Darling, Bitcoin. It appears to be having a bit of a moment – a decidedly downward moment, I might add. Trading some 30% below its former glory of $126,000, one detects a distinct lack of enthusiasm in the markets. Honestly, the confidence has evaporated faster than a dandelion wish! Investors, those ever-hopeful souls, are beginning to suspect the party is, shall we say, over.

The price, you see, is rather… fragile. Like a reputation after a scandalous rumour. The poor buyers are scrambling, utterly failing to seize control, while momentum indicators whisper tales of exhaustion. Yet, even in this gloom, a flicker of possibility. One dares to suggest a turning point, though one always approaches such optimistic pronouncements with a healthy dose of cynicism. 😉

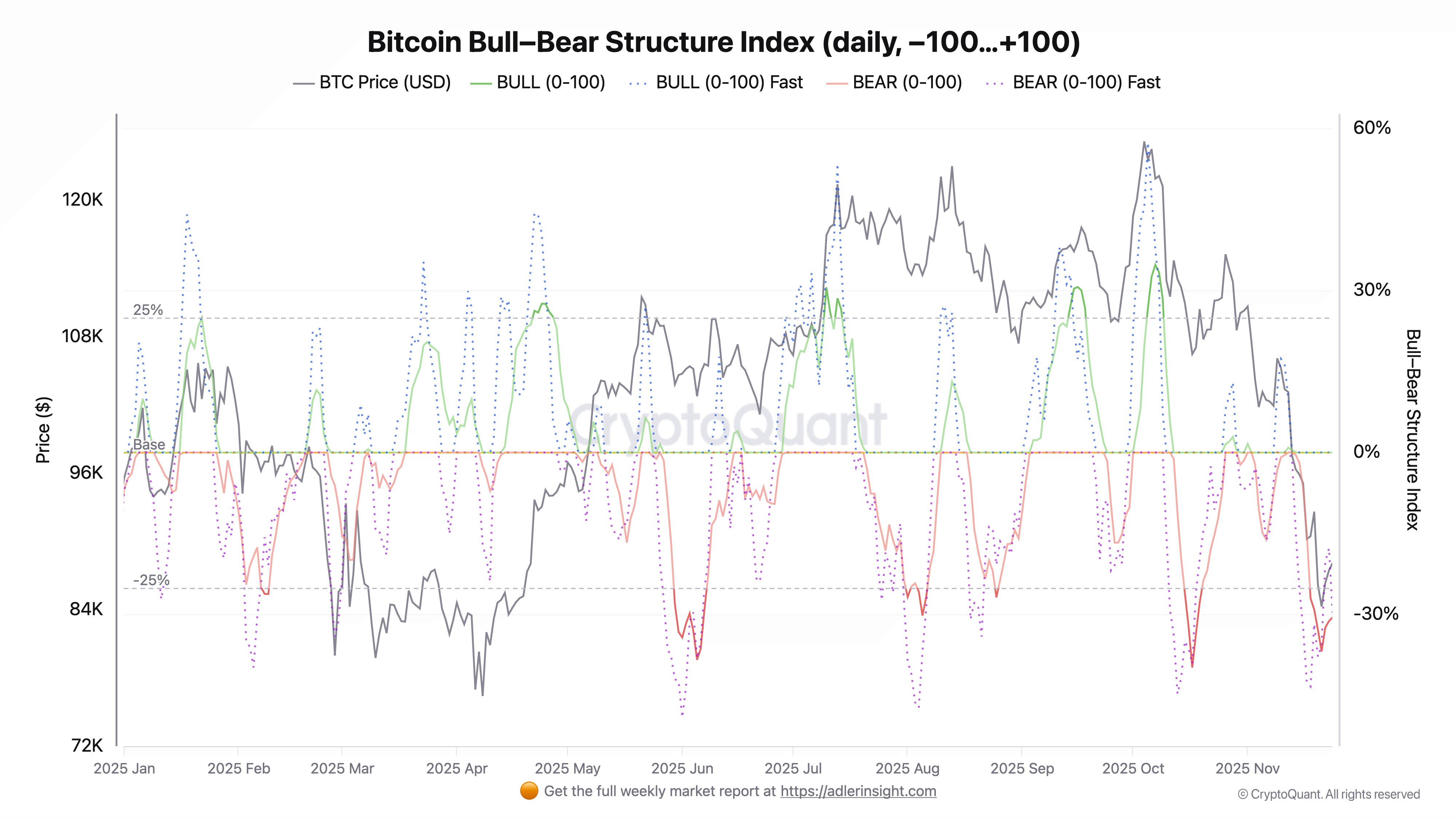

Our esteemed analyst, Mr. Adler, informs us that his indices remain resolutely bearish. Naturally. But, and this is the amusing part, Bitcoin is currently trading well below what Mr. Adler deems its ‘fair value’ – a concept as subjective as taste in wallpaper, wouldn’t you agree? This disconnect, he points out, often happens not during a descent, but when things are nearing the bottom. Ah, the delicious irony! 🎭

And indeed, the indices show a slight softening of the sell-off. A mere pause for breath, perhaps, but a pause nonetheless. A whisper of ‘perhaps things aren’t quite as dire as they seem.’ Though, one shouldn’t hold one’s breath, my dear.

Bearish Structure Weakens as Bitcoin Attempts to Stabilize

The daily index, like a melancholic poet, has been decidedly pessimistic since November. A great show of ‘downside momentum,’ it claims. The BEAR line, a rather gloomy shade of red, plunged to -36%. However, it’s begun to… reverse. Such a dramatic turn of events! It suggests the most aggressive phase of bearish control may be fading. Bitcoin itself is consolidating around $87,000 – a desperate attempt to regain composure after a rather undignified plunge. 😮

The ‘fast’ indices are all aflutter, showing increased volatility – a sign that the bears are losing their grip, though not necessarily relinquishing it entirely. In the futures market the news is just as grim… or perhaps marginally less so. A move above 55 would be thrilling, wouldn’t it? But for now, it remains a distant dream. The ‘fair value’ – that most elusive of quantities – remains a good $11,000 above the current price. It suggests the market is attempting to escape its bearish prison, though further proof is, naturally, required.

Weekly Structure Tests Key Support Amid Attempted Stabilization

The weekly chart reveals the market attempting a rather wobbly form of ‘stabilization’ after a fall from grace. A 30% drawdown is hardly conducive to a cheerful disposition! The recent candle structure suggests buyers have tentatively stepped in, offering a brief respite.

The 100-week moving average, that stalwart of technical analysis, is attempting to offer support. Let’s hope it manages. Though it’s still below the 50-week – a rather ominous sign. Volume, naturally, increased during the selloff. People rushing for the exits, you see. Such a common occurrence. If Bitcoin can hold above this level, a recovery to $95,000-$102,000 is possible. But if not… well, prepare for a further descent into the abyss! 😈

The weekly structure, much like a society novel, is full of correction, but not yet a complete ruin. The upcoming events will dictate whether the story continues or comes to a rather abrupt conclusion.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Mario Tennis Fever Review: Game, Set, Match

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- Brent Oil Forecast

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- All Itzaland Animal Locations in Infinity Nikki

2025-11-26 04:14