Oh, dear reader, let us not pretend we are not trembling at the mere whisper of VanEck’s latest prophecy-a 25-year odyssey into the abyss of speculative finance. They dare to claim Bitcoin, that sardonic little digital ledger, might ascend to $2.9 million per coin by 2050. A 15% annual growth rate, they say, as if the universe itself conspires to grant us mathematical miracles while we sip our coffee and scroll through memes.

Matthew Sigel, VanEck’s self-proclaimed oracle of digital assets, and Patrick Bush, his scribe of questionable numerology, have penned this manifesto. Their vision? A world where Bitcoin, that most enigmatic of modern relics, carves its name into the annals of global finance. Or perhaps into the tombstones of our collective sanity.

How Does Bitcoin Get to $2.9 Million?

Behold, two grand illusions fuel this prophecy. First, Bitcoin shall command 5-10% of global international trade and 5% of domestic trade by 2050. Imagine, if you will, a world where this decentralized ledger battles the British pound-a currency currently clinging to relevance like a drunkard to a lamppost. Second, central banks, those paragons of fiscal prudence, shall allocate 2.5% of their reserves to Bitcoin. One can only hope they’ve remembered to charge their mining rigs.

“Bitcoin is not a tactical trade in this framework; it functions as a long-duration hedge against adverse monetary regime outcomes,” the analysts wrote, as if they had peered into the future and found it… profitable.

Three Scenarios, One Takeaway

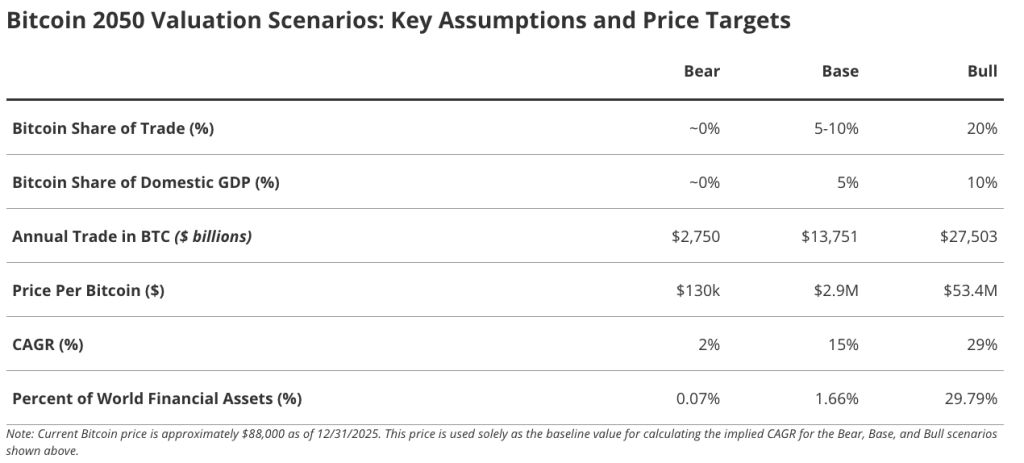

VanEck’s triad of outcomes-bear, base, and bull-reads like a Russian novel’s tragic love triangle. The bear case: $130,000, a mere 2% annual return. The base case: $2.9 million, 15%. The bull case: $53.4 million, 29%. But let us not forget, even the “bear” scenario leaves Bitcoin perched above its current $88,000-proof that optimism is the only viable investment strategy in this madhouse.

What This Means for Investors

VanEck suggests allocating 1-3% of one’s portfolio to Bitcoin. A modest request, akin to asking a gambler to limit their losses. They argue that zero exposure to this “non-sovereign reserve asset” is riskier than the asset itself. A bold claim, especially when the asset’s volatility could bankrupt your emotional stability faster than your wallet.

“The cost of zero exposure to the most established non-sovereign reserve asset may now exceed the volatility risk of the position itself.” A poetic way of saying, “Don’t be a coward-gamble wisely!”

And yet, let us note: this 15% growth assumption is a timid shadow of VanEck’s December 2024 projection (25%). Perhaps they, too, have learned the folly of hubris-or simply realized that even 25% annual growth is less absurd than claiming Bitcoin will replace gold. 🤷♂️

Read More

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

- LINK PREDICTION. LINK cryptocurrency

- Will there be a Wicked 3? Wicked for Good stars have conflicting opinions

- Decoding Cause and Effect: AI Predicts Traffic with Human-Like Reasoning

- Hell Let Loose: Vietnam Gameplay Trailer Released

- Ragnarok X Next Generation Class Tier List (January 2026)

- The Best TV Performances of 2025

- Inside the War for Speranza: A Full Recap

- 🤑 Altcoin Bottom or Bear Trap? Vanguard & Ethereum Whisper Secrets! 🕵️♂️

- Tiger King star Joe Exotic is selling phone calls from prison for Christmas

2026-01-09 15:04