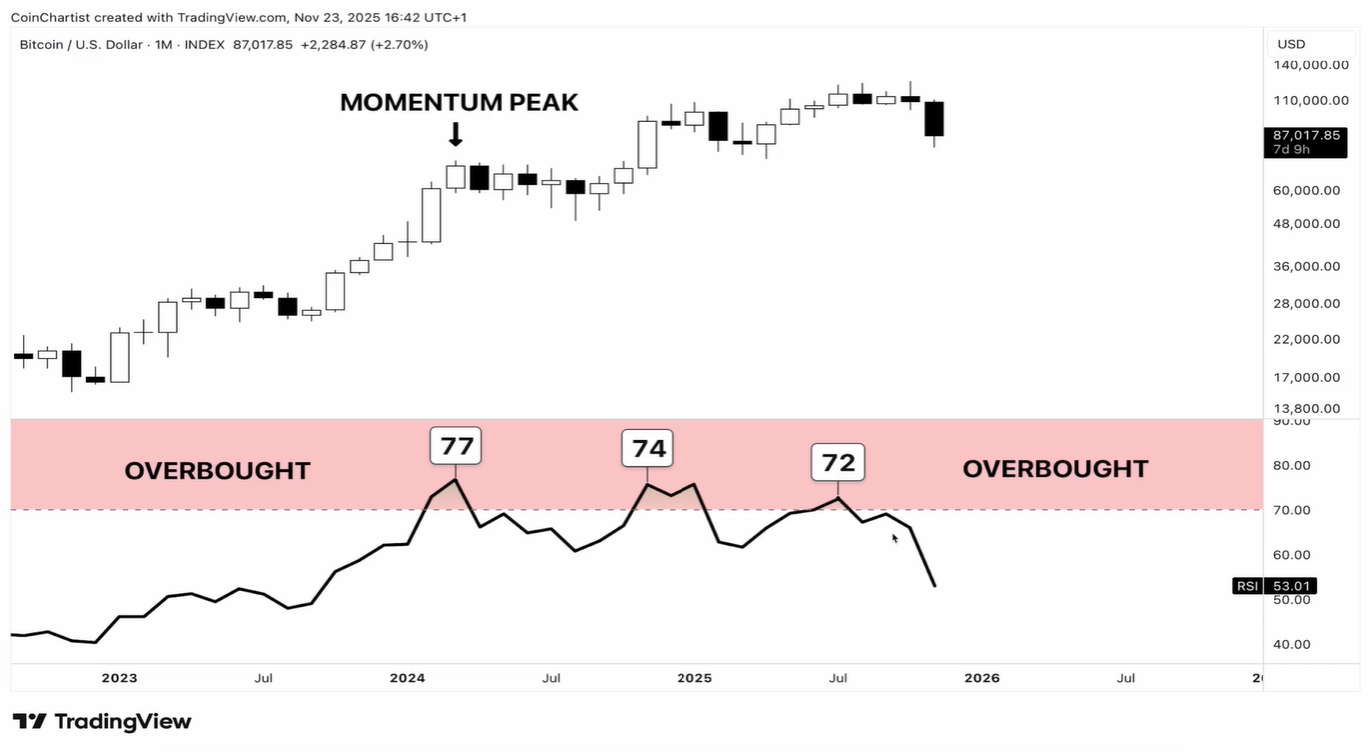

“three successive higher highs on price, three successive lower highs on the indicator.” A trend, he declares, “dying under the hood,” while the masses, blind and gleeful, chase the mirage of fresh highs. 🤑💀

The Triple Curse: A Market in Agony

In a video, shared on the digital gallows of X, Severino laments the rarity of this “triple negative divergence.” A single divergence, he notes, is but a whisper of caution. But three? “A triple divergence is like yellow, orange, flashing red,” he warns, his voice dripping with the gravitas of a man who has stared into the abyss of candlestick charts. 📉🔥 The market, he insists, is “screaming,” yet the mob, ever greedy, marches onward, oblivious to the knife dangling above their necks. 🧑🤝🧑⚔️

