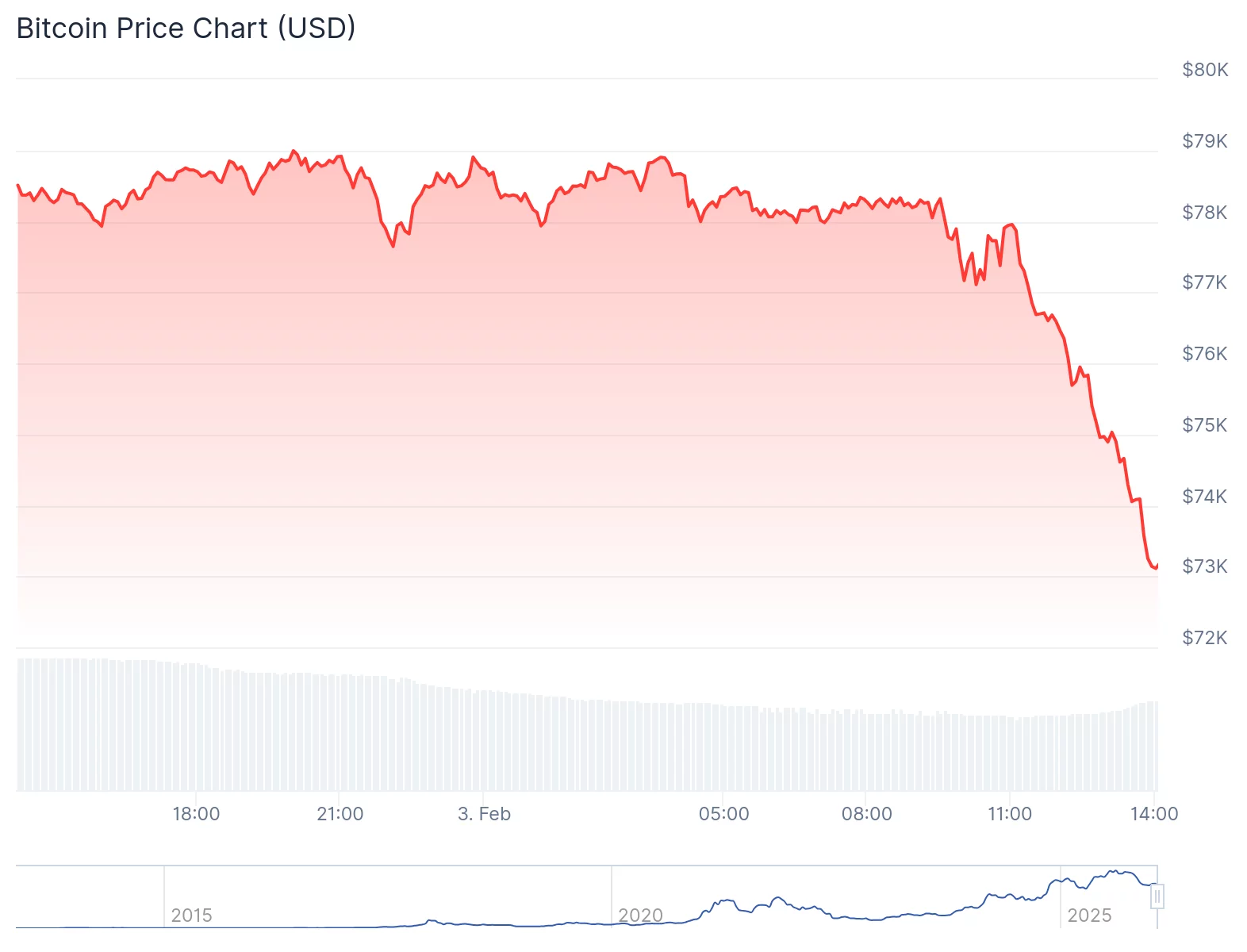

Ah, the mighty Bitcoin, that digital chimera of fortune, has tumbled once more, crashing to depths around $73,000 on a Tuesday as gray as the souls of its beleaguered investors. Its lowest point since the early days of 2025, it now wallows, a pitiful 15% down year-to-date. A tragedy? Or merely the universe mocking the hubris of those who dared to call it “digital gold“?

- Since its October 2025 peak, Bitcoin has spiraled downward, goaded by the blustering tariff proclamations of President Trump. A man whose words, like his hair, defy gravity-but only momentarily.

- Despite the White House’s crypto-coddling policies and the slavish devotion of institutional investors, Bitcoin’s market remains as stable as a tightrope walker with vertigo.

- “Digital gold,” they said. Ha! It trades more like a carnival ticket-exciting, risky, and ultimately, a gamble for fools.

Meanwhile, gold, that ancient relic of greed and fear, soared in its largest single-day gain since November 2008, rebounding from a plunge earlier in the week. Silver, not to be outdone, surged by 15% after a dramatic 27% crash on Friday. Both metals, like seasoned actors, know how to make an entrance-and an exit.

Their sell-offs, of course, were sparked by Trump’s nomination of Kevin Warsh as Fed Chair, a move that tightened rate cut expectations faster than a noose at a cowboy convention.

Bitcoin, ever the drama queen, plummeted over 6% on the day, dragging Ethereum down to $2,100 in a broader crypto slump. The $65,000 level now looms like a specter, a psychological and technical crossroads where demand gathers like vultures over a dying beast.

Bulls, those eternal optimists, must reclaim the $87,551 level to reverse the bearish trend. But in this market? It’s about as likely as Trump admitting he’s wrong. Immediate resistance sits at $80,000 and $84,000-walls as impenetrable as the man’s ego.

Massive Selloffs: A Comedy of Errors

Bitcoin’s fall follows a year as turbulent as a Trump rally, marked by a steep decline from its October 2025 peak. A series of market-moving events, including Trump’s tariff tirades, triggered a selloff that wiped out $19 billion in leveraged bets. Bitcoin, once the darling of the digital age, has tumbled over 40% since, according to Bloomberg.

Despite Trump’s grand promises to make the U.S. the “crypto capital of the world,” Bitcoin struggles to regain its footing, now testing critical support levels below $75,000. Perhaps it’s time to admit: the emperor has no clothes-and neither does his favorite digital currency.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- Mario Tennis Fever Review: Game, Set, Match

- Brent Oil Forecast

- EUR INR PREDICTION

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

2026-02-04 00:04