Oh, Bitcoin… What On Earth Is Happening? 🤦♂️

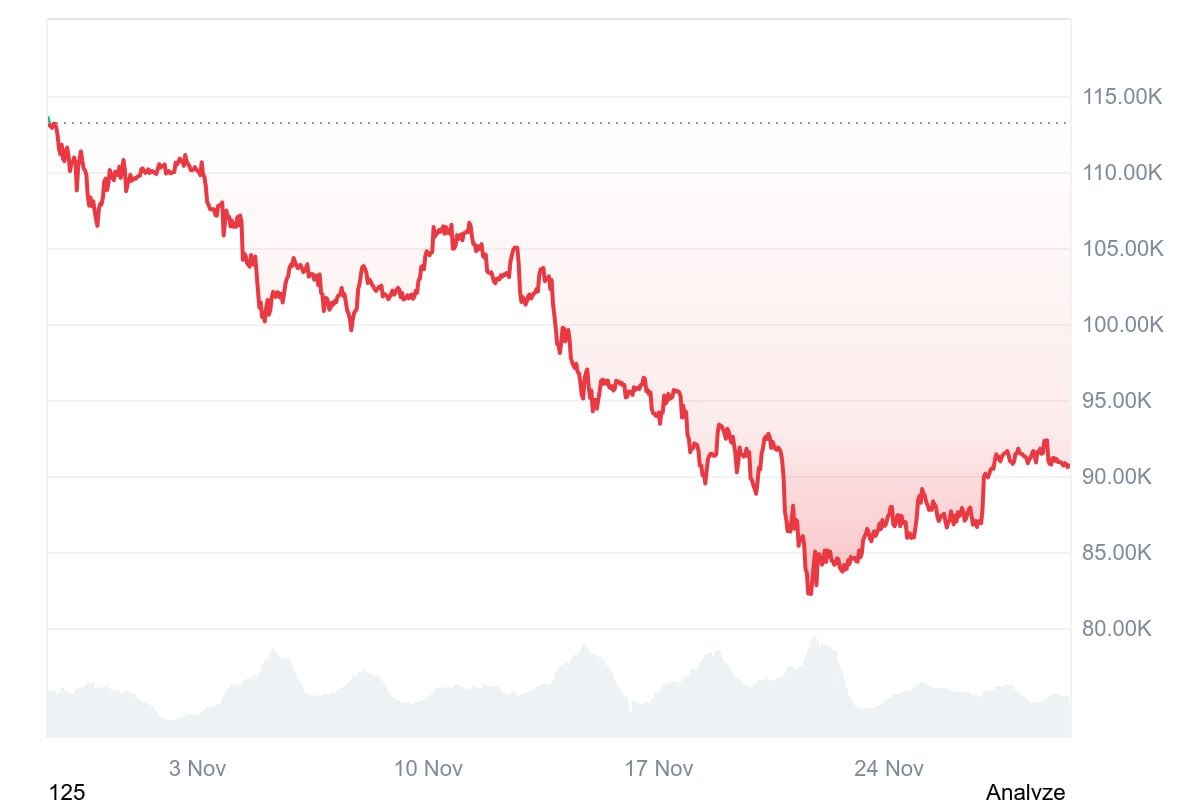

Bitcoin’s been in a bit of a tizzy lately, having lost more than 20% over the past month. Oh, and it’s down by over 40% since that tantalizing high of $126,000 earlier in October. Talk about a rollercoaster! 🎢

November has been the worst month since June 2022 – you remember, that dramatic, market-melting time of chaos. Well, it’s back, and it’s worse than ever!

The crypto darling hit its lowest point in seven months, dipping below $80,000. Sure, there’s been a small bounce back, but honestly, the chart still looks like a sad trombone on repeat. 🎶

And it seems the sellers have finally gotten tired. Last week, Bitcoin stopped falling under pressure from spot markets and perpetual futures. What a twist! 🧐

There’s still liquidity stacked above $92,000, meaning some brave souls are still selling into strength. But they’re not pushing the market down like they did in early November. A subtle shift, my friends…

At this point, it’s like a tug of war, with bears trying to hold their ground. But who will win? Only time will tell. Will the bulls come back to play? The suspense is killing me. 😅

Who’s Got Bitcoin’s Back? Institutional Investors, Of Course!