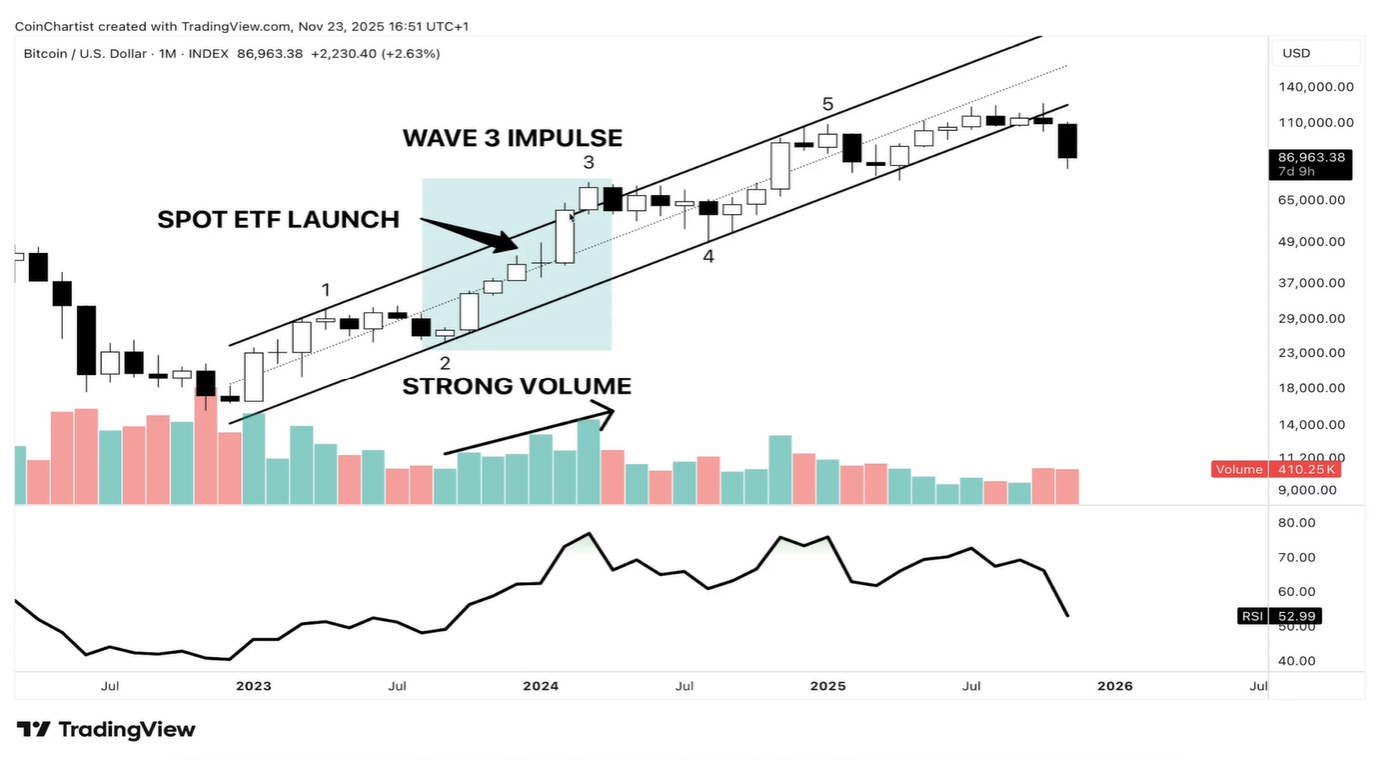

Severino, with the precision of a tormented soul, maps this tragedy onto Bitcoin’s bull cycle. The first high, a moment of euphoria, coincided with the ETF launch – a wave-three impulse in his Elliott Wave symphony. “Everybody’s excited,” he recalls, his tone tinged with sarcasm. But the second high, though breaking records, was a hollow victory, its internals weak. “Fewer aggressive buyers,” he notes, “early participants taking profits.” Ah, the first cracks in the facade! 🕳️💔

The third high, a marginal whisper above $126,000, was the death knell. “Buyers exhausted,” he declares, “shorts covering, late FOMO buyers pushing it higher.” The pros, ever cunning, used this moment to offload their positions, leaving the naive to drown in their greed. 🌊🤑 Yet, Severino, ever the pragmatist, sold at $105k, leaving only a pittance to fate. “I didn’t want to get caught up in what comes after all this,” he admits, his voice heavy with the weight of experience. 🧐💼

