In the grand theater of human folly, where numbers dance and fortunes sway, the spectacle of Bitcoin’s recent tribulations unfolds with all the drama of a Tolstoy novel. Behold, the mighty network, having endured an 11% difficulty slash-its most profound since the great Chinese exodus of 2021-now stands on the precipice of a recalibration so aggressive, one might mistake it for a duel at dawn. And yet, with 34% of the epoch’s blocks still unmined, the stage is set for a climax as inevitable as it is absurd.

Bitcoin’s Next Act: A Difficulty Adjustment Fit for a Farce

Over the past fortnight, the Bitcoin network has abandoned its usual metronomic grace for a performance so theatrical, one wonders if it has taken lessons from the Bolshoi. Hashrate, block intervals, revenue, and difficulty have all performed a chaotic waltz, their steps dictated by the whims of nature and the greed of men. What a spectacle!

The culprit, as always, is the hand of fate-or rather, an Arctic storm that swept through the American heartland, forcing miners to retreat like peasants fleeing a Cossack raid. The chill was so severe that even the machines, those tireless servants of capitalism, had to pause, lest they overburden the fragile power grids. Ah, the irony of progress!

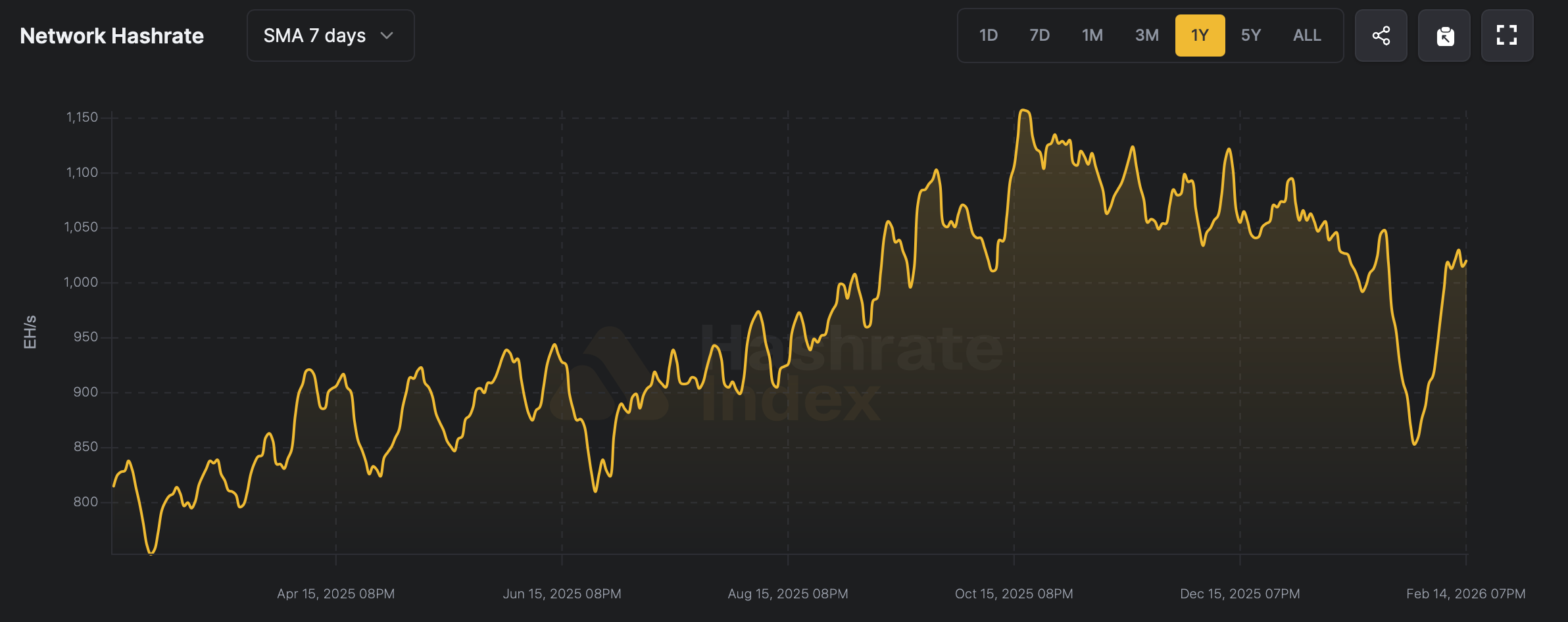

The result? A hashrate that plummeted below the vaunted 1,000 exahash per second (EH/s), a milestone as fleeting as a nobleman’s promise. Block production slowed to a crawl, stretching beyond 12 minutes per block-an eternity in the digital age. Then, on Feb. 7, at block height 935424, the difficulty adjusted downward by a staggering 11.16%. A retreat, yes, but one that smacks of both tragedy and farce.

