Oh, what a curious spectacle! The exchange-traded funds, those modern-day alchemists of finance, now find themselves inundated with a torrent of liquidity, as if the very soul of the market has been stirred from its slumber. January 2026, that most enigmatic of months, may yet defy the gloomy prophecies of “Crypto Winter,” which, like a fickle lover, has long whispered of eternal frost.

Bitcoin Spot ETFs: A Deluge of Gold

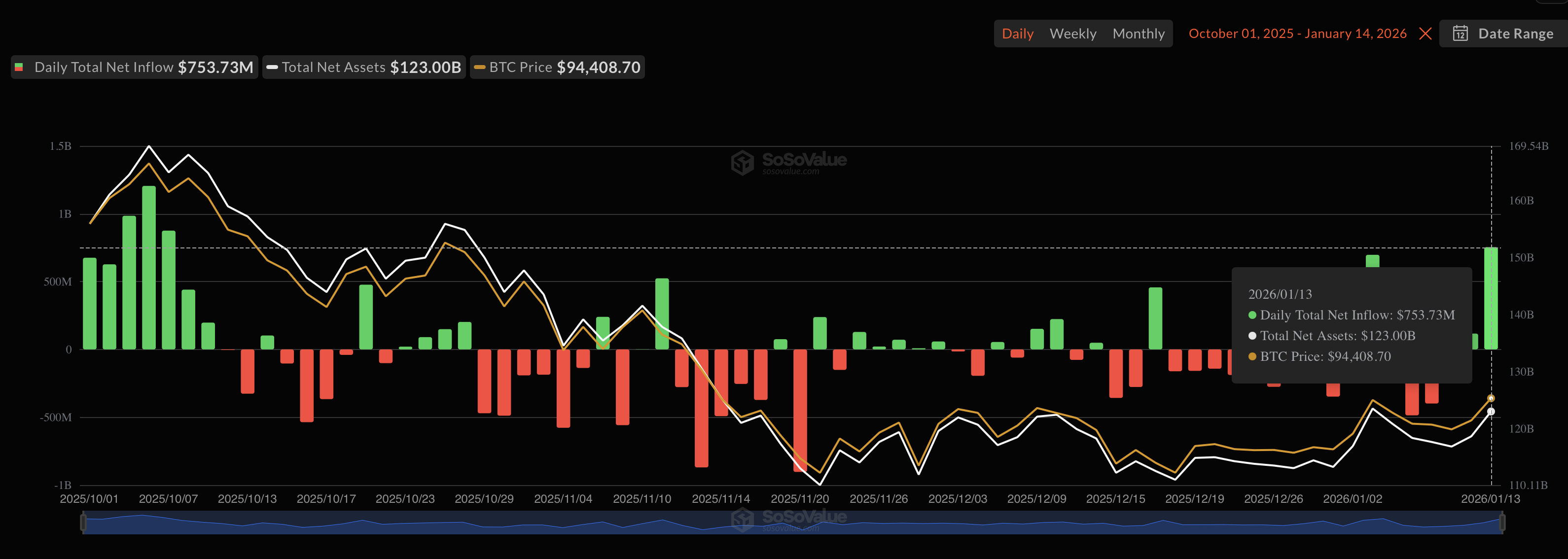

Behold, the Bitcoin Spot ETFs-those peculiar creatures of the U.S. financial realm-have witnessed an influx of capital so grand it rivals the fabled treasures of ancient kings. On the fateful day of October 10, the market trembled, but now, in a twist of fate, investors have poured $753 million into this noble endeavor, as if casting coins into the abyss to summon prosperity. 🧠💸

Indeed, the Jan. 13 session was a triumph of sorts, a day when the Bitcoin ETFs danced with joy, their fortunes swelling since the fateful Oct. 7, 2025. This week, a mere seven days, has become the most vibrant since the autumnal chill of mid-October. How ironic, that the very season of decay should birth such vitality!

Since the dawn of this year, the realm of spot Bitcoin ETFs has grown by $660 million in assets under management-a modest sum, yet a testament to the tenacity of hope. 🌟

Among the champions of yesterday’s frenzy, Bitwise’s NYSE, BlackRock’s IBIT, and Fidelity’s FBTC emerged as titans, their coffers swelling with nearly 7,000 BTC. One might say they have become the new kings of the financial realm, though their crowns are forged of digital gold. 🏆

This surge of optimism, so fervent and unyielding, is attributed to the whispers of regulatory and macroeconomic blessings from the United States-a land where even the shadows of uncertainty seem to bow to the light of progress. 🌈

Bitcoin’s Price: A Phoenix Reborn

And lo, the price of Bitcoin (BTC) has ascended to $95,700, a height not seen since the waning days of November. A 3.1% rise, modest yet significant, while the broader market, ever the fickle companion, has also climbed by 3.2%. 📈

In the last 24 hours, the market has seen $300 million in liquidations, with 99% of them being shorts-those brave souls who bet against the tide. For Ethereum (ETH), the figure stands at $220 million, as its price surges by 5% to $3,283. A $12 million ETHUSDT long on Binance, according to CoinGlass, has become the stuff of legend. 🧠

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Gold Rate Forecast

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- EUR INR PREDICTION

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

2026-01-14 16:24