Bitcoin, that digital enigma that keeps us all awake at night, is once again testing the collective patience of investors. It’s clawing to stay above the $110,000 mark after last Friday’s nosedive, which felt less like a correction and more like a carnival ride gone horribly wrong 🎢. Traders, clutching their coffee cups and Pepto-Bismol, are now watching intently to see if BTC can find some semblance of stability or if it’s just warming up for another round of chaos.

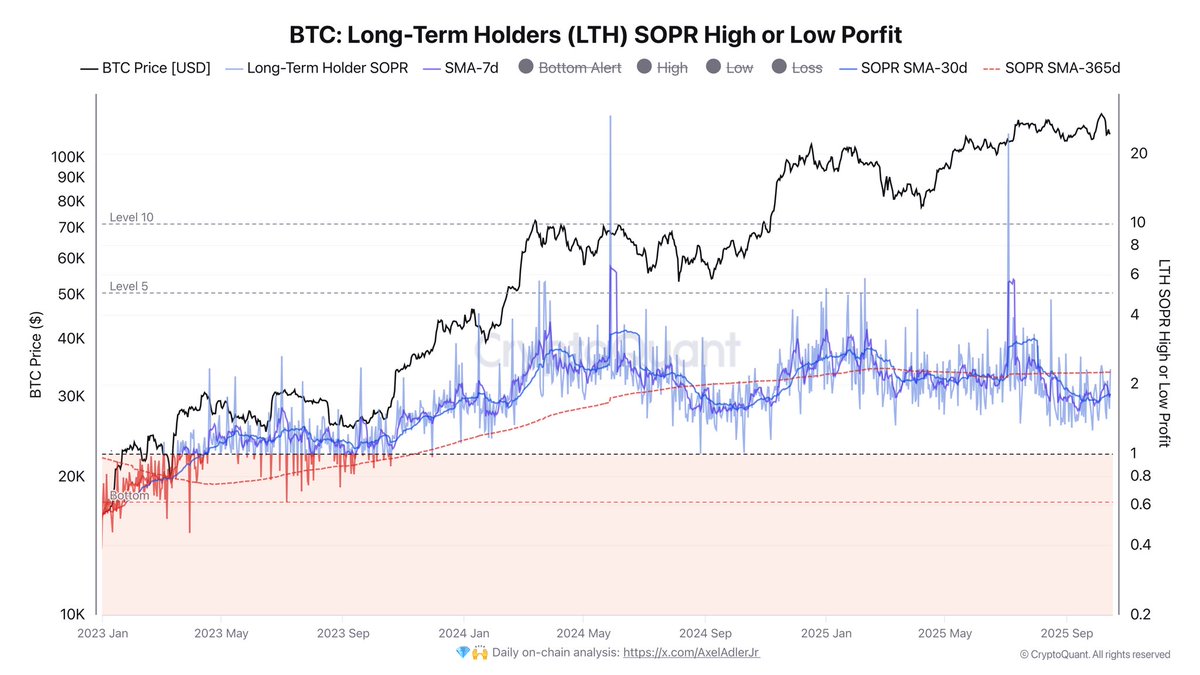

Enter Darkfost, the on-chain Sherlock Holmes, who reveals that Long-Term Holders (LTHs) are flexing their muscles-or perhaps their wallets-by exerting significant pressure on the market. Their Spent Output Profit Ratio (SOPR) sits at a whopping 2.32, which, in plain English, means they’re selling coins at an average gain of over 130%. Talk about cashing in on the crypto craze! 💰

This level of profitability is like a neon sign flashing “TAKE PROFITS NOW!” It’s no surprise that long-term investors are hitting the sell button after extended rallies, which naturally adds selling pressure and keeps Bitcoin looking a little wobbly. But hey, the fact that BTC is still holding its range suggests there’s still some demand out there-probably from folks who missed the memo that crypto markets are not for the faint of heart.

Profits Galore, But Fatigue is Creeping In

Darkfost, our favorite crypto sleuth, notes that while the Long-Term Holders’ SOPR is still sky-high at 2.32, the shorter-term averages are starting to lose steam. The weekly SOPR has dipped to 1.82, and the monthly SOPR sits at 1.79, both trending downward since summer. Translation: profit-taking is cooling off like a forgotten cup of tea ☕. This could mean the selling pressure is easing, which, in crypto land, is akin to a collective sigh of relief.

This dynamic is like watching a high-stakes poker game unfold. Long-term holders are still cashing in their chips (coins?), which caps momentum and makes price recovery feel like pushing a boulder uphill. But the decline in SOPR averages suggests this profit-taking spree might be running out of steam. Historically, such dips have paved the way for market stabilization and even recovery phases. So, fingers crossed 🤞!

Darkfost draws parallels to the October 2024 correction, when Bitcoin’s SOPR bottomed at similar levels before the next big rally. If history rhymes-and let’s face it, in crypto, it often does-this could mean the worst of the correction is behind us. But keep an eye on those SOPR levels; they’ll be the key to unlocking the next chapter of Bitcoin’s wild ride.

Bulls vs. Bears: The Battle for $110K

Bitcoin is currently hovering around $111,500, trying to catch its breath after last Friday’s sell-off. The 8-hour chart shows a fragile recovery, with BTC struggling to regain key moving averages and momentum fading below the $117,500 resistance. It’s like watching a tired boxer trying to stay on their feet 🥊.

The 50-day, 100-day, and 200-day moving averages are converging, which is crypto-speak for “things are about to get interesting.” BTC is currently trading below all three, meaning sellers still have the upper hand in the mid-term trend. Holding above $110,000 is crucial; a break below could lead to a retest of the $105,000-$106,000 range, where buyers previously showed up like fans at a Beyoncé concert.

Reclaiming $114,000-$115,000 would be the first sign of strength, potentially setting the stage for a push toward the $117,500 barrier. But volume remains muted, as if traders are holding their breath, waiting for the dust to settle.

Bitcoin’s price action suggests a consolidation phase, with buyers and sellers locked in a temporary stalemate. If bulls can defend the $110K zone and rebuild momentum, BTC might stage a gradual recovery. But if they fail? Well, let’s just say the correction could drag on longer than a Marvel movie marathon 🍿.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- NBA 2K26 Season 5 Adds College Themed Content

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- A free trip to the Moon will soon be possible. This upcoming exploration simulator is all about scientific realism

- Every Death In The Night Agent Season 3 Explained

2025-10-17 03:14