Imagine a world where your crypto investments are as unpredictable as a squirrel on a caffeine binge. Well, buckle up, because Bitcoin‘s latest dance move suggests a potential sprint to $96,000, or maybe just a fancy hop – nobody’s quite sure. Market uncertainties and the kind of volatility that would make a hedgehog blush suggest we should probably keep our expectations tethered to a sturdy post. 🎢

Recently, Bitcoin has been playing hide-and-seek with its support levels, all the while forming an inverse head-and-shoulders on the 4-hour chart – which sounds like a really sarcastic way to describe a giant, confusing mountain of lines and squiggles. According to Feral Analysis (because who wouldn’t want a research firm with a name that sounds more like a wild animal than a financial analyst), this pattern could be a sign of a short-to-mid-term turnaround. Or, you know, a fancy way for the market to tease us.

BTC‘s Fancy New Pattern

This pattern is basically three valleys in a line: a big, glorious “head” in the middle, flanked by two somewhat smaller “shoulders.” It’s the technical analysis equivalent of a moody teenager leaning against a wall – but apparently, it’s a good sign. John Murphy, the guy who wrote the book – literally – on technical analysis, says it’s an indicator that the selling pressure might just take a coffee break.

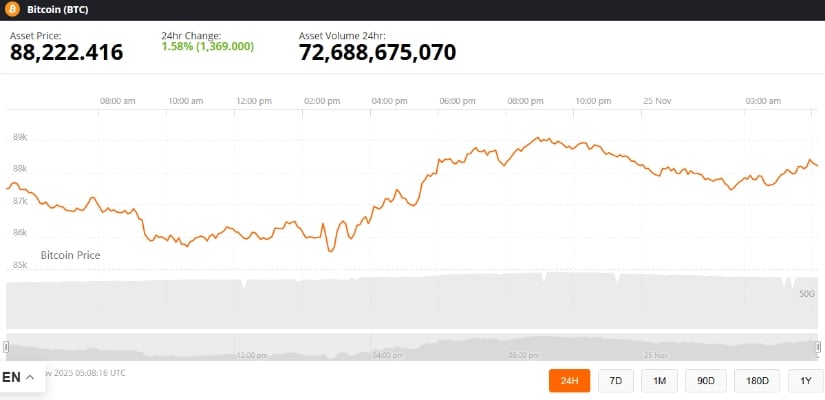

Projections based on chart magic suggest that if Bitcoin breaks above the mystical $87,000 line, it might just sprint to about $96,400 – assuming it’s feeling up to it, of course. According to Feral Analysis, the “height” of this pattern is like an upside GPS, but the actual journey depends on market liquidity, macroeconomic mumbo jumbo, and trading volume – basically, all the things that like to keep traders awake at night.

Bitcoin’s Support Fortress

Despite a brief dip (because who doesn’t love late-night market dips?), Bitcoin held firmly above $84,000 – kind of like that stubborn aunt who refuses to leave your house. It even brushed past $80,000 but then bounced back like a rubber ball on caffeine, ending the week at around $86,850. Because, of course, it did.

Support zones are listed with the enthusiasm of a weather forecast:

- $75,000 – the secondary floor, if everything goes to hell in a handbag.

- $72,000-$69,000 – the high-volume cluster that doesn’t like to let go of its grip.

- $58,000-$57,700 – long-term support, including the Fibonacci retracement (because traders love fancy numbers).

Historical analysis shows that even when markets are feeling bearish, oversold conditions (that RSI thingy) can spark a short-term bounce – kind of like a rubber duck in a flood.

Resistance and Targets – The Mountain to Climb

Using a blend of Fibonacci magic and high-volume zones, traders have their eyes on these levels:

- $91,400 – the first big hurdle (Fibonacci 0.236)

- $94,000 – the high-volume sweet spot

- $98,000 – more resistance for those with lofty ambitions

- $103,000-$109,000 – Fibonacci and Voluminous Highs, because why not?

- $116,500 – the final boss before all-time highs, or just another mirage.

Remember, these are educated guesses dressed up like certainty. Traders are advised to keep their volume and macro-level eagle eyes peeled, because holiday low-volume shenanigans can turn the market into a rollercoaster on steroids. 🎢

What’s the Future? A Mix of Hope and Doh!

The current technical indicators suggest a mild bullish mood if Bitcoin can keep its support above $84,000. Possible scenarios include:

- Breaking above $87,000 might just send it running toward $94,000 – or another fiasco.

- If it can’t hold $80,000, a tumble to $75,000 isn’t out of the question – better pack a parachute.

Crypto analyst Ethan Greene from MarsBit warns, “These patterns are more like weather forecasts – promising, but not guaranteed. Sometimes, the crypto gods just smirk and say, ‘Nope,’ where extreme leverage or low liquidity are involved.”

The Big Picture: Market Chaos or Calm?

Global shenanigans like Federal Reserve interest rate debates, the U.S. economy doing the hokey pokey, and liquidity uncertainties make predicting Bitcoin’s short-term moves as fun as herding cats. It’s been resilient so far, but one unexpected external shock could turn everything upside down faster than you can say “volatility.”

Forecast 2025 & Beyond: The Long Game

Looking ahead, experts are cautiously optimistic about Bitcoin consolidating around current levels before attempting new heights. Key factors include:

- Liquidity and trading depth (think of it as market stamina)

- Interest rate shenanigans

- The reliability of our beloved technical patterns under stressful conditions

While the models suggest there’s a glow of upside potential, remember: in crypto, luck, timing, and a sprinkle of insanity often determine who wins the jackpot – or the trash heap.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- All Itzaland Animal Locations in Infinity Nikki

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- EUR INR PREDICTION

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

2025-11-25 22:07