But what of sentiment? “Complacent,” he scoffs, “not euphoric.” The masses, lulled by the siren song of endless gains, believed the lie: “It’s going up forever.” Oh, the folly of man! 🌍🤡

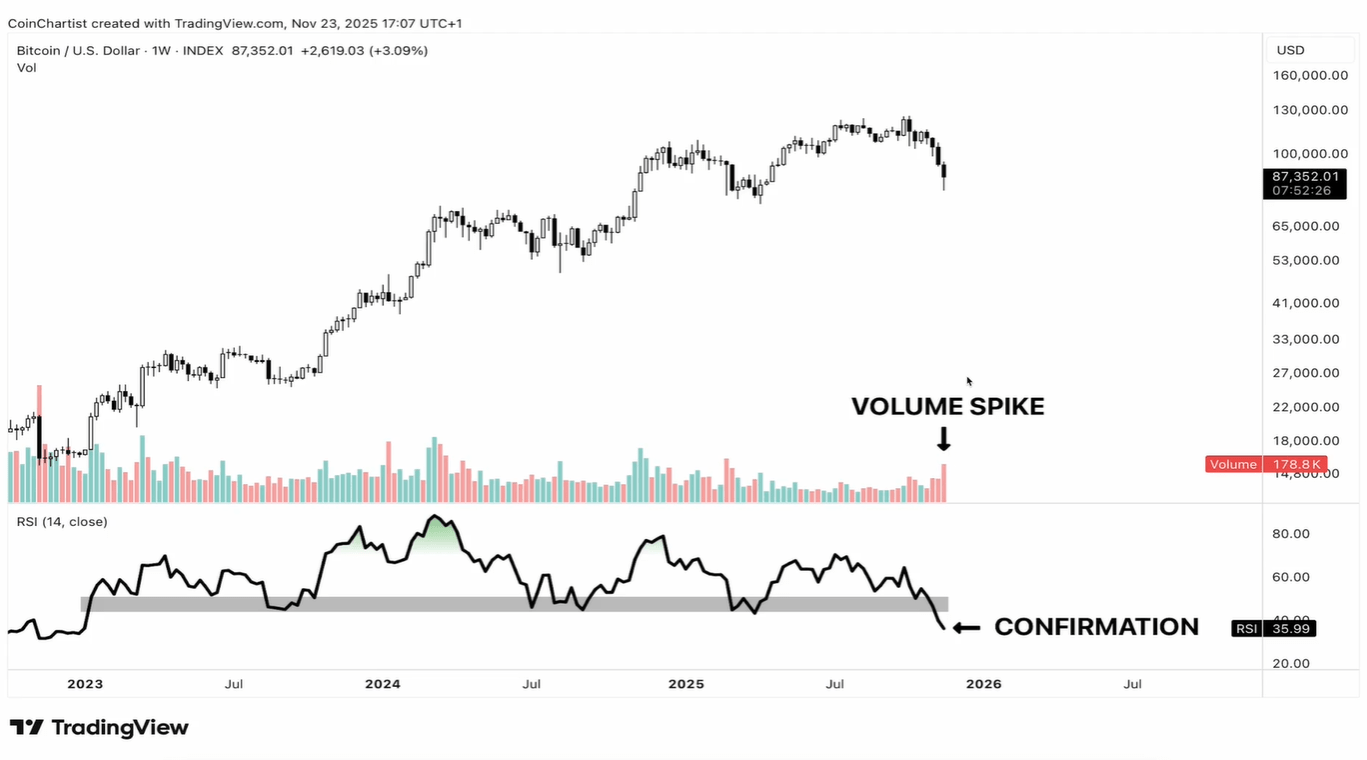

Yet, Severino is no alarmist. The divergence, he insists, is but a setup. Confirmation is key. A break of the rising trendline, the loss of key moving averages, a shift in weekly RSI – these are the signs. “The trend is no longer holding,” he warns, his words a funeral dirge for the bull. ⚰️📉

