Oh, Bitcoin. Still a thing, huh? Apparently. It’s hovering around $90,000, which is… a lot, I guess. But now Japan’s messing with things. They’re thinking about raising interest rates, and honestly, who asked them? 🤷

Because of course, everything has to be complicated. Every time these Bank of Japan people tweak something, Bitcoin takes a dive. It’s like they’re deliberately trying to ruin my weekend.

Here’s the completely unnecessary breakdown, just in case you were enjoying your life:

Japan To Hike Interest Rate By 25bps (Seriously?)

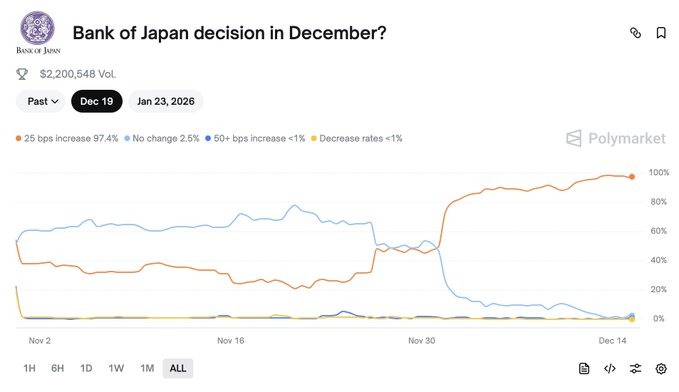

December 19th. Mark your calendars. Because apparently that’s when the Bank of Japan is going to do… something. Raise rates by 25 basis points. Like that’s going to fix anything. Polymarket says there’s a 98% chance. 98%! As if they know. These prediction platforms. It’s all a racket, I tell ya.

Some ‘experts’ even think they might go up to 75 basis points. 75! Like that’s even logical. It’s madness, pure madness.

And apparently, Japan has a lot of US debt – $1.1 trillion. Who knew? It impacts global finance. Of course it does. Everything impacts global finance. It’s all connected. It’s exhausting. 😩

Bitcoin Price To Drop To $70K (You Don’t Say!)

History, apparently, is repeating itself. Every time Japan fiddles with rates, Bitcoin coughs and sputters. Look at this:

- March 2024: Down 23%. So predictable.

- July 2024: Down 26%. Seriously?

- January 2025: Down 31%. They’re just messing with us now.

So, naturally, this guy, Merlijn The Trader (who probably has a basement full of charts) is warning it could go below $70,000. Of course. Why wouldn’t it?

THE BANK OF JAPAN MIGHT BE BITCOIN’S BIGGEST ENEMY

Japan holds the most US debt.

Every time they hike, Bitcoin bleeds:March 2024: -23%

July 2024: -30%

Jan 2025: -31%Next hike: Dec 19

Next move: loading…If the pattern repeats, $70K is in play.

– Merlijn The Trader (@MerlijnTrader) December 14, 2025

Rising Japan Bond Yields (Just When You Thought It Was Over)

Oh, but wait, there’s more! It’s not just the rate hike. It’s the bond yields, too! They’re up to 2.94%, which is 1998 levels. Who even remembers 1998? It was a simpler time.

Apparently people were borrowing yen to buy crypto. Now, that’s getting expensive. So they’re selling. And causing a “market drop.” It’s like dominoes! 🙄

And possibly up to $500 billion could leave global markets. Five hundred billion! Where does all this money go?

Crypto Market Already A Mess

Bitcoin is down 30% from its peak. The whole crypto market is imploding. XRP, Solana, Cardano… all down. Even memecoins are crashing. Memecoins! It’s a disaster. A complete and utter disaster. 🤦

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- NBA 2K26 Season 5 Adds College Themed Content

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- EUR INR PREDICTION

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- 2026 Upcoming Games Release Schedule

2025-12-15 10:25