KEY POINTS, or as the Bard would say, “Aye, there’s the rub!”

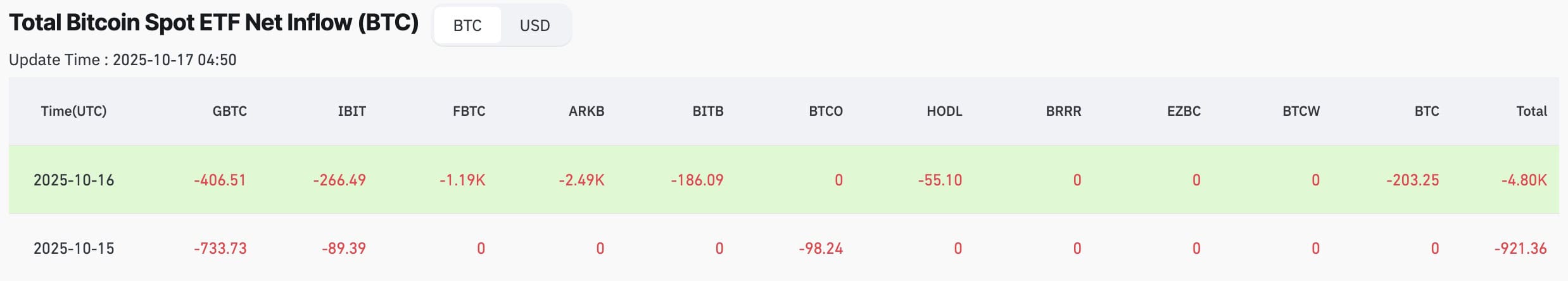

DeepSeek AI, that paragon of wisdom, forecasts a short-term Bitcoin correction to around $100K, driven by ETF outflows of 4.8K Bitcoin yesterday. 📉 A most alarming dip, if you’ll pardon the pun.

Bitcoin ($BTC) dropped roughly 6.7% in 24 hours to $104K, entering the ‘caution zone’ between $102K-$107K. A realm as perilous as a London fog at dawn. 🌫️

