In the dusty plains of the digital frontier, the Bitcoin derivatives market hums with the restless energy of traders, their eyes gleaming like prospectors in a gold rush. Futures and options, they say, are the new forty-niner’s pan, and the open interest? Well, it’s deeper than a canyon.

Futures Trading: A Stampede to $110K Max Pain 🏇💔

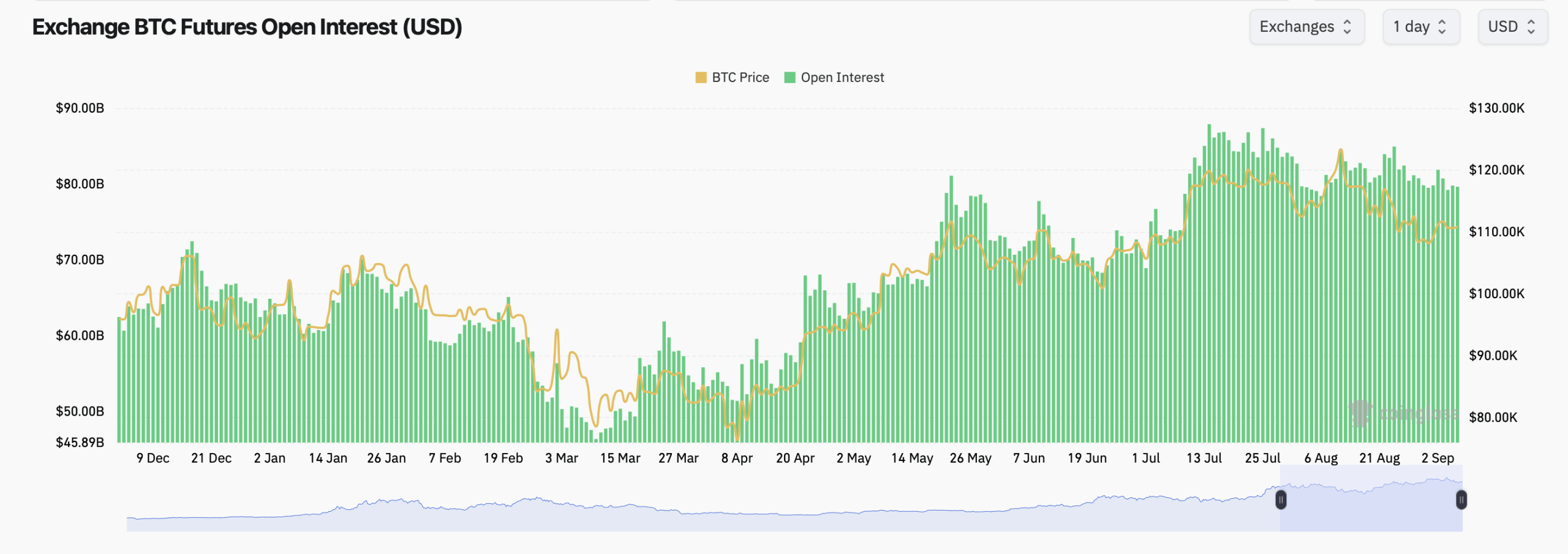

On a Saturday in September 2025, Bitcoin moseyed along at $110,894, down 1.8% in the past 24 hours, its hooves dragging between $110,339 and $113,142. This digital stallion, as they call it, ain’t been tamed yet. Coinglass.com’s metrics show futures open interest at 717,980 BTC ($79.63 billion), a number so big it’d make a Texas rancher blush. CME leads the pack with 136,380 BTC ($15.12 billion), followed by Binance and Bybit, each with their own chunk of the pie. 🥧

OKX, Gate, and Kucoin trail behind like stragglers in a wagon train, with Gate showing a bit of pep at +1.45% in open interest. BingX, though? It’s taken a tumble, dropping 15.84% in four hours-faster than a cowboy off a bucking bronco. 🤠 Aggregate futures open interest has dipped since late August, but it’s still higher than a prairie dog’s hat. Open interest and Bitcoin’s price move together like two drunks in a saloon, with peaks above $90 billion during mid-July’s rally.

Now, in early September, futures interest sits near $80 billion, a slight pullback after the summer’s wild ride. In the options market, total open interest is nearly $60 billion, with most of the action on Deribit. Calls make up 59.27% of open interest, like a chorus of optimists in a room full of skeptics. Puts, at 40.73%, ain’t far behind, though. Over the past 24 hours, calls led the volume with 52.19%, just a hair ahead of puts at 47.81%. It’s a tug-of-war, and the rope’s getting frayed. 🧵

The tilt toward calls suggests folks are betting on a moonshot, but those puts? They’re the safety net, just in case the rocket crashes. The biggest bets are on Dec. 26, 2025, $140,000 calls and Sept. 26, 2025, $95,000 puts. Other strikes are clustered around $115,000 to $150,000, like vultures circling a carcass. 🦅

On the volume side, near-term expiries are the stars of the show, with Sept. 12 $110,000 puts and Sept. 26 $116,000 calls leading the charge. Max pain, the point where option holders feel the most pinch, sits near $110,000 for September expirations. That’s where the market makers aim to keep things, minimizing payouts like a shrewd bartender watering down drinks. 🍻

With Bitcoin trading just above max pain on Saturday, the derivatives market’s balanced on a knife’s edge-bullish calls on one side, defensive puts on the other. It’s a game of chicken, and nobody’s blinking yet. 🐔

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- All Itzaland Animal Locations in Infinity Nikki

- NBA 2K26 Season 5 Adds College Themed Content

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- EUR INR PREDICTION

- Super Animal Royale: All Mole Transportation Network Locations Guide

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- Gold Rate Forecast

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

2025-09-06 18:27