Well, well, well… looks like Bitcoin’s price decided to take a little dip, falling to a modest $96,000 on Friday. Why? A massive sell-off, combined with a growing sense of risk aversion. Now, traders and analysts are out there, scratching their heads, wondering if this is just some casual profit-taking or if we’re witnessing the start of a market turnaround. 🤔

The drop wasn’t pretty-$700 million in long positions were wiped out, and the month of November is already down by more than 10%. Ouch. But, hey, don’t panic just yet. The drama’s just getting started. 😱

Enter the Bitcoin Whale: A Whale of a Tale 🐋

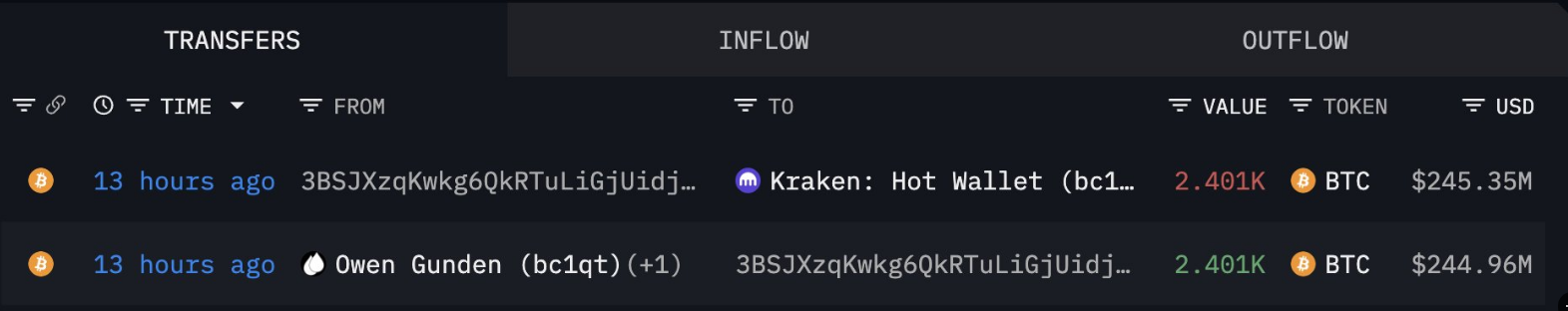

So here’s the juicy bit. Owen Gunden, a trader who apparently can move Bitcoin like a game of Monopoly, shifted a whopping 2,400 BTC-worth around $237 million-onto the Kraken exchange. Blockchain sleuths at Arkham were quick to spot this transfer, and they’re not shy about sharing it. Who can blame them? This is serious cash. 💸