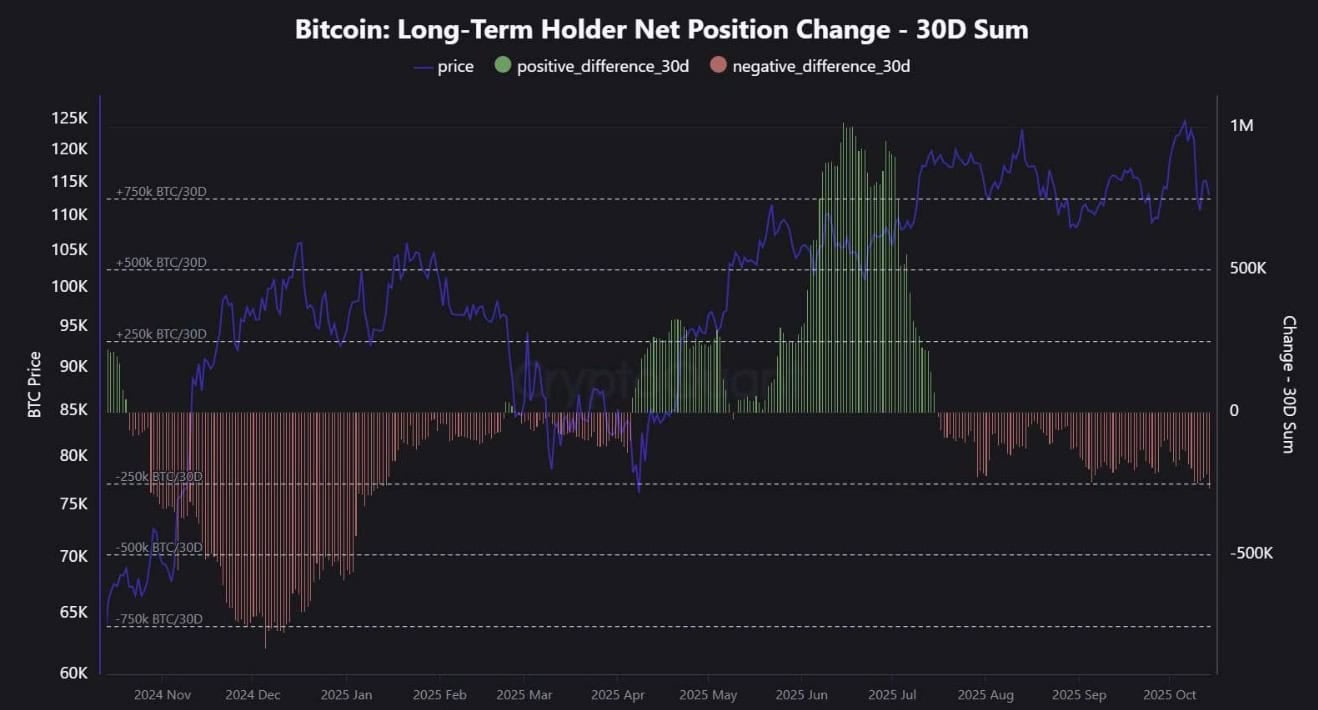

Long-term holders have moved over 265K $BTC this month, signalling the largest profit-taking shift since January. A veritable tempest in a teacup, if you ask me. 🧴

As volatility rises, investors are rotating toward presales like Bitcoin Hyper ($HYPER), which offers Layer-2 scalability and steady phase-by-phase growth. A beacon of hope in a sea of chaos. 🌊

The model has analyzed ETF flows, order book depth, and on-chain movement to flag elevated outflows from U.S. spot funds as the primary driver behind the latest selloff. A tale as old as time, but with more spreadsheets. 📊

Data shows that institutional selling accelerated yesterday with 4.8K Bitcoin (around $530M worth) flowing out. This forced $BTC to lose its support near $110K and fall into what analysts refer to as the ‘caution zone’ between $102K and $107K. A fate as grim as a poorly timed pun. 😅

DeepSeek claims that another cause of the recent selloff is the increased activity of long-term holders. Over 265K $BTC has been moved this month, the largest transfer since January. A spectacle as thrilling as a horse race, but with fewer jockeys. 🐎

But traders like to believe that this is simply ‘old money taking profit, new conviction stepping in.’ A sentiment as fleeting as a sunset. 🌅

Still, DeepSeek’s model doesn’t see this as a collapse. Or the start of a bear market like you’ll read on crypto Twitter (now X). Instead, it points to a healthy reset that will fuel the next leg up. A glass half full, if you’ll pardon the cliché. 🥄

However, periods like this often prompt capital to shift toward alternative investments. Some investors now seek ways to remain connected to Bitcoin’s upside without direct exposure to its volatility. A prudent move, if you ask the wise ones. 🧠

That’s why Bitcoin Hyper ($HYPER) is garnering significant attention – a new Layer-2 ecosystem designed to scale Bitcoin’s speed and utility, while offering presale investors structured, phase-by-phase growth. A marvel of modern finance, if I do say so myself. 🚀

Investors Rotate Toward Presales as Bitcoin Consolidates

Bitcoin’s pullback has investors split. Some see it as a short-term shakeout. Others panic, thinking it signals the start of a deeper rotation. Either way, the market’s tone has shifted from greed to caution. A mood swing as unpredictable as a British summer. ☔

And that’s often when early-stage projects start attracting fresh capital. Presales don’t move with market fear. Their prices only rise in incremental phases. So if the coins start to dump 10-20%, presales give investors a sense of control that’s rare in crypto. A rare bird, indeed. 🦜

So while $BTC tests support around $104K, fresh capital is flowing into $HYPER. A tale of two assets, if you will. 📈

Bitcoin Hyper ($HYPER) – Bitcoin’s Speed Problem Finally Gets a Fix

Let’s be honest, Bitcoin’s biggest weakness has always been speed. According to data, the network handles just 6.28 transactions per second (TPS) in real-time. Add to that the high fees that often make small transfers impractical, and it doesn’t look good. A situation as dire as a sock missing a mate. 👖

