Ah, dear reader, in the bleak days of our modern existence-from the 6th to the 10th of October, a number, like a specter haunting our financial lives, emerged: $2.71 billion. This remarkable figure, in fact, heralds the net inflow into spot Bitcoin ETFs, a testament to the enigmatic yet undeniable confidence of the institutional investors. Can one be simultaneously enamored and terrified by such figures? I suppose that is the curse of our age.

BlackRock’s own iShares Bitcoin Trust (IBIT), the gallant warrior amongst these financial footmen, singles itself out with a staggering contribution of $2.63 billion-a veritable king commanding loyalty over his subjects.

According to the unflinching reports from SoSoValue, IBIT now possesses net assets that tower majestically at $94 billion. But do not let your heart flutter too much; the market is as capricious as an angry deity, oscillating between elation and despair.

From the precise hours of October 6 to October 10 (ET), spot Bitcoin ETFs experienced an avalanche of inflow-$2.71 billion to be precise-while BlackRock’s IBIT led the charge. Meanwhile, the humble Ethereum, less grandiose but equally ambitious, scraped together a net weekly inflow of $488 million, with BlackRock’s ETHA shining brightly at $638 million.

– Wu Blockchain (@WuBlockchain) October 13, 2025

This wave of financial exuberance washes over us amidst the hopeful chants for an “Uptober” rally, even as uncertainty clings to our spirits like a fog that refuses to dissipate. The price of BTC, oh lovely yet maddening BTC, teetered on the edge of a critical abyss, flirting with the $110,000 mark-a mere whisper of a threat before returning to the warm embrace of $115,570, marking a jubilant rise of 3.5%. And, heaven help us, Bitcoin’s trading volume ascended to dizzying heights, nearing $92 billion-a digital rapture that some might liken to the second coming.

The Specter of Liquidity

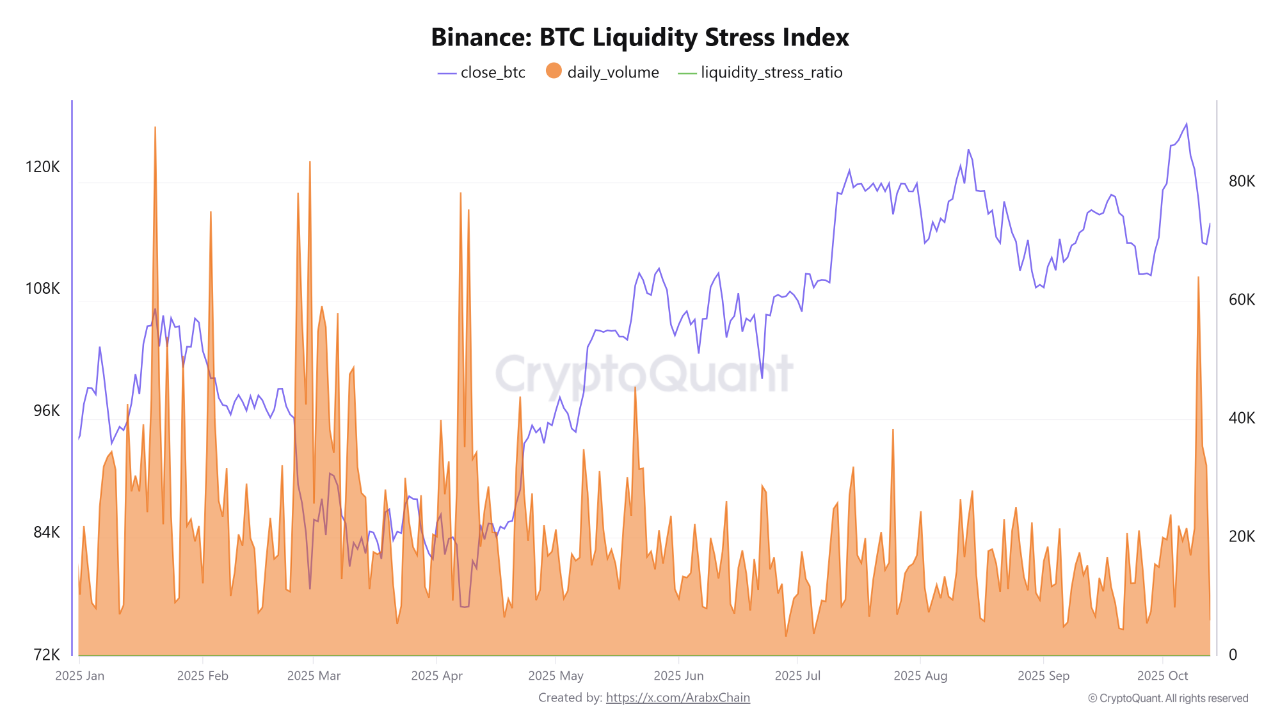

But lo! As we frolic in this sea of prosperity, we encounter strange currents that tug at our very souls-the liquidity stress has reached peaks not seen since the early days of 2025 upon Binance, the undisputed heavyweight of crypto exchanges. A warning sign? An omen? Or merely a jest played upon us by cruel fate? It appears that executing large trades has become akin to navigating a ship through a storm of uncertainty.

Data that spills forth from the annals of CryptoQuant reveals the liquidity stress index, a point of contemplation, currently standing at an alarming 0.2867, breathing like some monstrous creature lurking beneath the surface. There is talk-oh how there is always talk-of a liquidity transfer, moving swiftly from the trembling short-term traders to the steadier hands of institutional holders. The whispers suggest that the wise among us are seizing the opportunity to gather BTC as it descends into the depths.

Bitcoin liquidity stress index on Binance | Source: CryptoQuant

As one delves into the murky waters of analysis, one must ponder: is this our moment of redemption, a signal for the return of confidence? Might we stabilize and regain our footing should volumes subside whilst prices cling to $112,000? Such thoughts dreamily dance in the mind.

What Awaits the BTC Soothsayers?

Glassnode, that modern oracle, divulges grim tidings-the funding rates across dominant derivatives exchanges have plunged to depths akin to those of a bear market. During the tumultuous days between October 10 and 12, a staggering $20 billion in positions vanished into the ether, only to modestly reappear at $74 billion, leaving traders in a fog of confusion. What shall it be-a mere correction, or the herald of a deeper abyss?

Yet, amidst this uncertainty, there are still the bright-eyed analysts, clinging to hope and predicting Bitcoin’s ascent to the heavens, perhaps even touching the ethereal $150,000 by the quarter’s end. Ah, the allure of fortune and folly! 🍃

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- These are the 25 best PlayStation 5 games

- The MCU’s Mandarin Twist, Explained

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- Mario Tennis Fever Review: Game, Set, Match

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- All Songs in Helluva Boss Season 2 Soundtrack Listed

2025-10-13 15:32