Ah, Bitcoin, that darling of digital speculation, now gingerly flirting with the $115,000 mark-an almost noble ascent following yesterday’s tepid jig. The great puppeteer behind this spectacle? None other than the US Federal Reserve, whose anticipated interest rate cut next week has markets collectively holding their breath, hoping for looser monetary gravy. Risk assets, with crypto in tow, have responded with the enthusiasm of debutantes at a dull country ball, buoyed but hardly breathless.

Our dear Bitcoin’s real trial, however, is much less glamorous: can it keep up the charade of strength? Standing above $115K is heartening, but the road ahead bristles with the usual suspects-macroeconomic dread and inscrutable blockchain whispers. Investors stare cautiously, half expecting a gentleman’s agreement to be broken at any moment.

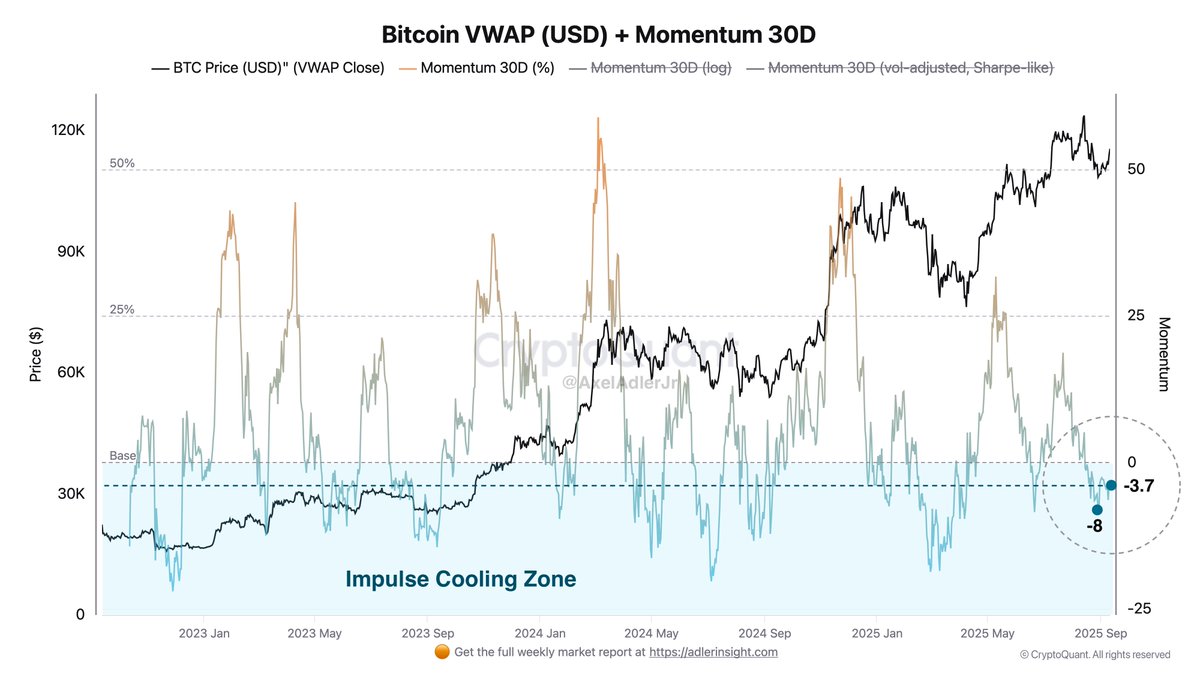

Enter the erudite Axel Adler, wielding his charts and mind like a slightly bemused sorcerer. According to him, Bitcoin’s 30-day momentum currently languishes in what he terms the “Impulse Cooling Zone”-a phrase that implies more huffing and puffing than actual progress. Yet, he assures us, the trend trudges on, merely consolidating rather than collapsing, as if Bitcoin were taking a brief nap rather than heading for the guillotine.

The market remains an exquisite mess of volatility, eagerly awaiting the Fed’s next decree. Bitcoin’s ability to hover above its newfound perch might yet determine whether it pirouettes into fresh highs or stumbles back into obscurity, a delicate dance choreographed by macro forces and blockchain resilience.

Bitcoin Market Drift: Momentum, Liquidity, and Demand

What, pray tell, does this all mean for the discerning observer? Adler notes Bitcoin is engaged in a kind of sideways shuffle rather than a reckless plunge. Negative 30-day momentum, paired with price clinging stubbornly to lofty heights, suggests coins change hands slowly-like a family heirloom passing reluctantly through generations. No full-blown trend reversals, just tedious, incremental unloading.

For the bulls with patience-and who, at this juncture, might as well knit a scarf while waiting-true momentum demands a return to the realm of positive figures, ideally surpassing +10%, signaling a reawakening of the upward impulse. Until then, Bitcoin drifts in a fog of thin liquidity, crawling higher on the strength of weak supply and the occasional local buyback, as precarious as a cat balancing on a polished marble floor.

Adler, ever the party pooper, reminds us that genuine demand rarely springs forth at the cyclical peaks. Instead, value hunters appear when Bitcoin hangs its hat at a discount, lured by his sophisticated analyses of Short-Term Holder costs and market premiums. In other words, the sustainable bull run is not a fevered sprint but a cautious trudge through the discount aisle, where wary buyers carefully check price tags rather than chase momentary euphoria.

This all paints Bitcoin as a creature of delicate temperament-structurally firm, yet prone to shattering glass should liquidity spasm. One might think it a metaphor for most social gatherings.

BTC Holds Strong Above Demand

Currently perched at approximately $115,142 after a commendable recovery from $110,000, Bitcoin scales its charts with measured ascension. The 12-hour analysis shows BTC eyeballing a cluster of moving averages: the 100 SMA plays the role of a slightly unwilling gatekeeper at $114,610, while the 200 SMA has our hero safely supported at $112,267, and the 50 SMA flirts with upward momentum near $111,987-together composing a technical symphony that sings to bullish ears.

A triumphant close beyond $116,000 would have the bulls polishing their trophies, setting the stage for an encore at $118,000 and the formidable resistance bastion of $123,217; a true Everest before the fabled summit of all-time highs reveals itself.

Should the price falter near $114,000, followed by a tumble below $112,000, the mood could sour rapidly. The 200 SMA’s support might give way, inviting a fresh round of selling-a collapse towards $110,000 less of a collapse and more of a fainting fit.

In short, Bitcoin has dusted itself off after recent volatility. Hold above those moving averages, break $116,000, and the next bullish movement may well be underway-though the $123K barricade shall strictly judge its mettle.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- NBA 2K26 Season 5 Adds College Themed Content

- Gold Rate Forecast

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- Pokemon LeafGreen and FireRed listed for February 27 release on Nintendo Switch

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- Train Dreams Is an Argument Against Complicity

- EUR INR PREDICTION

2025-09-12 20:06