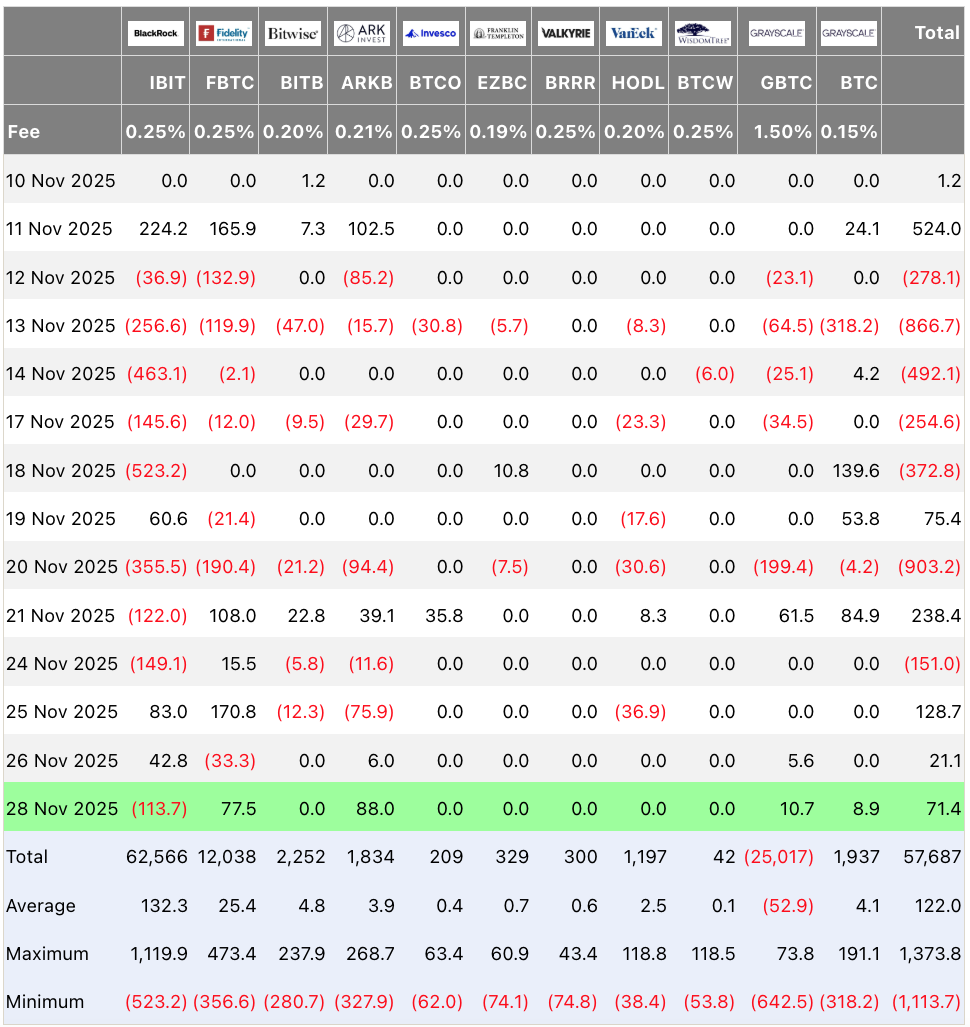

Turns out, institutional investors are the ones still keeping Bitcoin afloat. In November, the iShares Bitcoin Trust ETF saw about $2.2 billion in outflows. Yikes. 📉

Sentora analysts believe ETF redemptions are now accelerating the price drops by pushing Bitcoin through support zones. Stress all around, folks. 😓

Meanwhile, JPMorgan has decided that macroeconomic conditions are more important than Bitcoin’s four-year halving cycle. Looks like they’re just not into old-school patterns anymore.

Retail investors? Meh, not so much. Institutional big shots are the ones providing the depth and stability that Bitcoin desperately needs right now.

Speaking of which, ARK Invest increased its exposure to the ARK 21Shares Bitcoin ETF. Over 70,000 shares were purchased. They must be holding onto some serious faith in Bitcoin, even as the world crumbles around it. 💪

JPMorgan is also preparing a bond linked to BlackRock’s Bitcoin ETF. Some say it’s a short-term speculative move. Others, like Anthony Scaramucci, see this as a huge sign of Bitcoin’s growing potential. What a time to be alive, huh? 🙄

I don’t think people are fully understanding how huge it is that JP Morgan is now offering a bitcoin back Bond.

– Anthony Scaramucci (@Scaramucci) November 26, 2025

The Strategy Problem – Wait, What’s Going On There? 😲

Now, JPMorgan’s got something to say about Strategy (formerly MicroStrategy). Apparently, it could face a whopping $2.8 billion in outflows if MSCI removes it from major equity indices. Say what?!

Despite the massive $19 billion liquidation event in October, Strategy isn’t backing down. Oh no, they’re doubling down on Bitcoin. 💸

CEO Michael Saylor insists they’re not just a fund or a holding company. No, no. They’re an operating business with a $500 million software division and a very special treasury strategy using Bitcoin as productive capital. Talk about a pitch! 📈

Strategy is not a fund, not a trust, and not a holding company. We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.

– Michael Saylor (@saylor) November 21, 2025

Bitcoin Price Predictions: Is December Going to Be A Total Disaster? 😬

Veteran trader Peter Brandt, ever the optimist, pointed out that Bitcoin’s recent price action resembles the “dead cat bounce” pattern. That’s not exactly confidence-boosting, is it? But hey, he’s still bullish in the long run. Good for him. 😏

Full disclosure folks: Of my maximum ever Bitcoin position I still own 40%, at a price 1/20th of Saylor’s avg buy. I am a long-term bull on Bitcoin. This dumping is the best thing that could happen to Bitcoin. The next bull market in Bitcoin should take us to $200,000 or so.

– Peter Brandt (@PeterLBrandt) November 21, 2025

Right now, the $80,000 mark is the critical line of defense. If it breaks, we could be looking at a slide toward $72,000 to $75,000. That’s where things get really interesting – and potentially painful.

If the sell-off continues, Bitcoin could dip to the $60,000 to $65,000 zone. And while that might sound like disaster, some say it will be contained by ETF inflows and treasury companies stepping in. Nice of them, really.

But here’s the kicker: None of this is guaranteed. It could all change in an instant. Will Bitcoin stabilize, or is the downward slide here to stay as we approach the new year? The suspense is killing me. 😅

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- All Itzaland Animal Locations in Infinity Nikki

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- EUR INR PREDICTION

- There’s a simple way to watch Finding Lucy doc Storyville: The Darkest Web for free

2025-11-29 13:03