On the eve when markets danced the cha-cha of confusion, marked by an odd mixture of gaiety and gloom, the crypto stocks-those sprightly children of a digital age-especially the bitcoin miners, surged forth with an exuberance befitting a carnival parade amidst a backdrop of global economic disarray and geopolitical jitters.

Wall Street Stumbles While Bitcoin Miners Flourish in a Market of Uncertainty

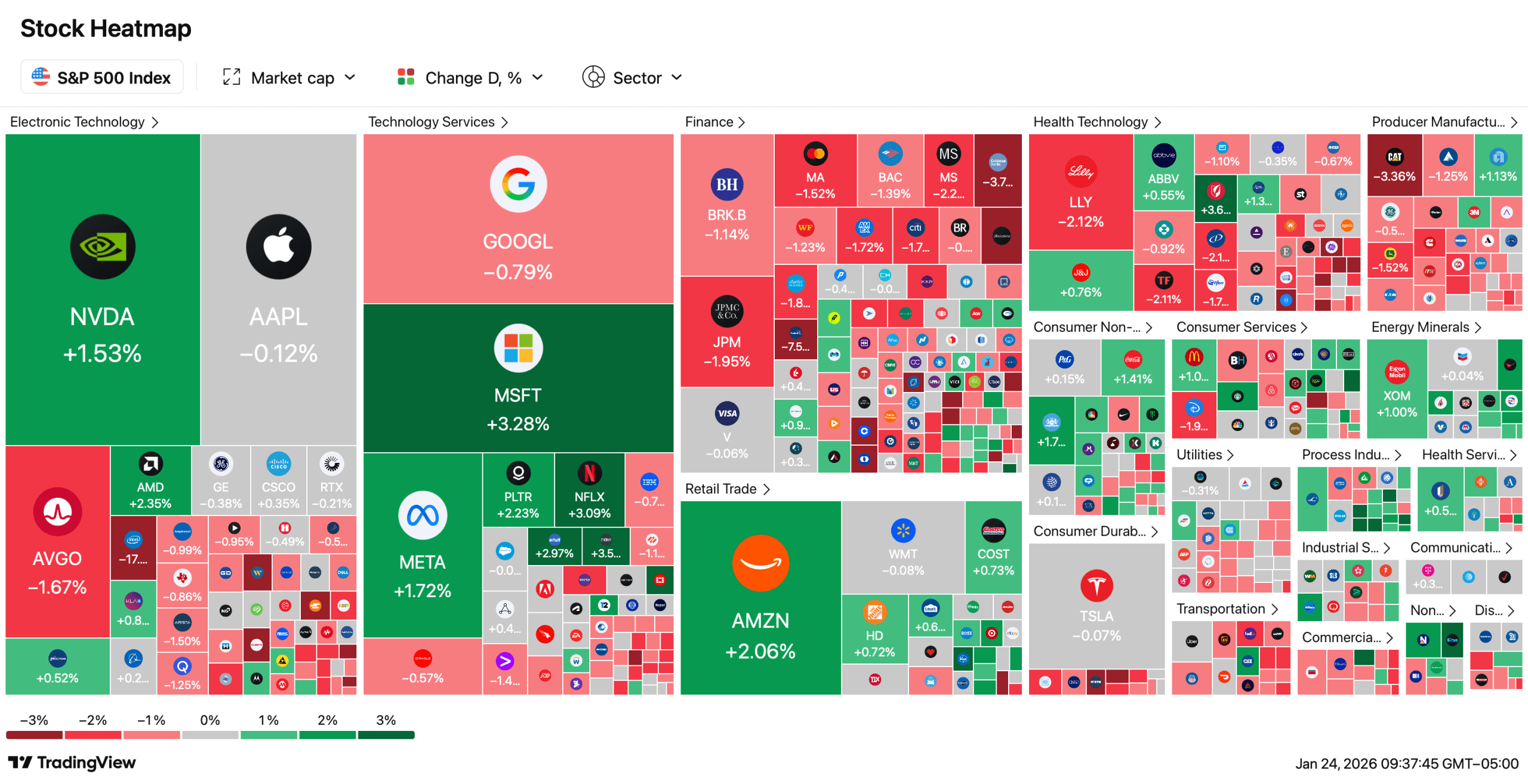

As Friday, January 23, drew its curtains, the four major U.S. stock indexes finished with the theatrical flair of a split personality that would make any psychiatrist raise an eyebrow. The Nasdaq Composite, like a show-off at a family reunion, managed to add 65.22 points, finishing at 23,501.24, while the S&P 500 crept up 2.26 points to 6,915.61. Meanwhile, the Dow Jones Industrial Average took a tumble, losing 285.30 points to rest at 49,098.71, as if saying, “Do I really have to dance?” The NYSE Composite, feeling rather shy, dipped 40 points down to 22,757.16, showing a market imbued with confidence in some corners yet riddled with anxiety in others.

This uneven footing cascaded into the realm of crypto stocks, where fortunes fluctuated like a tightrope walker on a windy day. On Nasdaq, Coinbase (COIN) slipped 2.77%, radiating caution like a cat near a dog park. In contrast, Strategy (MSTR) performed a cheeky little jig, rising 1.32%, behaving less like a software company and more like a flamboyant bitcoin proxy masquerading in equity’s clothing.

