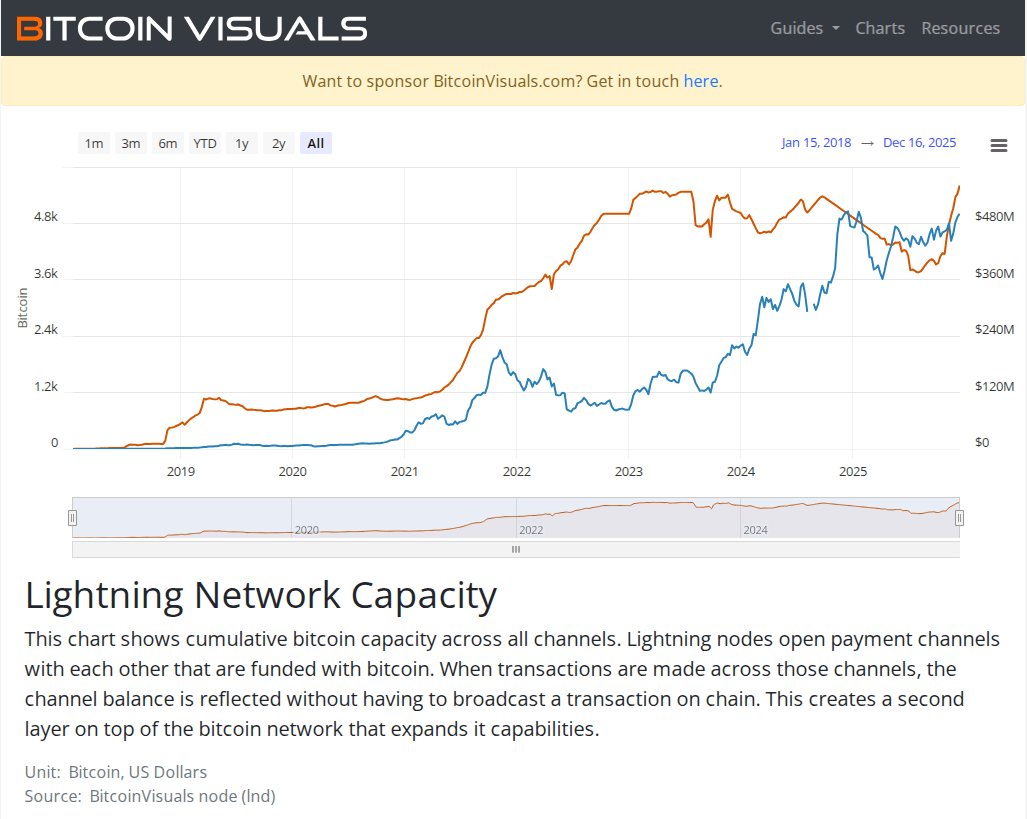

Ah, behold the marvels of our age! The Lightning Network, that cunning offspring of Bitcoin, hath reached a new zenith, swelling to a capacious 5,606 BTC! 🌟 Major exchanges, those grand purveyors of digital treasure, have deigned to pour their riches into off-chain channels, thus enriching the network’s liquidity and transforming the very manner in which mortals move their BTC. A triumph, you say? Nay, a farce of modern finance!

Exchanges: The New Patrons of Speed and Thrift

Reports doth proclaim that the Lightning Network’s public capacity hath ascended to near 5,606 BTC, with whispers of a fleeting peak at 5,637 BTC. A modest uptick, sayest thou? Fie! ’Tis the highest mark yet recorded, a testament to the exchanges’ largesse. Binance and OKX, those titans of trade, have led the charge, while Kraken and Bitfinex follow suit, all in the name of hastening deposits, withdrawals, and slashing fees. Yet, is this not but a gilded cage, where convenience doth mask the chains of custody?

Nodes and Channels: A Tale of Imbalance

Mark well, dear reader, that this surge in capacity hath not been matched by a commensurate rise in public nodes or channels. A mere 14,940 nodes and 48,678 channels stand sentinel, while the Bitcoin flows ever more freely. ’Tis as if the rivers of wealth are widening, yet the bridges remain few. Exchanges, those custodians of convenience, concentrate liquidity in their grand channels, moving vast sums without multiplying public routes. A clever ruse, perchance, but one that muddles the metrics of on-chain activity. Transaction counts and fee savings may sing of user benefits, yet the node graph remains a stoic observer, unmoved by the tumult.

Consider this: one exchange, in its wisdom, hath routed 15% of its Bitcoin transactions via Lightning, a testament to the network’s growing utility. Yet, is this not but a drop in the ocean of possibility? Stablecoins, remittances, merchant payments-all are but fledgling use cases, awaiting their moment in the sun.

Funding and Upgrades: The Winds of Change

Lo, the winds of innovation blow! Tether, that stalwart of stablecoins, hath led a round of funding, pouring $8 million into a startup dedicated to Lightning payments. A bold move, indeed, signaling a future where stablecoin flows dance upon Lightning’s rails. And what of protocol upgrades? Taproot Assets v0.7 arrives with reusable addresses, auditable supplies, and larger transactions-a foundation, they say, for trillions to flow. Yet, we ask, at what cost? Centralization looms, a specter haunting the peer-to-peer dream.

Announcing Taproot Assets v0.7, now with reusable addresses, a fully auditable asset supply, and larger, more reliable transactions. With this release, we are laying the foundation for trillions of dollars to flow on Bitcoin and Lightning. Read more below. Upgrade today! – Lightning Labs (@lightning) December 16, 2025

Critics, ever the naysayers, warn of centralization’s grasp, as custodial channels grow in might. Yet, the masses, ever practical, rejoice in lower costs, faster finality, and a seamless experience. A comedy of priorities, is it not? The idealists weep, while the pragmatists laugh all the way to the digital bank.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- These are the 25 best PlayStation 5 games

- The MCU’s Mandarin Twist, Explained

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- Gold Rate Forecast

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Mario Tennis Fever Review: Game, Set, Match

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- What time is the Single’s Inferno Season 5 reunion on Netflix?

2025-12-17 15:06