Oh, dear reader, it appears our beloved Bitcoin has indulged in a little melodramatic swoon-down by 30%! But fret not, for Grayscale Research, that beacon of relentless optimism, assures us that no, this is not the lamentable beginning of a lengthy winter, but merely a “typical” decline, reminiscent of our favorite melodramas from yesteryear. 🎭

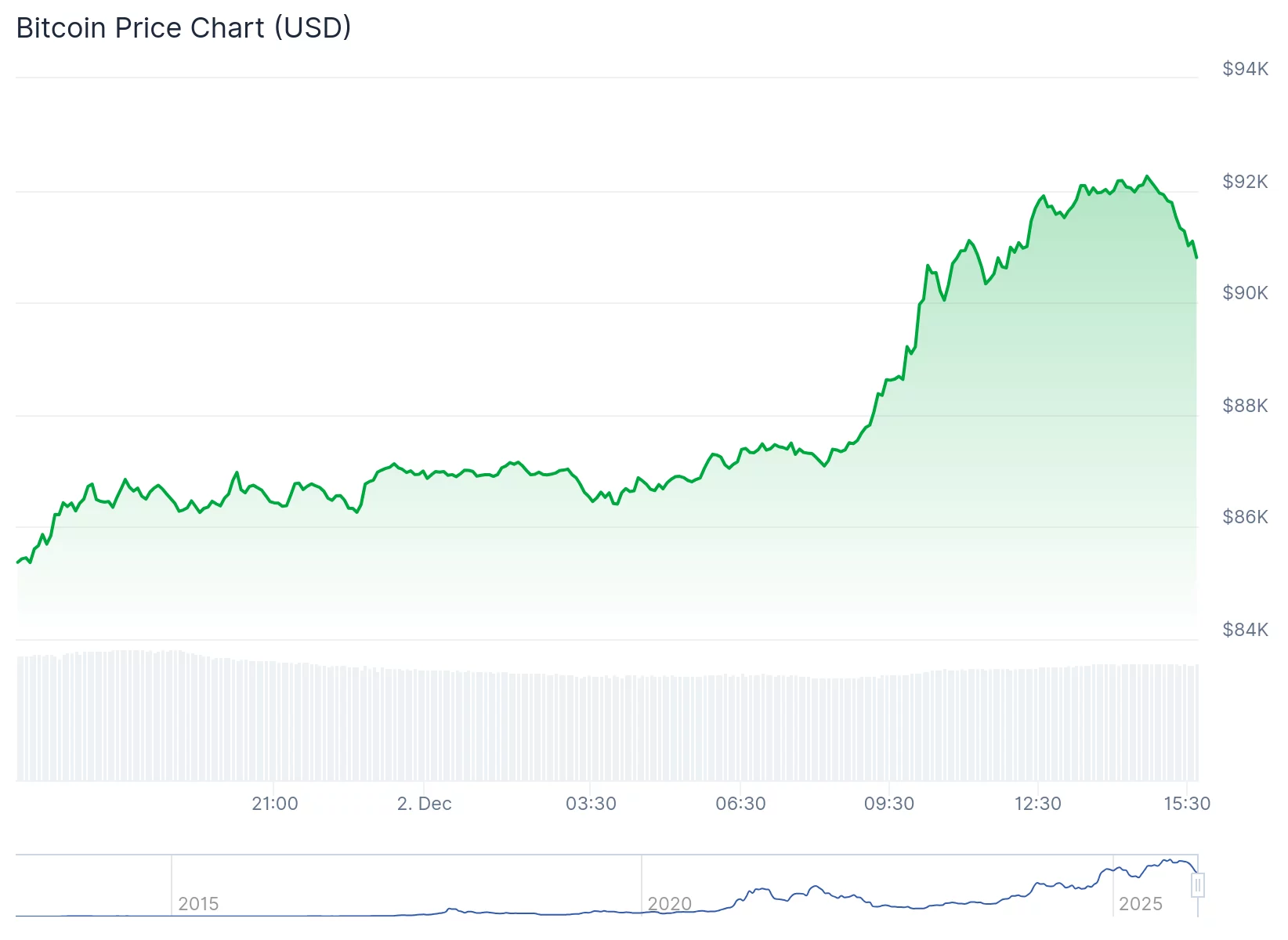

In the grand theater of finance, this latest tumble is but a minor act, a fleeting flaw in the star-studded saga of cryptocurrency. Since the dawn of 2010, Bitcoin has undergone nearly fifty such downward duels, averaging a 30% fall-hardly tragic, more like a city-wide picnic in comparison. And yet, here we stand, trading above the $90,000 mark, as if nothing untoward has happened.

Grayscale Dismisses the ‘Four-Year Cycle’ Doomsday Ballad

While some soul-singers of doom cling to the belief that Bitcoin’s halving cycle will inevitably lead us into a dark, roaring 2026, Grayscale waves their quill and shouts, “Not so fast, dear skeptics!” They claim this cycle looks distinct-lacking the parabolic outburst, and richly endowed with institutional guests, digital treasuries, and macroeconomic bliss. 🏦✨

And if that weren’t enough, the wise firm hints that a short-term bottom might be sniffing around: options skewed toward the pessimistic, assets trading below their net asset values-signs that perhaps the circus of speculation is taking a few days off.

The Privacy Tokens Steal the Show While AI Fades into the Shadows

Meanwhile, outside the glitzy Bitcoin limelight, the crypto stage is divided: privacy coins-like Zcash and Monero-prance about with notable gains, though danger lurks, as Zcash lost 24% in a day. Analysts warn that the privacy parade might have rougher seas ahead, but long-term devotees hold fast to their faith.

In the enchanted realms of Ethereum, privacy initiatives bloom: Vitalik Buterin unveils his latest cloaking device, and Aztec rolls out its Ignition Chain-truly the masked ball of blockchain innovation. 🎭

Contrarily, the AI sector-like a forgetful cousin at a family gathering-is plunging by 25%, despite the tech having a family reunion of its own, with new protocols and bigger transaction counts stealing the show.

Economic Romance and Political Ballads: The Promise of a 2026 Revival

Amidst this chaos, the macroeconomic stage offers a hopeful script. The Fed’s potential rate cuts-announced perhaps on December 10th-could weaken the dollar’s grip, making assets like gold and Bitcoin more alluring than a summer’s eve in Venice. 🌅💰

Rumors swirl that the ever-charming Kevin Hassett may replace Jerome Powell-our own Gatsby in the Federal Reserve ball-promising lower rates and a more welcoming attitude toward crypto’s party crashers.

Legislative serenades continue, with bipartisan lawmakers drafting legislation that could see the crypto market transform from a chaotic carnival into a well-orchestrated symphony, possibly just in time for the 2026 midterms. 🎶

But heed this-Grayscale reminds us, amidst all this turbulence, that for those with patience-“Long-term holders will be rewarded,” they whisper. Eventually, the grand narrative will align, and the stars will favor those who HODL through the tempest. 🤞

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- NBA 2K26 Season 5 Adds College Themed Content

- Mario Tennis Fever Review: Game, Set, Match

- All Poppy Playtime Chapter 5 Characters

- Pokemon LeafGreen and FireRed listed for February 27 release on Nintendo Switch

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- EUR INR PREDICTION

2025-12-03 00:36