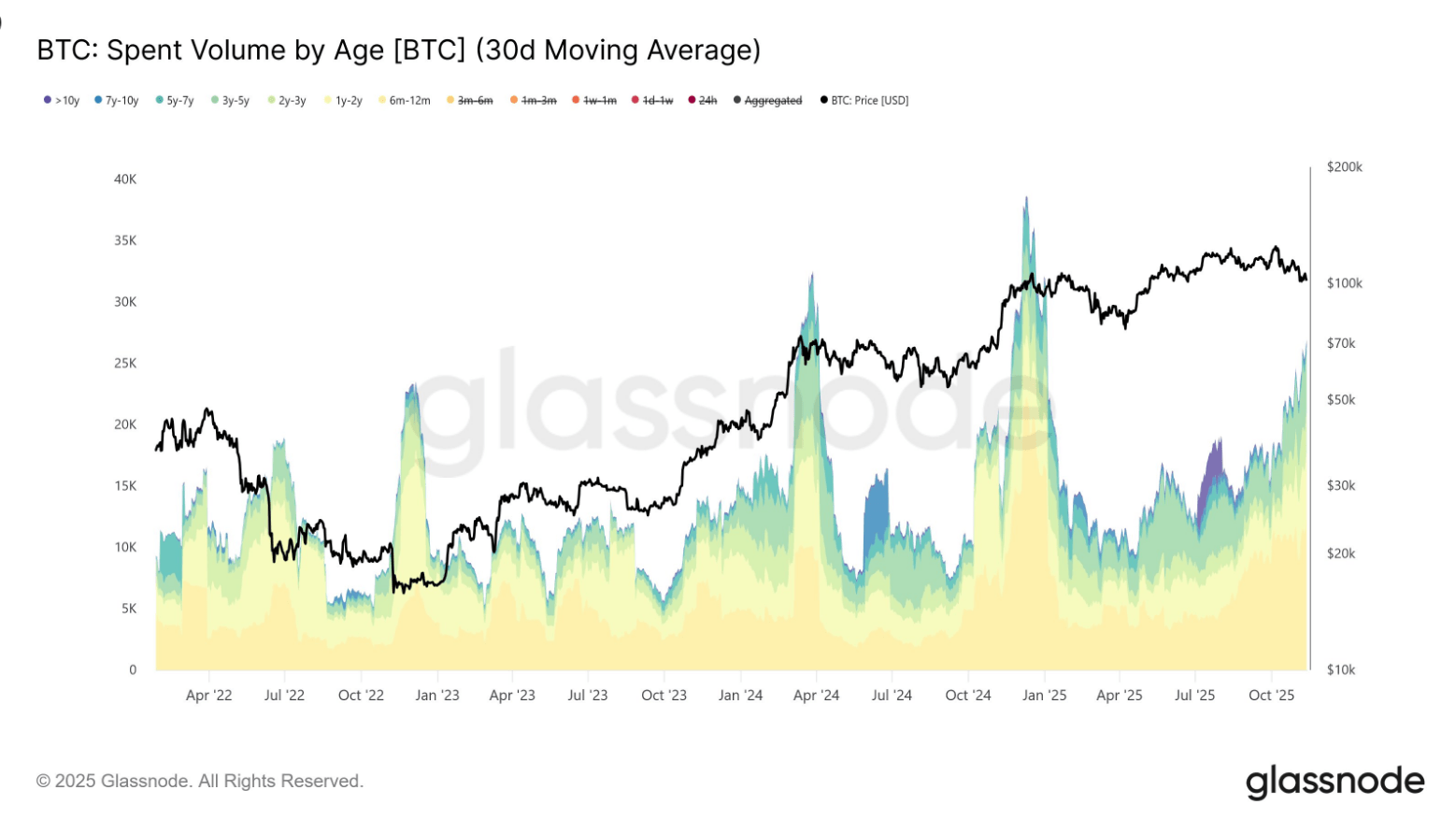

According to Glassnode, the average daily spending by long-term Bitcoin holders has surged from 12,000 BTC per day back in July to nearly 26,000 BTC per day now. Looks like the old guard is starting to unload a bit more frequently. Is this a sell-off or just your average end-of-cycle shuffling? 🤷♂️

OWEN GUNDEN JUST SOLD ANOTHER $290M BTC

Yes, you heard that right. Gunden moved a chunk of his holdings-$290.7 million worth-into Kraken. And guess what? He’s down to a measly $250M in Bitcoin. What a poor guy, right? 😆

– Arkham (@arkham) November 13, 2025

Glassnode analysts are calling this a “steady distribution” from long-term holders, not a “run for the exits” scenario. It’s a carefully calculated move. Late-cycle profit-taking? Perhaps. At least these whales aren’t in a rush to get out, so let’s not jump to conclusions. 📈