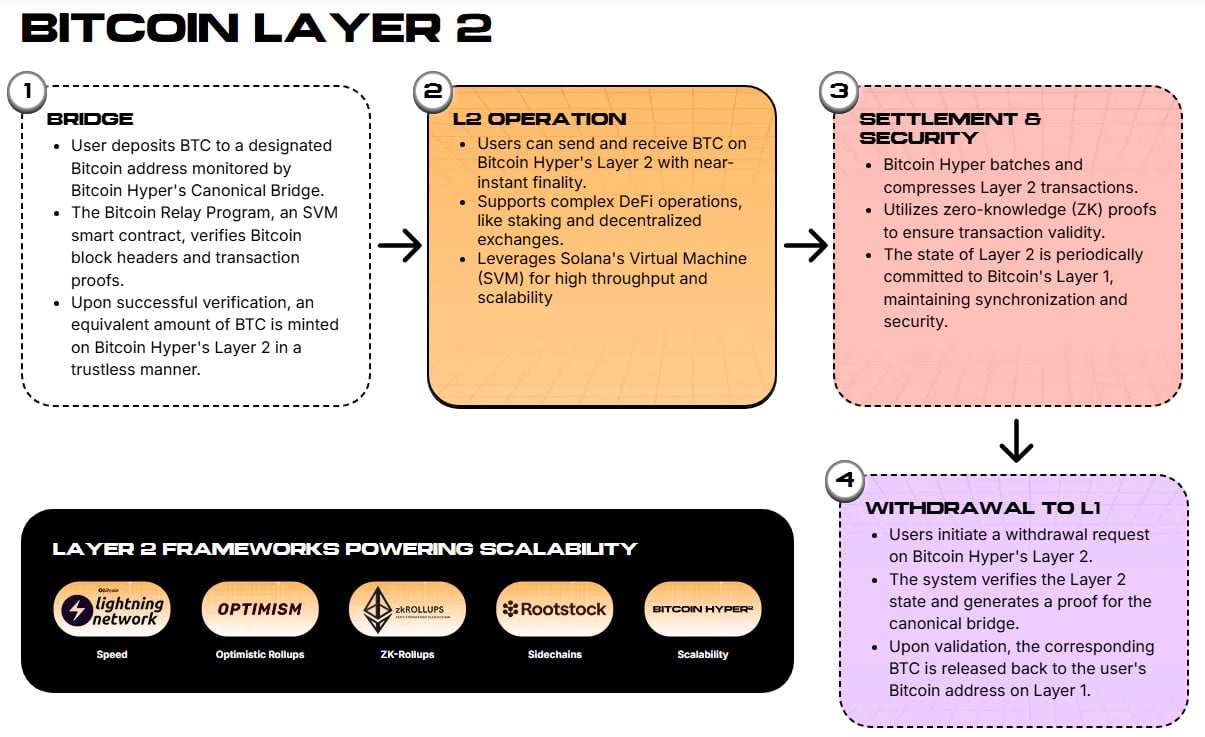

Bitcoin Hyper ($HYPER) was designed to address this issue. It’s a full L2 network that delivers Solana-level performance to Bitcoin, utilizing the Solana Virtual Machine (SVM) for sub-second execution. A speed demon, if you ask me. 🏃♂️

You bridge $BTC to the Hyper network, where it’ll be mirrored 1:1. From there, you can trade or stake instantly with near-zero gas fees. This opens up a whole world of opportunities for DeFi, dApps, and meme coins all on Bitcoin. A digital utopia, perhaps? 🌐

Later, the mirrored $BTC can be bundled back onto Bitcoin’s base chain, utilizing zero-knowledge (ZK) proofs for secure settlement. It’s not an attempt at a sidechain or a wrapped $BTC; it stays fully synced with Bitcoin for a trustless experience. A feat of engineering, if I may say so. 🧠

Learn how to buy Bitcoin Hyper in our step-by-step walkthrough. A guide as clear as a bell. 🔔

Bitcoin Hyper is all cross-chain from day one. It connects with the Bitcoin, Solana, and Ethereum ecosystems, allowing assets and apps to move freely. Think of it as Bitcoin’s execution engine running on Solana-grade speed. A marriage made in heaven, or at least in a blockchain. 🕊️

Early buyers earn 49% APY through staking plus governance, airdrops, and launchpad access. On-chain trackers also show multiple six-figure buys in recent weeks, including $379.9K and $274K purchases. This indicates that there’s a firm conviction among whales in $HYPER. A whale with a plan, if you will. 🐋

Each presale phase lifts the price slightly, meaning no downside for early entries. While $BTC churns between $102K and $107K, $HYPER’s growth remains linear. A steady hand on the tiller. 🧭

Buy $HYPER before the next price increase. A call to arms for the bold! 🚀

Read More

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- MNT PREDICTION. MNT cryptocurrency

- ‘Stranger Things’ Creators Break Down Why Finale Had No Demogorgons

2025-10-17 15:58