Derivatives desks are basically throwing a wild party this weekend, and Bitcoin’s options board is like, “Pick a side, or I’ll throw you out!” 🎉🔥

Deep Liquidity, Sharper Bets: Bitcoin Options Crowd Eyes $110K Strikes (Because Who Needs Sleep?) 🤡

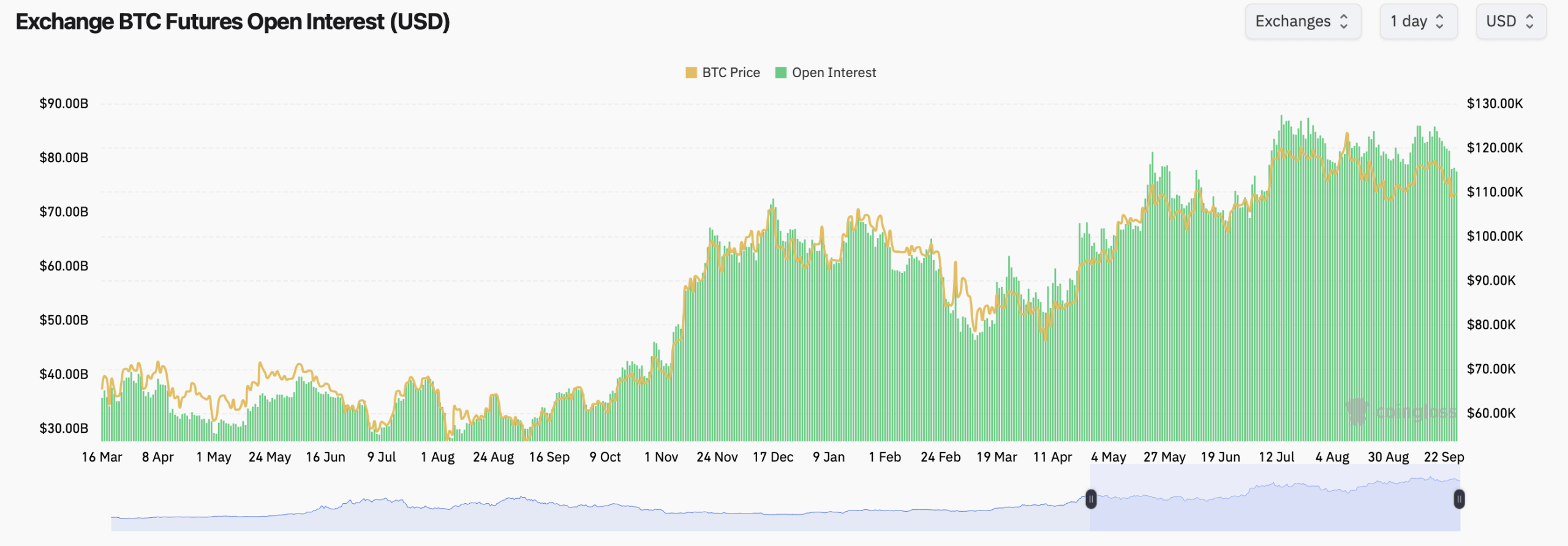

Bitcoin is trading at $109,449 on Saturday, and the futures complex is thick like a New York City traffic jam. Total open interest (OI) is at 707.59K BTC ($77.45B). Depth is broad, and the tape shows plenty of two-way interest. Because nothing says “I’m confident” like betting on both sides. 🤷♀️💰

CME is the big dog with 138.82K BTC ($15.19B), but Binance is like, “I’m not jealous, I just have a 17.42% share and my OI slipped 0.90% today. Not a big deal. 😬”

Bybit’s book carries 84.39K BTC ($9.23B), down 0.87% in 24 hours. OKX posts 37.78K BTC ($4.13B) with a 1.31% daily rise, while Gate shows 78.24K BTC ($8.56B), off 1.07%. It’s like a rollercoaster, but the track is made of crypto. 🎢

Second-tier flow is mixed: Bitget holds 52.33K BTC ($5.72B), up 0.45% on the day. Kucoin sits at 6.12K BTC ($669.49M), down 2.88%. WhiteBIT has 20.94K BTC ($2.29B), off 0.55%. MEXC pops 4.87% to 26.42K BTC ($2.89B). BingX shows 9.15K BTC ($1.00B) after a steep 42.96% drop. 😱

This weekend, Bitcoin options lean bullish by positioning but not by tape. Calls command 60.66% of open interest at 199,102.16 BTC versus 39.34% for puts. So, the market is mostly bullish, but the tape is like, “I’m not saying I’m not bearish, I’m just not saying it.” 🤔

Yet in the last 24 hours on Deribit, puts narrowly led volume with 16,247.21 BTC (50.87%) against 15,694.48 BTC in calls. Traders are hedging into the weekend, not just cheerleading. Because nothing says “I’m prepared” like buying puts. 🛡️

The busiest contracts clustered near Bitcoin’s current trading range. On Sept. 28, the Deribit $110,000 put option saw 1,311.9 BTC in volume. The Oct. 10 $100,000 put added 853.3 BTC, while the Oct. 31 $116,000 call recorded 812.5 BTC. Several other contracts tied to the $110K strike also kept activity humming. It’s like a crypto version of a high-stakes poker game. 🃏

Looking further out, December’s calls dominate the open interest leaderboard. The Dec. 26 $140,000 call holds 9,804.5 BTC, followed by the $200,000 call with 8,527.2 BTC. Strong stacks also sit at the $120,000 and $150,000 strikes, underscoring traders’ appetite for lofty upside bets into year-end. Because who doesn’t want to bet on Bitcoin hitting $140K? 🤯

Max pain-the level where option buyers feel it most-tracks a smooth band around $110,000 to $116,000 across near-term expiries, with a shallow dip toward $105,000 into late-December rolls. So, the market is basically saying, “We’re all in, but if it goes wrong, we’ll blame the $105K.” 😅

Put together: futures liquidity is ample, options OI favors calls, near-term volume tilts to puts, and the max-pain map pins the magnet near $110K. Bitcoin traders have their playground; now price decides who pays for the ride. 🎢💸

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- NBA 2K26 Season 5 Adds College Themed Content

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- Train Dreams Is an Argument Against Complicity

- Pokemon LeafGreen and FireRed listed for February 27 release on Nintendo Switch

2025-09-27 18:28