So, Bitcoin‘s trying to wake up from its nap after hitting the $90,000 snooze button! 💤 You can almost hear the market say, “Is it safe to come out yet?” It’s like waiting for a bus that never shows up-after weeks of sitting still, there’s a glimmer of hope! But hold your horses; we’re still not sure if this is a party or just another awkward family reunion.

Top analyst Axel Adler, a name that sounds like he should be on a talk show, says the On-Chain Pressure Oscillator is giving us some juicy gossip about the market. This fancy gadget combines all sorts of numbers-like a mathlete’s wet dream-showing it’s lounging around the 46 mark. Historically, that’s where accumulation parties happen, not the distribution ones where folks run off with the punch bowl!

What’s the scoop? No aggressive sellers in sight! It’s like a bar at last call-everyone’s holding on to their drinks! 🍹 Exchange inflows are as quiet as a library, meaning investors aren’t rushing to toss their coins into trading chaos. Meanwhile, the old-timers are just chilling, refusing to sell even while the market throws a tantrum. And our short-term pals? They’re feeling the heat but keeping their wallets shut tighter than a clam at high tide.

All this tells us the market is balancing on a seesaw, held up more by a lack of supply than any wild demand. Talk about a delicate dance! 💃

Short-Term Holder Stress: The Silent Scream

Adler also mentions that our dear On-Chain Pressure Oscillator is still stuck in a consolidation phase, kind of like a couple thinking about whether to move in together-awkward and uncertain. While daily readings have softened like a marshmallow under a heat lamp, the overall trend is still hanging in there like a stubborn cat on a windowsill.

These moments usually pop up when the market is digesting its last meal (or maybe a bad burrito) before gearing up for the next big move. This stability means the sell-side pressure is napping, even if the demand hasn’t decided to join the fun yet. But beware! If that oscillator drops below neutral, it could mean the party is over, and the sellers are back with a vengeance!

This whole situation is tied to Bitcoin’s relationship with the Short-Term Holder (STH) price. With Bitcoin dancing below what recent buyers paid, most short-term holders are looking at their wallets wondering why they thought buying at the peak was a good idea. Their selling motivation? About as low as a limbo stick at a beach party. 🌴

But things could change if Bitcoin gets close to that magical $100,000 mark! A break-even for short-term holders might unleash a flood of coins like they’ve just won the lottery. Yay! But if we want real excitement, we need prices to reclaim the STH level while the oscillator puts on some muscle. 💪