Meanwhile, the BTC hashprice softened like a nobleman’s resolve in the face of debt, retreating to levels unseen since 2024. Yet, as with all things in this absurd dance, the retreat was temporary. The network’s computing power has since roared back, surpassing the 1 zettahash per second (ZH/s) band with the vigor of a peasant uprising. As of Sunday at 9 a.m. Eastern time, the hashrate stands at 1,030.21 EH/s, according to hashrateindex.com. A triumph, perhaps, but one that leaves us wondering: for how long?

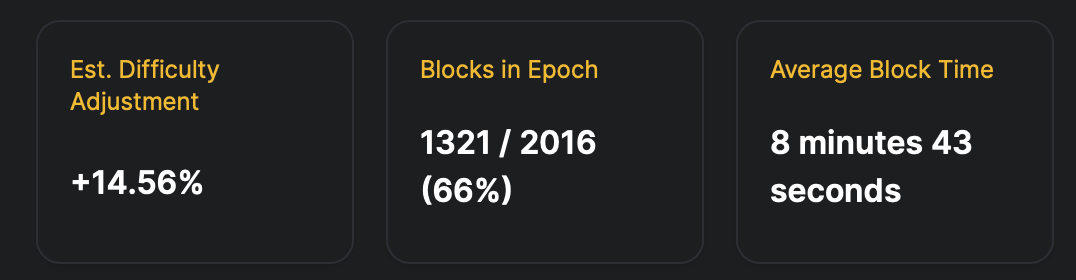

With miners back in their digital trenches, block intervals have quickened, clocking in at a brisk 8 minutes and 43 seconds over the past 24 hours. This acceleration, like a character’s sudden change of heart in a Tolstoy novel, sets the stage for the next difficulty epoch, projected for Feb. 19. Early estimates suggest a sizable upward adjustment-enough, perhaps, to erase the last drop entirely. Ah, the circle of life, or rather, the circle of Bitcoin!

Current projections indicate a possible 14.71% increase, though this may soften as the epoch unfolds. Regardless, the coming adjustment promises to be pronounced, a reminder that equilibrium in Bitcoin is as fleeting as happiness in a Tolstoy novel. Weather, price action, and miner economics have collided, briefly slowing the network before its self-correcting mechanism kicked in. Now, with computing power restored and blocks arriving faster than a gossip spreads in a village, the protocol tightens once more. A dance, indeed, but one without end.

FAQ ❓

- Why did Bitcoin mining difficulty drop by 11.16% on Feb. 7?

Because even the digital realm is not immune to the whims of nature-an Arctic storm forced miners to curtail operations, lest they freeze alongside their machines. - How low did Bitcoin’s hashrate fall during the storm?

To roughly 800 EH/s, a fall as dramatic as a nobleman’s from grace. - When is the next Bitcoin difficulty adjustment expected?

Around Feb. 19, 2026-mark your calendars, for the farce continues. - Why could the upcoming difficulty increase be significant?

Because the network, like a Tolstoy protagonist, is ever seeking balance, even if it means overcorrecting with the zeal of a convert.

Read More

- United Airlines can now kick passengers off flights and ban them for not using headphones

- SHIB PREDICTION. SHIB cryptocurrency

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- These are the 25 best PlayStation 5 games

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- The MCU’s Mandarin Twist, Explained

- MNT PREDICTION. MNT cryptocurrency

- Gold Rate Forecast

- Rob Reiner’s Son Officially Charged With First Degree Murder

- Pacific Drive’s Delorean Mod: A Time-Traveling Adventure Awaits!

2026-02-15 19:17