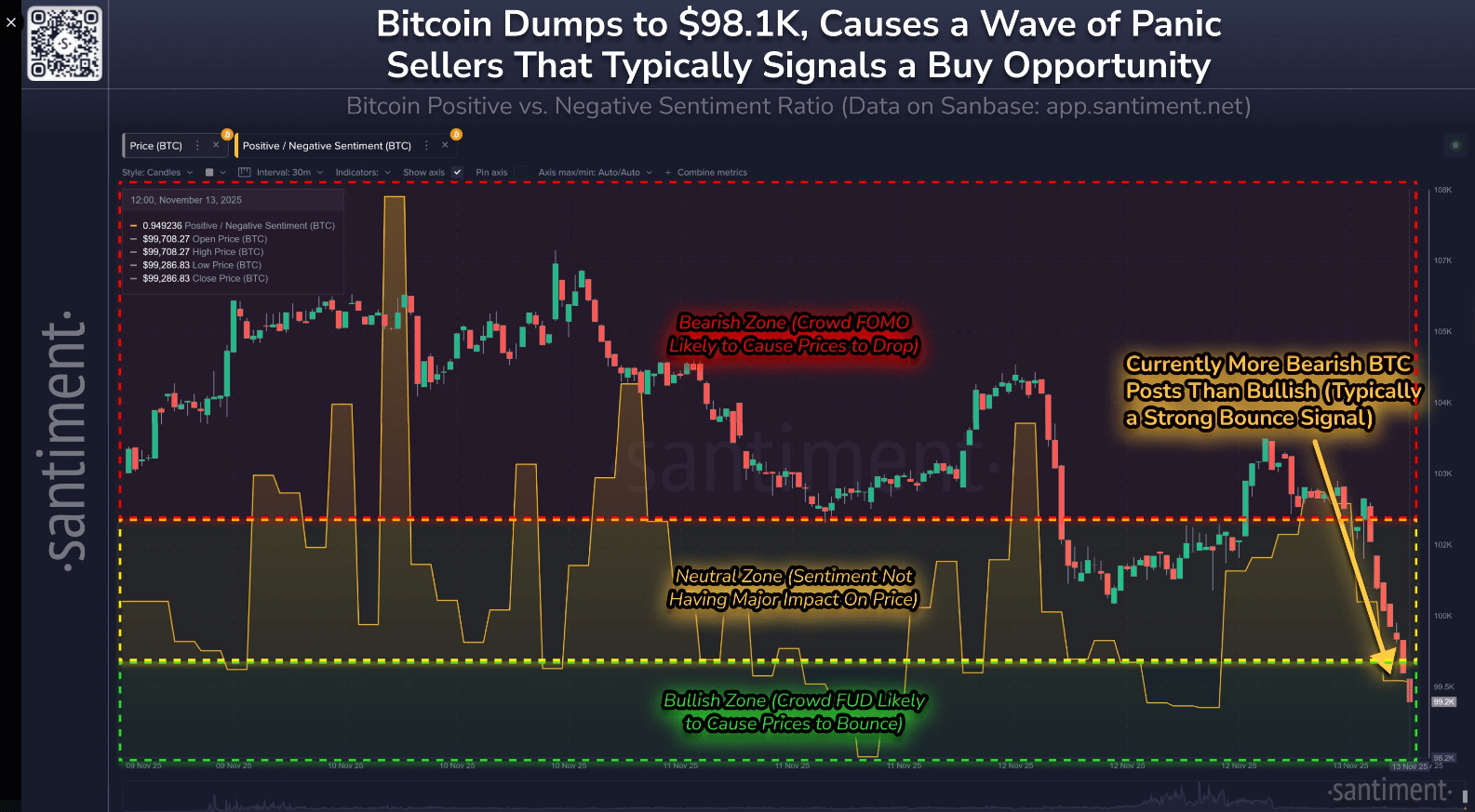

And oh, by the way, Bitcoin dipped below the $100K mark for the second time this month. And guess what that triggered? A flood of fear and confusion from retail traders flooding social media with “oh-no” posts. Classic. 🙄

Bitcoin has dumped below $100K for the second time this month. Predictably, this has caused a wave of FUD and concerned social media posts from retail traders. Like, duh.

– Santiment (@santimentfeed) November 13, 2025

No Meltdown Yet, Folks! Relax… 💆♂️

Vincent Liu, CIO at Kronos Research, dropped some wisdom, saying this kind of structured selling and steady rotation of gains is typical in the late stages of a market cycle. But here’s the catch: it doesn’t mean the end is near. If there are still buyers out there-there’s still hope. Don’t pack up your bags just yet. 🧳

Being in a late-cycle phase doesn’t mean Bitcoin has hit its ceiling, either. Liu points out that while momentum is slowing, external factors like macro trends and liquidity are taking charge. So, no, we haven’t hit the “end of the world” button yet. Hang tight, the market’s not dead yet. 💀

On-chain indicators are under a magnifying glass, too. Bitcoin’s net unrealized profit ratio is hovering near 0.476, which some traders are eyeing as a signal that short-term lows could be just around the corner. Just another clue in the ever-expanding puzzle. 🧩

A closer look at the monthly average spending by long-term holders reveals a clear trend: outflows have climbed from roughly 12.5k BTC/day in early July to 26.5k BTC/day today (30D-SMA). Old investors are getting itchy.

– glassnode (@glassnode) November 13, 2025

And while all this is going down, traditional markets aren’t doing much better. Stocks tied to the crypto world are feeling the heat. The Nasdaq took a 2% dive, while the S&P 500 dropped 1.3%. Cipher Mining, Riot Platforms, and others took a serious hit, and let’s not even talk about Coinbase. Ouch. 💔

Reports are coming in that large institutions like BlackRock, Binance, and Wintermute sold off more than $1 billion in Bitcoin. That caused a sudden 5% price drop. The big players are calling the shots now, and they’re not afraid to make a splash. 🌊

Meanwhile, the Crypto Fear & Greed Index is at a nail-biting 15, signaling “extreme fear.” Traders are panicking, and social sentiment has plummeted. But is this the big collapse everyone’s waiting for? Time will tell… ⏳

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Gold Rate Forecast

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- Every Death In The Night Agent Season 3 Explained

- 4. The Gamer’s Guide to AI Summarizer Tools

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- All Songs in Helluva Boss Season 2 Soundtrack Listed

2025-11-14 14:47