Finance

What to know:

- Aave V4 will support native bitcoin collateral via Babylon’s trustless Bitcoin Vaults, banishing the specter of wrapped BTC and its custodial overlords. 🤯

- This gambit invites BTC liquidity to flood Aave’s markets, as if the blockchain gods had finally relented to mortal innovation. 🌪️

- Babylon, ever the visionary, plans to let BTC holders earn yield while insuring protocols against hacks-because why not gamble with other people’s coins? 🎲

Behold, the brooding alliance of Babylon and Aave! With the solemnity of a funeral for custodial models, they declare: BTC shall now be collateral, unshackled from wrapping or centralized tyranny. A brave new world, or a dystopia in waiting? Only time will judge. 💀

But wait! Babylon’s ambitions stretch further-DeFi insurance, where BTC becomes both shield and sword. Deposit coins, earn yield, and when chaos erupts, you’ll be the first to bleed liquidity. A noble cause, if you enjoy existential quandaries. 😂

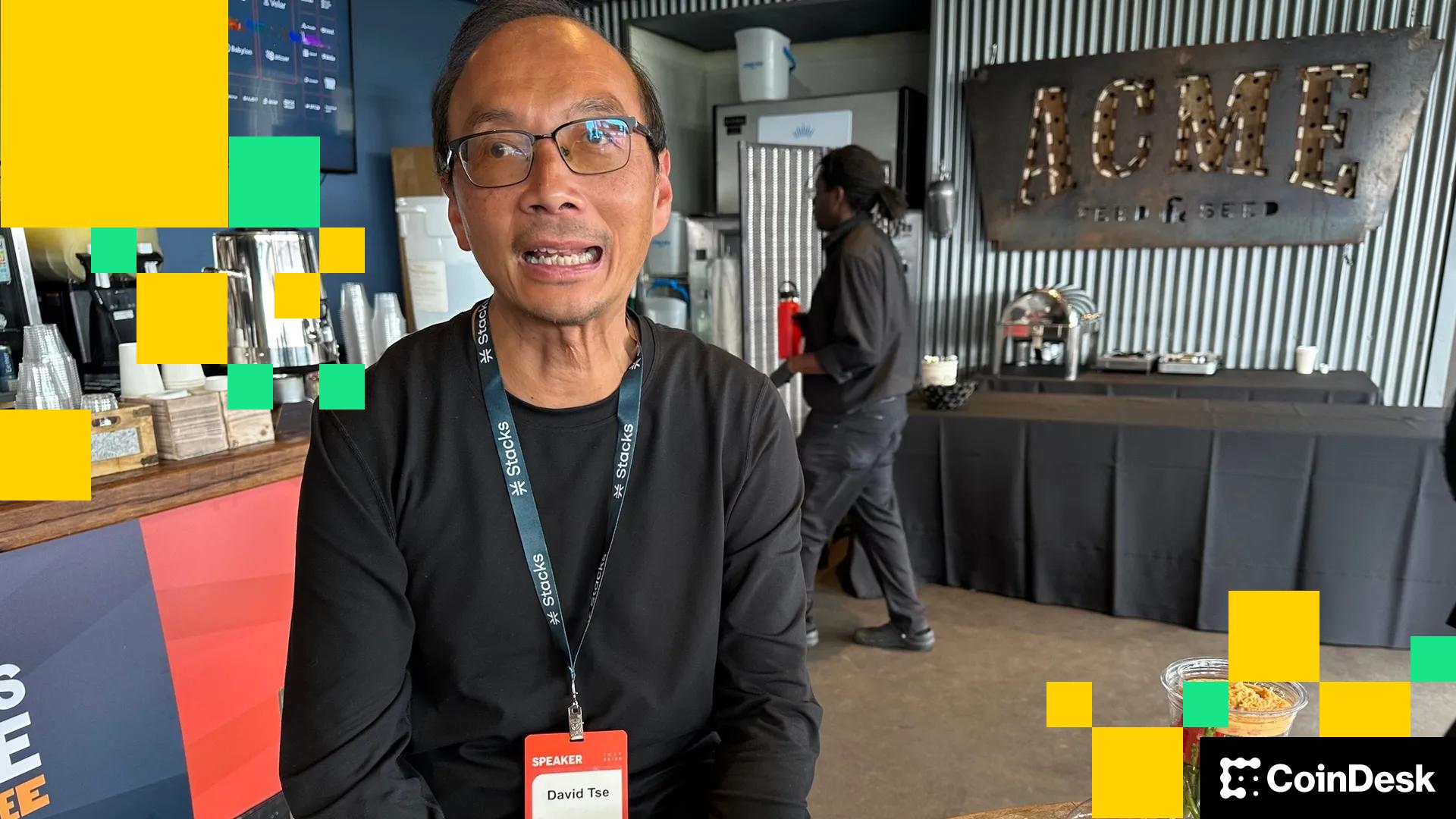

“By January 2026,” declared David Tse, co-founder of Babylon, “we shall unveil this madness.” One wonders if he speaks of salvation or damnation.

Babylon and Aave: A Love Story of BTC and Trustlessness 💔

In a realm where BTC-backed lending blooms like a weed in a crypto wasteland, custodial models cling to life, peddling WBTC like a beggar’s alms. Yet even these tokens, with their hollow promises, constitute less than 1% of BTC’s cap-a paltry offering for DeFi’s ravenous maw. 🍷

Native BTC, that purest of digital gold, may yet redeem this sordid market. “Even 5% of Bitcoin’s supply,” Tse intoned, “would drown today’s lending protocols in liquidity.” A vision of utopia, or a fever dream?

Babylon’s staking product, guarding 56,000 BTC ($5.15 billion), whispers of humanity’s eternal struggle: to hold, to earn, to lend. A trinity of greed and hope. 🙌

Together, Babylon and Aave weave a tapestry of trustless vaults and “hub and spoke” architectures. Imagine: depositing BTC on base chain, borrowing stablecoins, and dancing on the edge of solvency. A ballet of risk and reward! 🎭

Testing begins in 2026, with a grand unveiling slated for April. Will this be the dawn of a new era, or the final act of a tragicomedy? The future, as always, remains shrouded in ambiguity-and probably bugs. 🐛

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- NBA 2K26 Season 5 Adds College Themed Content

- Mario Tennis Fever Review: Game, Set, Match

- 2026 Upcoming Games Release Schedule

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

- 4. The Gamer’s Guide to AI Summarizer Tools

2025-12-03 13:48