Bitcoin Bounces Back But Faces Resistance Like a Bad Movie Sequel

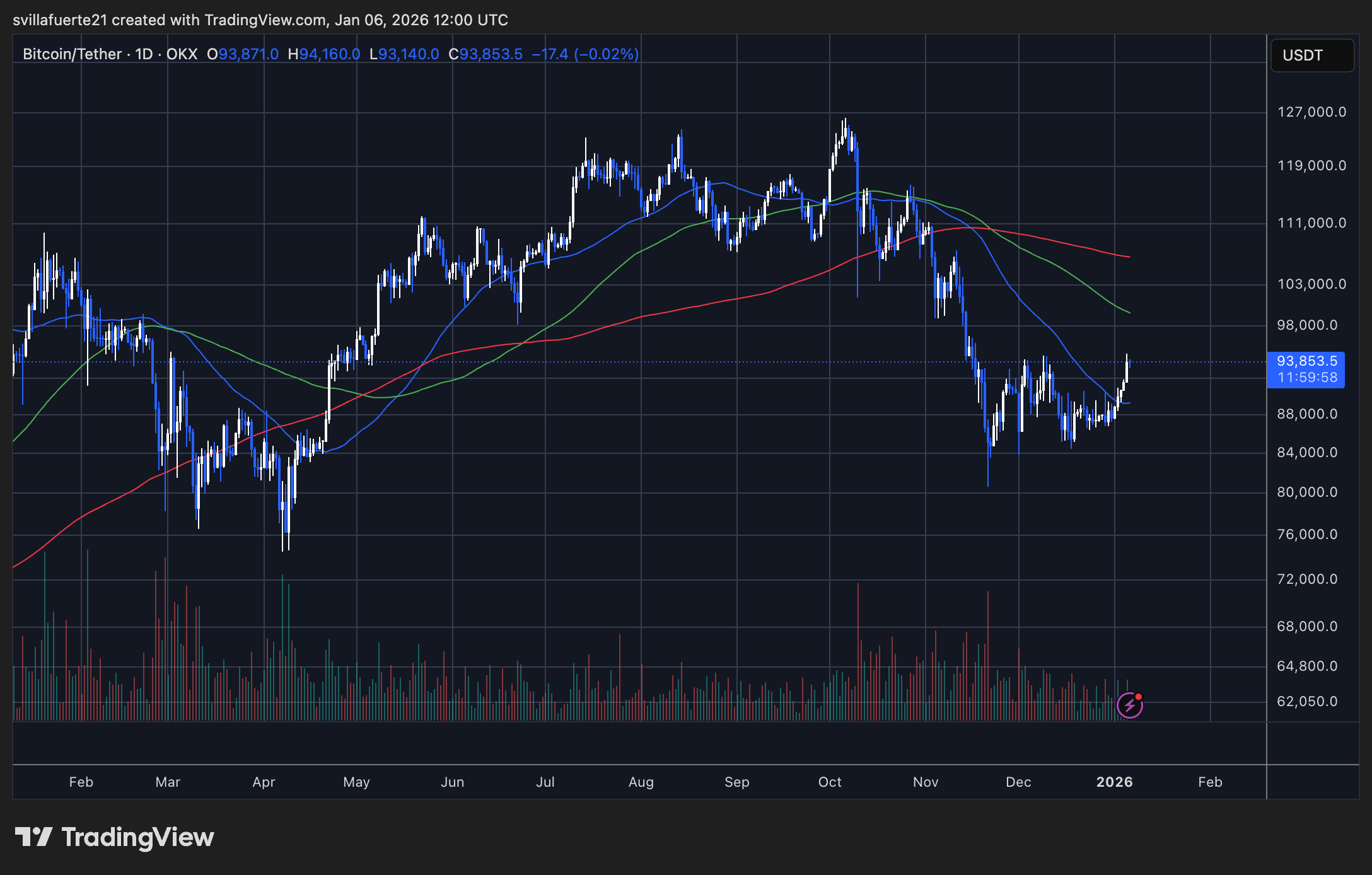

Right now, Bitcoin is trading around $94,000 after doing a fantastic leap from December’s lows, which were hovering around $82,000-$84,000. It’s like watching a superhero movie, but with fewer explosions! 🚀 Despite the bounce, the bigger picture looks like a rollercoaster ride: thrilling but constrained!

Bitcoin’s just reclaimed its short-term moving average-like finding the remote after losing it for hours! 📺 This is a good sign, hinting that those pesky downside forces are easing up. But wait! It’s still below the mid- and long-term moving averages, which are acting like the bouncers of the club, keeping the party from getting too rowdy.

All this selling drama peaked during the November-December breakdown, while the current rebound feels more like a gentle hug than a wild rave. The market seems to be swinging from a panic sell-off into a cozy recovery phase. Holding above $90,000-$92,000 is crucial to avoid a dramatic plot twist back down. If they fail, it’s back to the drawing board! 🎨

Read More

- All Itzaland Animal Locations in Infinity Nikki

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- James Gandolfini’s Top 10 Tony Soprano Performances On The Sopranos

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Ethereum’s Volatility Storm: When Whales Fart, Markets Tremble 🌩️💸

- Super Animal Royale: All Mole Transportation Network Locations Guide

- 7 Lord of the Rings Scenes That Prove Fantasy Hasn’t Been This Good in 20 Years

- Silver Rate Forecast

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

2026-01-07 07:27