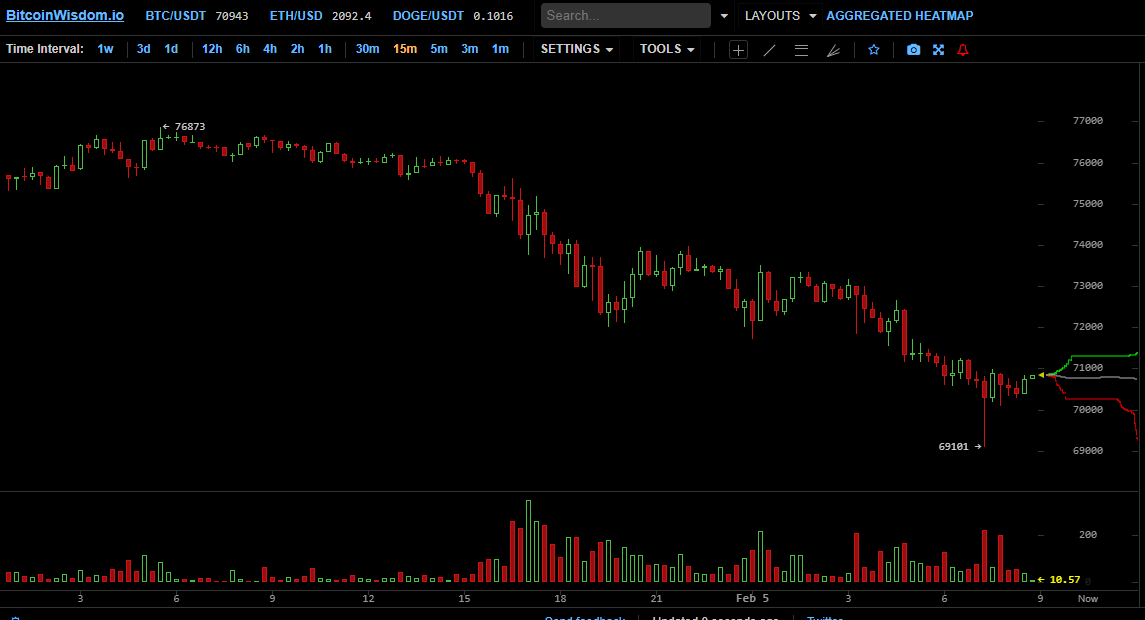

On this gray day the digital gold wore a tired coat, and the street of numbers sighed. Bitcoin slid beneath seventy thousand for the first time since last November, and the whole landscape of crypto tilted like a ship in a shallow bay. The market, a vast manifold of digits, settled at about 2.47 trillion in value. Some say the ground may sink further toward 67,000, while others call it a humble reset, a rainstorm that might coax fresh highs out of the earth in 2026, if luck and volatility can mind their manners.

Broad Market Retreat and Reduced Leverage

Bitcoin’s freefall quickened its pace, the cryptocurrency slipping below $70,000 for the first time since November. Bitstamp’s ledger tells of over $2,000 being shaved off in a handful of minutes, the price dipping to a low of $69,101 around 11:15 p.m. EST. A seven-percent intraday plunge pressed Bitcoin’s market cap below the imagined line of $1.4 trillion, like a tired farmer counting his cattle and finding a few missing.

The bearish mood rode the market as if it were a dusty road turning uphill, with altcoins such as BNB and XRP posting near double-digit losses. Other major tokens slipped between 2% and 8%, dragging the total crypto market cap to 2.47 trillion.

Curiously, the data on liquidation tells a quieter tale: only about $62 million in long and short bets wiped out in an hour-a far cry from earlier in the week when a nearly similar retreat triggered more than $100 million in liquidations. It seems folks are stepping back from the ledgers of leverage as the bear’s paw sits down to sharpen its claws.

The ‘Saylor Line’ Under Pressure

Since late January, bitcoin has knocked against several stubborn supports. Then, on Feb. 2, it began to flirt with prices well below $76,000-the so-called “Saylor Line.” At these prices, the coin’s treasury companies-most notably those under Michael Saylor’s banner-find themselves underwater, stirring unease about long-term strength.

Experts like Stephan Lutz, CEO of BitMEX, warn that a sustained stretch below this threshold could poke panic in boardrooms that echo the Strategy playbook. Yet Lutz says the real signal isn’t on the crypto charts but in the widening gap between bitcoin and gold.

“Gold and silver have already bounced away from the shutdown scare, yet Bitcoin lags behind,” Lutz observed. “This divergence suggests the present weakness is crypto-specific scarring, not a verdict on BTC’s long-term worth.”

Institutional Caution and Price Compression

Meanwhile, Nicholas Motz, CIO of Soil.co and CEO of ORQO.digital, attributes the squeeze to a trio of forces: commodity contagion, institutional caution, and a market in an exhaustion phase.

“While retail is buying, institutional flows from ETF data have paused to reassess risk,” Motz explained. “The market is testing the resolve of the ‘Trump trade.’ If psychological support at $72,600 fails, we risk a deeper correction toward $67,000.”

Not everyone reads the dip as a fundamental collapse. Gil Rosen, co-founder of the Blockchain Builders Fund, argues that the 2025 rally to $120,000 was an unsustainable straight-line move. He sees the present correction as a reset born of geopolitics, tariffs and policy fog rather than a crypto-driven wreck.

Rosen stays hopeful in the medium term: “I expect the market to drift away from the clean four-year cycle. We’ll likely see new highs in 2026, though they’ll be laced with volatility rather than pure euphoria.”

Conversely, Han Tan, chief market analyst at Bybit Learn, believes bears have “firmly taken the reins.” He points to the descent to late-2024 prices as evidence that retail traders are drawn back to steadier, traditional assets that offer more predictable returns.

Onchain analyst Ananda Banerjee agrees with the bearish view, noting that investors use minor rallies to exit rather than build exposure. Banerjee warns of further downside toward the $63,000 to $69,000 zone unless spot demand returns with force.

FAQ ❓

- Why did bitcoin drop below $70K in the U.S.? Heavy selling pressure and fading ETF inflows triggered a sharp overnight decline.

- What’s the impact on bitcoin treasury companies? Treasury firms tied to the “Saylor Line” face renewed boardroom stress as BTC trades under $76K.

- How does this affect traders? Local traders are watching liquidity tighten, with reduced leverage signaling a cautious shift.

- Will bitcoin reach new highs in 2026? Industry experts like Gil Rosen expect bitcoin to hit fresh milestones by 2026 as the market recovers from current geopolitical and policy resets.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- NBA 2K26 Season 5 Adds College Themed Content

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- 4. The Gamer’s Guide to AI Summarizer Tools

- Train Dreams Is an Argument Against Complicity

- Every Death In The Night Agent Season 3 Explained

2026-02-05 11:17