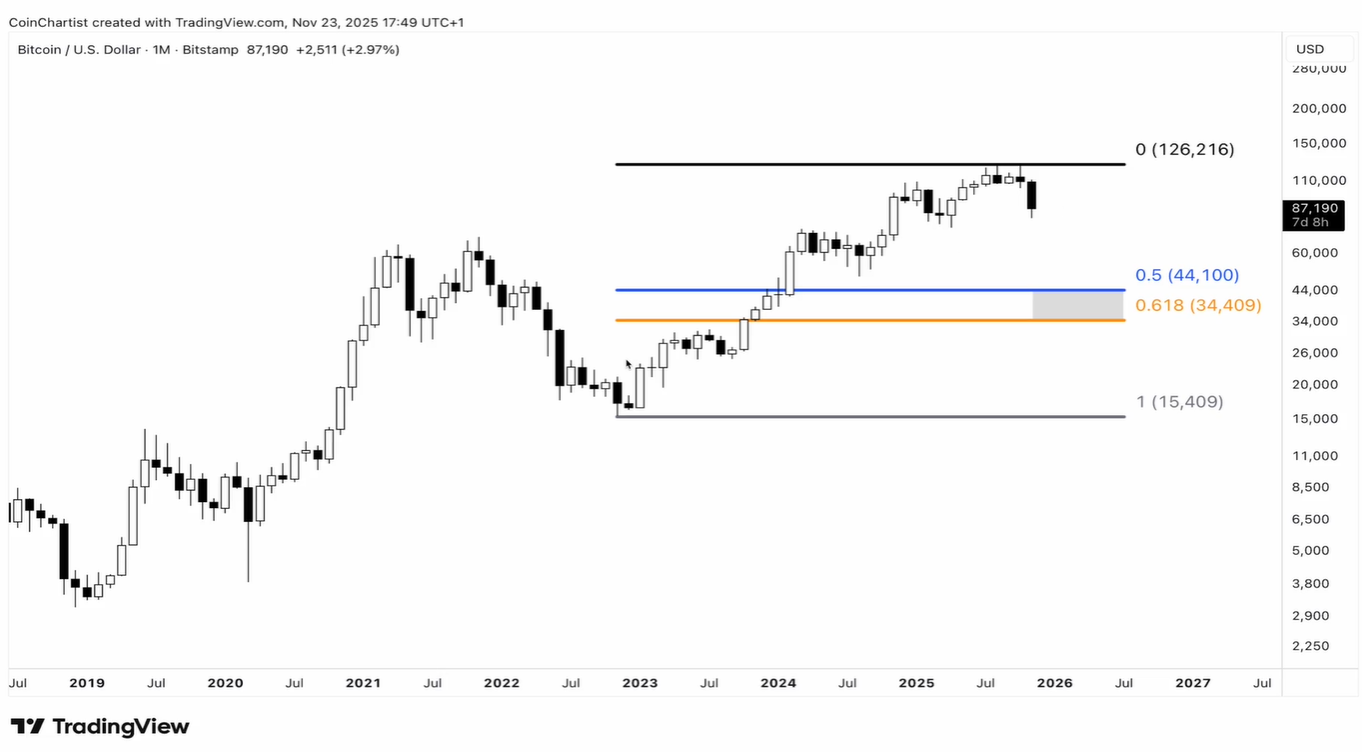

And how low can Bitcoin go? Severino, ever the pessimist, overlays Fibonacci levels, pointing to a retracement between $44,100 and $34,409. “About 60 to 70 percent from the top,” he estimates, “par for the course in a Bitcoin bear market.” 🌪️💸 But wait, there’s more! A “bigger version” of this doom may be lurking on higher timeframes, a nested nightmare within a nightmare. “This could not be so great for Bitcoin,” he mutters, his voice a whisper in the void. 🕳️🌀

Yet, even in his darkest prognostications, Severino clings to uncertainty. “I can’t say this is the end-all be-all,” he admits, “it doesn’t guarantee anything.” No, this is no call to arms, but a plea for caution. “Manage your risk,” he urges, his voice a beacon in the chaos. 🛡️🚨

At press time, Bitcoin traded at $87,658 – a number that, in the grand scheme of things, means nothing and everything. The market, ever fickle, continues its dance, while Severino, our modern-day prophet, watches from the sidelines, a silent witness to the folly of man. 🕺💸

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- All Itzaland Animal Locations in Infinity Nikki

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- EUR INR PREDICTION

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

2025-11-25 17:14