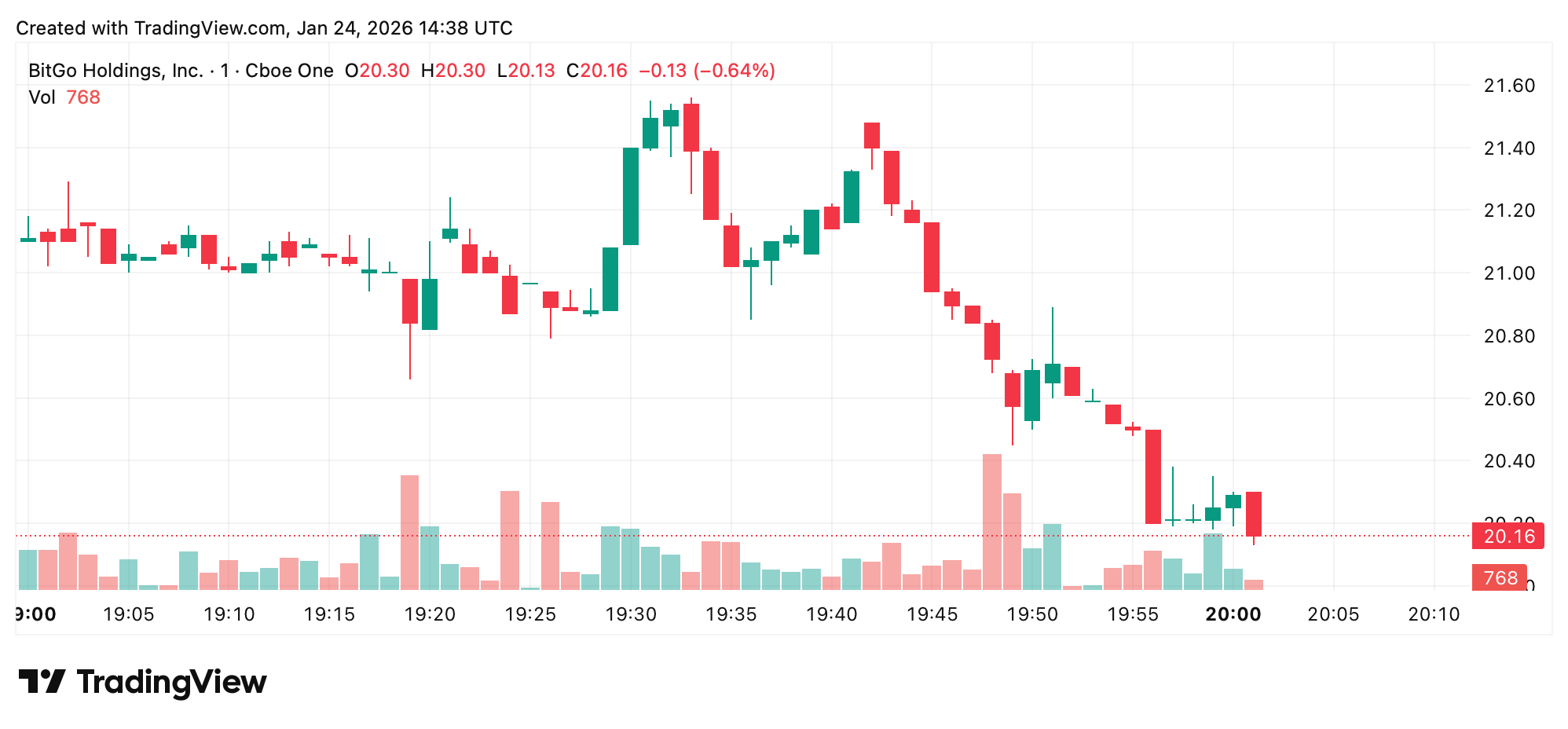

Fresh listings were not spared from this tumultuous spectacle. Bitgo’s NYSE debut (BTGO) was about as smooth as a catwalk model tripping over her heels, with shares plummeting 21.58% on opening day. Over on the NYSE, Circle (CRCL) barely budged, slipping a mere 0.03%. Bullish (BLSH) stumbled 2%, while Bitmine Immersion Technologies (BMNR) eased down 0.35%. A hesitant waltz, one might say, reflecting reservations more than panic, yet hesitation nonetheless.

