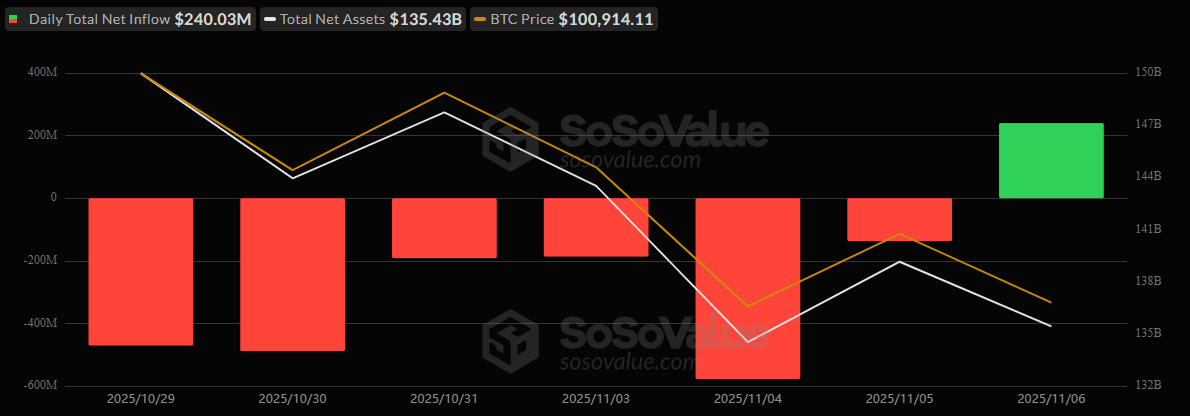

After a week-long soiree with the grim reaper of redemptions, Bitcoin and Ether ETFs pirouetted back into the green on Thursday, pocketing $240 million and $13 million respectively. Solana ETFs, ever the showoff, added $29 million to their coffers with a flourish.

ETF Turnaround: Bitcoin and Ether Snap Outflow Streaks as Solana Maintains Inflows

The streak, which had been clinging to life like a penguin on thin ice, finally snapped. After six days of weeping red, U.S. spot bitcoin ETFs roared back with inflows that would make a high-society auction house weep into their sherry. Ether funds followed suit, while solana’s ascent was as steady as Jeeves polishing a monocle.

Bitcoin ETFs, with the vigor of a man who’s just discovered his umbrella is also a sword, reclaimed $240.02 million. Blackrock’s IBIT led the charge like a general in a pith helmet, snatching $112.44 million. Fidelity’s FBTC added $61.64 million, while Ark & 21Shares’ ARKB danced in with $60.44 million. Bitwise’s BITB, ever the polite guest, contributed $5.50 million. The market’s caprices had drained nearly a billion earlier, but now, the tea was being poured anew. Trading volume? A robust $4.77 billion. Net assets? $135.43 billion, because why not?

Ether ETFs, with the subtlety of a peacock at a garden party, closed in the green with $12.51 million. Blackrock’s ETHA led with $8.01 million, Fidelity’s FETH added $4.95 million, and Bitwise’s ETHW brought $3.08 million. Grayscale’s ETHE, in a rare moment of clumsiness, lost $3.53 million, but even a spilled tea cup couldn’t spoil the mood. Total trading value? $1.62 billion. Net assets? $21.75 billion-because elegance is expensive.

Solana ETFs, ever the social climber, extended their winning streak. Bitwise’s BSOL, with the charm of a well-tied cravat, drew $29.22 million. Total net assets? $538.38 million. Trading volume? $27.95 million. One might say Solana’s performance was “quite the coup.”

Thursday’s inflows, after a week of financial waltzes with the devil, marked a psychological victory. Bitcoin led the charge, Ether followed with the grace of a well-trained spaniel, and solana proved it’s not just a background character in this crypto opera.

FAQ🌍

- What happened with Crypto ETF flows on Thursday?

Bitcoin and ether ETFs snapped their six-day outflow streak, bringing in $240 million and $13 million in inflows. 🦊 - Which Bitcoin ETF led the rebound?

Blackrock’s IBIT topped the list with $112 million in new investor inflows. 🎩 - How did Solana ETFs perform?

Solana ETFs extended their winning streak with $29 million in fresh capital. 🚀 - What does this mean for the crypto market?

The return of inflows signals renewed investor confidence after a week of heavy redemptions. 🎉

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- All Itzaland Animal Locations in Infinity Nikki

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Gold Rate Forecast

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- Exclusive: First Look At PAW Patrol: The Dino Movie Toys

2025-11-07 19:25