoin

BTC $111,040 (a price that frankly feels… optimistic 🙄) and Ethereum

ETH $4,287. They’re shoving these digital assets in and out of Coinbase like a disgruntled toddler with building blocks. It’s all very dramatic, and done through their iShares ETFs – IBIT and ETHA, because apparently, even Wall Street needs a catchy acronym.

Now, some people with far too much time on their hands (shoutout to Lookonchain and other “on-chain analytic tools” – seriously, a hobby!?) are tracking BlackRock’s every move. Apparently, they’ve noticed BlackRock dumping a significant amount of crypto onto Coinbase in the last couple of days. It’s like watching someone slowly realize they bought Beanie Babies in 1998.

$640 Million Down the Drain? (Maybe?)

On September 9th, BlackRock deposited 44,774 ETH (worth a breezy $195.29 million) and 900 BTC (a mere $101.67 million) to Coinbase Prime. Before that, on September 8th, it was 72,370 ETH ($312 million) and 266.79 BTC ($29.88 million). A lot of numbers. It makes my head hurt, and I just made toast. 🍞

BlackRock just sold 44,774 $ETH($195.29M) and 900 $BTC($101.67M) again.

– Lookonchain (@lookonchain) September 9, 2025

The Flows Don’t Flow (Apparently)

Apparently, these ETF things are designed to reflect… *something*. Something about investor demand and bridging the gap between fancy finance and the wild west of crypto. But honestly, it seems more like a complicated game of musical chairs. The deposits and withdrawals aren’t necessarily sales or purchases, just… adjustments. “Reserve adjustments”. Hmm. Sounds comforting. 🙃

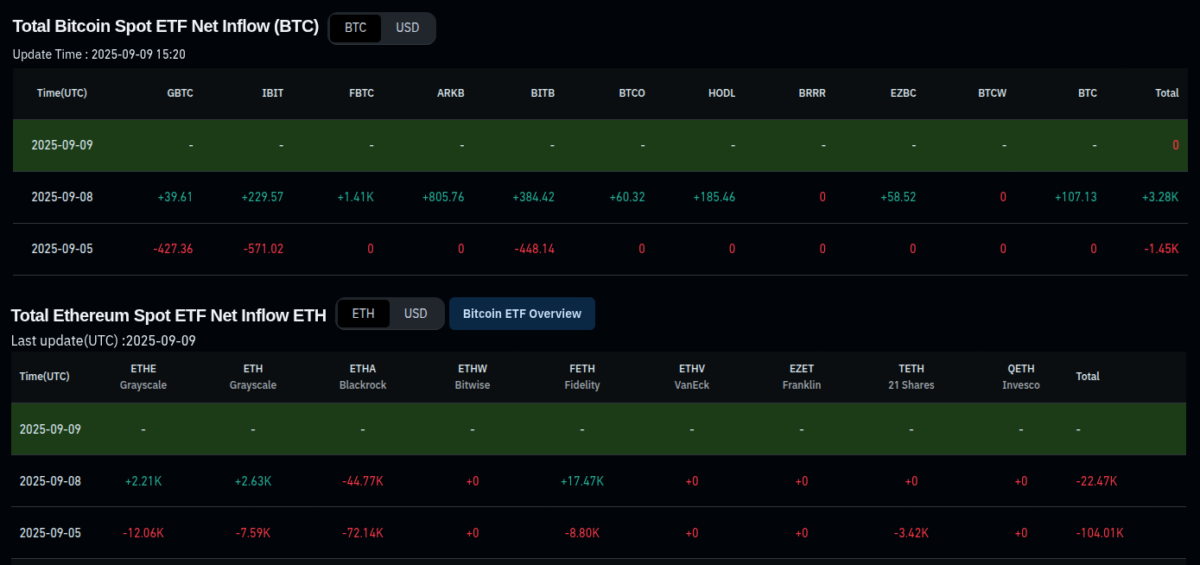

On September 8th, the ETFs added some BTC, but took away a bunch of ETH. On September 9th, they added more BTC. It’s a chaotic mess. It’s the financial equivalent of Schrödinger’s cat.

Total Bitcoin and Ethereum spot ETF net inflows | Source: Coinglass

Maybe BlackRock is simply preparing for something. Perhaps they know something we don’t. Maybe they’re just bored and decided to shake things up a bit. After all, when you have that kind of money, you can afford a little mischief. 😈

Analysts Predict… Something?

Despite BlackRock’s little tantrum, analysts are saying Bitcoin and Ethereum *might* be poised for a comeback. It’s the financial world’s version of “don’t worry, it’ll all be fine!” Arkham even reported BlackRock is “buying more” crypto, reaching over $100 billion in reserves. Which is… a lot. I haven’t even made that much money *total*.

BLACKROCK NOW HOLDS OVER $100B IN CRYPTO

AND THEY’RE BUYING MORE

– Arkham (@arkham) September 9, 2025

And this CrypNuevo fellow, a self-proclaimed Bitcoin expert, thinks BTC is about to rally. Because… reasons? Apparently, it has something to do with interest rates and “liquidity”. It’s all very important, I’m sure. 😴

$BTC Sunday update:

10 days until the first Interest Rate cut this cycle, and the chart is undecided with choppy Price Action.

Uptrend structure is intact but sentiment is bearish in this pullback and many are calling it a sell the news event.

How am I playing this?

🧵↓(1/7)

– CrypNuevo 🔨 (@CrypNuevo) September 7, 2025

Oh, and Tether is spewing out more USDT. Always a good sign… or a sign of impending doom. It’s really a coin toss. All of this just proves that crypto is a chaotic, unpredictable mess. Which, honestly, is kind of interesting. And keeps people like Lookonchain employed. 🤷

It’s all just short-term speculation anyway, a dizzying dance of nuances and the whims of the wealthy. Now, if you’ll excuse me, I need to go figure out what to do with this toast. 🍞

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- All Itzaland Animal Locations in Infinity Nikki

- NBA 2K26 Season 5 Adds College Themed Content

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Gold Rate Forecast

- Star Trek’s Controversial Spock Romance Fixes 2 Classic TOS Episodes Fans Thought It Broke

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- EUR INR PREDICTION

2025-09-10 06:27