In a twist that would make Dostoevsky roll his eyes and Putin double-check his crypto wallet, Blackrock’s Larry Fink has declared Bitcoin the “digital doomsday savior” for modern man. Meanwhile, he’s busy turning global markets into a blockchain-themed circus. 🐾🎭

From Crypto-Skeptic to BTC Evangelist: A Tale of Redemption (or Desperation?)

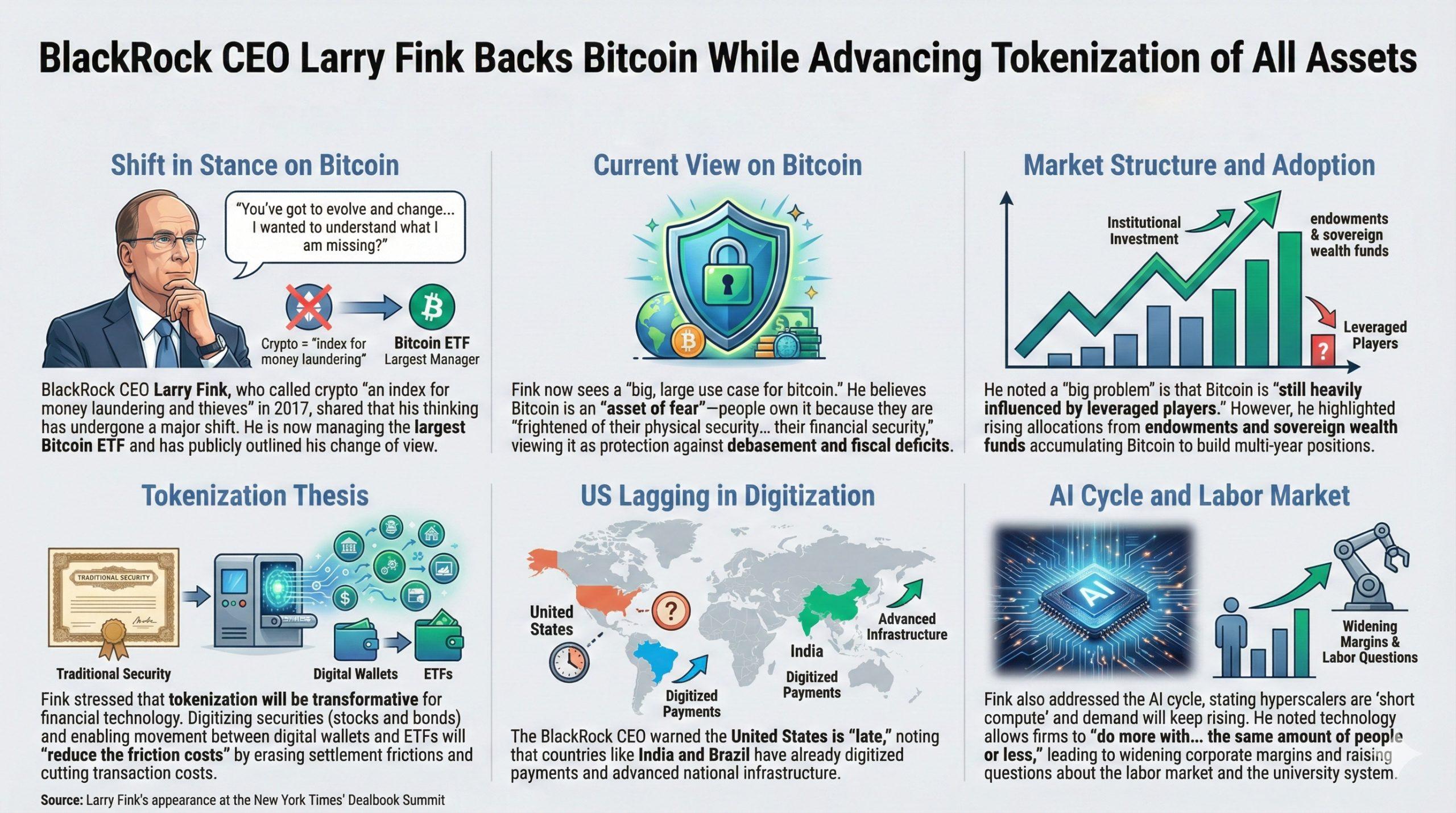

Larry Fink, Blackrock’s CEO and self-proclaimed “architect of capitalist dreams,” recently confessed at the New York Times’ Dealbook Summit that his views on Bitcoin have evolved from “money laundering index” to “fear-based financial fairy tale.” One wonders if this revelation came after a late-night chat with a ghost of Marx or perhaps a cryptic message from a mysterious investor in a fur hat. 🧠❄️

“You’ve got to evolve,” Fink proclaimed, as if quoting a Soviet-era reformer. “I visited experts, asked questions, and realized I was missing… something. Probably my dignity.” He clarified that his 2017 remarks were directed at Bitcoin specifically, not crypto broadly-a distinction as clear as a snowstorm in Moscow. Now, Blackrock, the “financial titan of titans,” manages the largest Bitcoin ETF, a title that sounds less like an investment strategy and more like a cursed heirloom. 🏛️💸

“Bitcoin is an asset of fear,” Fink declared, “a digital talisman for those terrified of their own financial mortality.” One imagines him clutching a golden ruble while whispering incantations to the blockchain gods. 🕯️🪙

He warned of leveraged players manipulating the market, a problem as old as capitalism itself but now dressed in NFTs and smart contracts. Yet, endowments and sovereign wealth funds, those “guardians of global greed,” are buying Bitcoin in bulk, as if stockpiling digital bread during a fiscal famine. 🍞💻

Fink then pivoted to tokenization, declaring it the “next great revolution” that will digitize everything from stocks to your grandma’s knitting patterns. “Friction costs will vanish!” he cried, as if solving centuries of economic inefficiency with a few lines of code. Yet, he lamented the U.S. lagging behind India and Brazil in digital payments, a critique that sounds less like a business strategy and more like a passive-aggressive tweet. 🌐💥

“If we digitize all stocks and bonds, friction costs will disappear,” he said, conveniently forgetting that human greed and incompetence are far harder to tokenize. 🤷♂️

He also warned of AI’s “compute famine,” a crisis that will likely be solved by mining more Bitcoin or, perhaps, sacrificing a goat to the cloud. Meanwhile, corporate margins widen as robots replace humans, leaving universities to wonder why they bother teaching anything. Fink concluded with a 30-year vision, as if he’s mastered the art of ignoring the next bear market. 🐺📈

FAQ ⏰

- What shift did Fink make?

From “Bitcoin is a scam” to “Bitcoin is my new financial exorcist.” - Why the sudden demand for Bitcoin?

Because fear tastes better than hope, apparently. 😈 - Tokenization’s impact?

It’ll make markets faster… or at least the paperwork will. - Concerns about Bitcoin’s market?

Leveraged players: the crypto version of a drunk bear juggling dynamite. 🐻🧨

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- The MCU’s Mandarin Twist, Explained

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- These are the 25 best PlayStation 5 games

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- SHIB PREDICTION. SHIB cryptocurrency

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Rob Reiner’s Son Officially Charged With First Degree Murder

2025-12-08 02:09