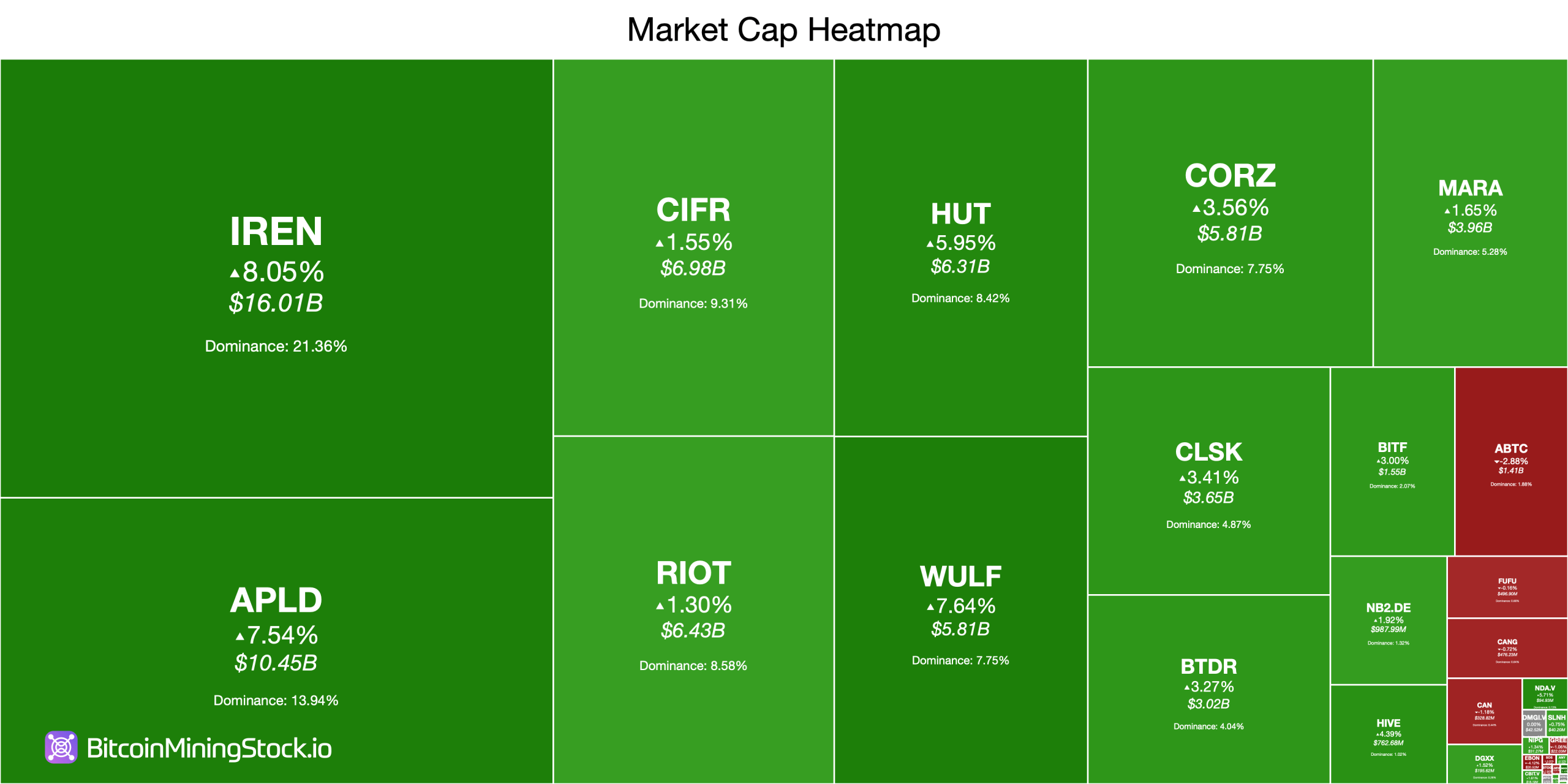

While the crypto infrastructure and exchange names tiptoed around, bitcoin mining stocks delivered a more robust performance, akin to a bull in a china shop. IREN Limited led with an impressive 8.05% gain to $56.47, followed closely by Applied Digital Corporation, galloping up 7.54% to $37.36. TeraWulf rose by 7.64% to $13.88, and Hut 8 Corp. advanced 5.95% to $58.40, underscoring the sector’s recent fortitude.

Mid-tier performers also leaned positive, with Core Scientific rising 3.56% to $18.73, CleanSpark gaining 3.41% to $13.64, and Bitdeer Technologies Group increasing 3.27% to $14.50. Bitfarms added a modest 3%, trading at $2.74, while Cipher Mining and Riot Platforms displayed lesser but still cheerful moves of 1.55% and 1.30%, respectively.

Not every miner joined the jubilation, however. MARA Holdings rose 1.65% to $10.46, yet American Bitcoin Corp. stood out as the solitary decliner among the top names, sliding down 2.88% to $1.52. Nevertheless, the broader mining collective leaned decisively towards green, especially when juxtaposed against the mixed performance of traditional equities.

This divergence signals a growing trend: bitcoin miners are increasingly evaluated based on their operational prowess, balance-sheet stability, and long-term network optimism rather than the capricious whims of daily market sentiment. As the fog of macroeconomic uncertainty lingers, investors seem to be playing favorites, rewarding those companies directly tied to bitcoin production while treating exchanges and fresh listings with a raised eyebrow.

Such selectivity makes perfect sense in a world that feels more fragile than a soap bubble in a hailstorm. Economic growth is patchy, central bank policies are tight, and geopolitical tensions continue to inject risks into markets already stretched thin by valuation and concentration worries.

