Ah, the tempestuous dance of Bitcoin! On the sixth of February, it plummeted toward the modest sum of sixty thousand dollars, a fall so precipitous it liquidated over two and a half billion in leveraged positions within a single day. A tragedy, you say? Nay, a farce-the most ludicrous since the grand collapse of FTX in the fateful November of 2022. The pundits, ever so wise, attribute this to “macro pressures” and “weak sentiment,” as if the market were a delicate maiden fainting at the sight of a mouse.

But hark! DeFi sage CryptoNobler, a voice in the wilderness, declares the true culprit to be structural-a slow-brewing storm of synthetic hubris. Bitcoin, he laments, no longer trades as a creature of supply and demand but as a puppet in the hands of derivatives. “The moment supply can be synthetically created,” he intones with the gravity of a prophet, “scarcity vanishes like a mist at dawn. And with it, the price, once discovered on-chain, now lies captive to the whims of derivatives.”

The Phantom Hard Cap

Oh, the irony! Bitcoin’s vaunted 21 million hard cap remains, a ghostly relic on-chain. Yet, its original promise-fixed supply and no rehypothecation-was shattered the moment Wall Street, with its insatiable appetite for complexity, layered futures, swaps, options, ETFs, and other financial chimeras upon the pristine blockchain. A tragedy of hubris, indeed.

Bob Kendall, the astute creator of PortfolioXpert, echoes this lament. “Synthetic supply,” he declares, “renders scarcity a mere illusion. The price, once a reflection of market forces, now dances to the tune of derivatives-a game of shadows and mirrors.”

The Six-Headed Hydra of BTC

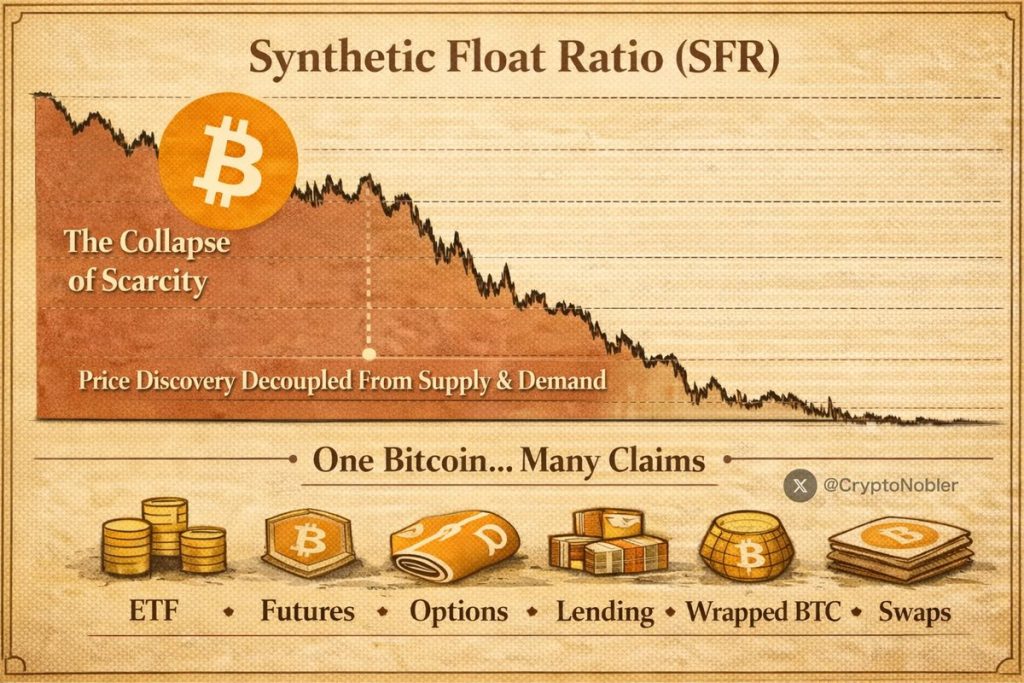

CryptoNobler introduces us to the Synthetic Float Ratio (SFR), a beast with six heads. One real BTC, he explains with a touch of mordant humor, now backs an ETF share, a futures contract, a perpetual swap, an options delta, a broker loan, and a structured note-all at once. “Six claims on one coin,” he warns, “a fractional-reserve system masquerading as Bitcoin. A free market? Nay, a carnival of financial prestidigitation.”

“That’s six claims on one coin. That is not a free market. That is a fractional-reserve price system wearing a Bitcoin mask,” he warned, his voice dripping with sarcasm.

And so, the tale repeats itself, as it did with gold, silver, oil, and equities-derivatives, those masters of illusion, seizing control. A structural break, a fall from grace, a comedy of errors.

Wall Street’s Perpetual Waltz

The researchers paint a picture of a cycle both relentless and absurd: create paper BTC without end, short into rallies, force liquidations, cover at lower prices, and begin anew. CryptoNobler dubs it “inventory manufacturing”-a term so apt it borders on poetry. Today’s crash, a mere chapter in this endless farce, saw $2.1 billion in long positions liquidated, derivatives leading the charge while the spot market remained, relatively speaking, a haven of calm.

What Awaits the Bitcoin Holder?

Bitcoin now hovers around sixty-six thousand dollars, having rebounded from its sixty-thousand-dollar nadir. The question lingers, heavy with irony: how long shall this cycle persist before the market awakens from its slumber? A riddle wrapped in a mystery, inside an enigma-or perhaps, merely a joke at the expense of the credulous.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- Best Zombie Movies (October 2025)

- All Songs in Helluva Boss Season 2 Soundtrack Listed

- This free dating sim lets you romance your cleaning products

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

2026-02-06 14:22