Ah, Ethereum. Once again, it finds itself squirming under the relentless pressure of selling, clinging desperately to a support level as the entire crypto market continues its sad struggle for a glimmer of bullishness. Altcoins are like a sinking ship, and traders, oh, they’re starting to whisper again. “Bear market.” Yes, those dreaded words. Ethereum, my dear, is now teetering on the edge, looking over its shoulder with nervous anticipation-will it hold its ground, or shall it plunge further into the abyss?

But wait! Not all is doom and gloom. Enter Bitmine, the majestic whale of Ethereum, who just made a rather ostentatious purchase. Yes, a massive 63,539 ETH, valued at a cool $251.6 million. Let’s not pretend this isn’t the kind of power move that makes other whales feel a tad… inadequate. You see, these large, timely buys might not flip the market overnight, but they certainly do make a statement. They whisper in the ears of market participants that someone with very deep pockets thinks there’s something worth snagging here. 💸

And now, dear readers, we wait. If Ethereum can hold this critical support and edge into a higher low, the market might just treat this selloff as a harmless shakeout. Lose it, though, and brace yourselves-bear market predictions will be echoing from every corner. At this point, Ethereum is like a person stuck between two doors, one leading to a fragile rally, and the other to a more ominous descent.

Bitmine Adds Ethereum Amid Market Weakness

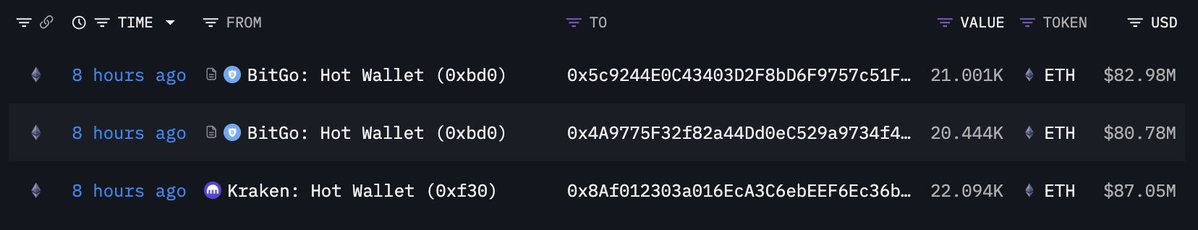

Just eight hours ago, in a move that could only be described as “suspiciously strategic,” Bitmine-an Ethereum whale of significant stature-added a considerable chunk of ETH to its already sizable stash. 63,539 ETH, in fact, bought from Kraken and BitGo. Now, this isn’t your run-of-the-mill “repositioning.” No, no. When this kind of volume moves during a market storm, it’s clear: we’re talking institutional accumulation. The kind that says, “I see value where others are blind.” And maybe, just maybe, it’s a psychological boost at a time when everyone else is in panic mode.

With this recent acquisition, Bitmine now controls a staggering 3,299,553 ETH-worth around $13.07 billion. That’s 2.73% of Ethereum’s total supply. When you own that much, you’re not just a player-you’re the referee. Bitmine’s position in the Ethereum landscape is so massive that it can influence both sentiment and liquidity. Analysts, of course, will say this is a clear sign of confidence, especially in times of high volatility. But let’s be real-when that much ETH changes hands, it might just be a signal that the smart money sees the dip as an opportunity. 🤑

But let’s not get too carried away. Yes, Bitmine’s strategic move might inject a bit of stability into a fragile market, but Ethereum is still vulnerable to those pesky macroeconomic headwinds. Big on-chain moves alone won’t save the day if the global market stays in a nosedive. But Bitmine’s actions-let’s call it a bold show of conviction-suggest that some investors still see this dip as a bargain, rather than the beginning of a deeper decline.

Testing A Pivotal Price Level

On the 3-day chart, Ethereum is attempting to regain composure after what can only be described as a dramatic drop. Trading around $3,871, it’s trying, valiantly, to hold onto the uptrend that has defined its broader structure. But-oh-those recent candles. They tell a story of waning bullish momentum. After hitting near $4,800, ETH fell back, testing its 50-period moving average (the blue line), a key short-term support level.

This zone, dear reader, is pivotal. Historically, it’s been the turning point during mid-cycle consolidations. If ETH can cling to this support, it will maintain its healthy market structure. If not-well, then we’re talking a potential drop to between $3,400 and $3,500, where the 100-period (green) and 200-period (red) moving averages meet-an area where long-term buyers might swoop in for a bargain.

On the upside, Ethereum needs a solid close above $4,000 to $4,200 to regain its swagger and possibly test the $4,500 resistance level, which has been a stubborn obstacle since late September. The market is watching, and the drama continues.

To sum up: Ethereum is facing short-term weakness within a broader bullish trend. If it can hold its mid-range support, we might just be looking at an accumulation phase rather than the start of a longer market retrace. Will Bitmine’s big bet pay off? Time will tell. But oh, what a show it’s putting on. 🎭

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- Every Death In The Night Agent Season 3 Explained

- Gold Rate Forecast

2025-10-22 03:39