Against this backdrop, crypto-associated stocks are no longer performing as a singular act. Friday’s performance illustrated a clear division amongst infrastructure, miners, and service providers-each responding differently to the same macro signals, much like a troupe of actors with varying interpretations of a classic script.

For now, bitcoin mining equities seem to be carving out their distinct path, buoyed by resilient price action and improving operational leverage. Whether this resilience endures will depend less on Wall Street’s mood swings and more on how the grand chess match of global economics and geopolitics unfolds in the weeks to come.

FAQ ❓

- Why did U.S. markets close mixed on Jan. 23?

Investors found themselves balancing the tech-heavy indexes’ strength against the losses in industrial and broader market benchmarks, as if playing a game of seesaw with the economic landscape. - Which crypto-linked stocks underperformed?

Coinbase and several freshly minted NYSE crypto firms felt the sting of the market’s fickle nature. - Why did bitcoin mining stocks outperform?

Miners capitalized on sector-specific dynamics rather than the erratic sentiment sweeping through broader equity markets-a true case of finding gold amidst the rubble. - What does this signal for crypto stocks going forward?

Performance is increasingly diverging by business model, resembling a competitive race rather than a single, synchronized ballet.

Read More

- United Airlines can now kick passengers off flights and ban them for not using headphones

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- These are the 25 best PlayStation 5 games

- The MCU’s Mandarin Twist, Explained

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- MNT PREDICTION. MNT cryptocurrency

- Gold Rate Forecast

2026-01-24 20:02