Ah, the capricious dance of AVAX, that digital darling of the crypto sphere, now finds itself in a predicament most delectable. After a dramatic tumble from its celestial heights, it lingers in a realm where sellers, those harbingers of doom, seem to be losing their grip. The price, my dear reader, clings to its long-term support with the tenacity of a socialite to her pearls, while volatility, that fickle mistress, fades into the background. Are we on the cusp of a grand movement, or merely witnessing the calm before the storm? One can only speculate with a raised eyebrow and a glass of champagne. 🥂

The Current Farce: Market Performance and Technical Trifles

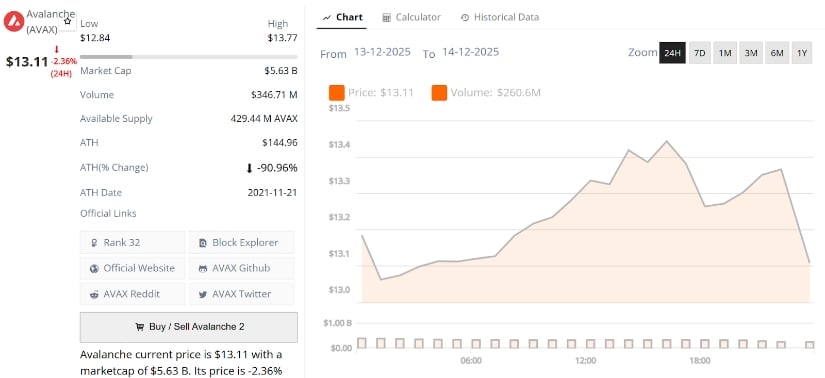

As the clock strikes mid-December, AVAX graces us with its presence at a modest $13, a far cry from its former glory but steadfastly above a demand zone that has proven more resilient than a Wildean wit. This zone, my friends, has absorbed sell pressure with the grace of a Victorian lady fainting at a ball, repeatedly acting as a structural floor across multiple timeframes. The price, ever the drama queen, has spent weeks consolidating, refusing to accelerate lower, much to the chagrin of the bears. 🐻

Short-term momentum, that elusive minx, remains neutral. AVAX neither ascends with the fervor of Icarus nor descends into the abyss, instead choosing to lounge in a state of equilibrium, much like a dandy reclining on a chaise longue. 🛋️

Consolidation: The Prelude to a Dramatic Breakout?

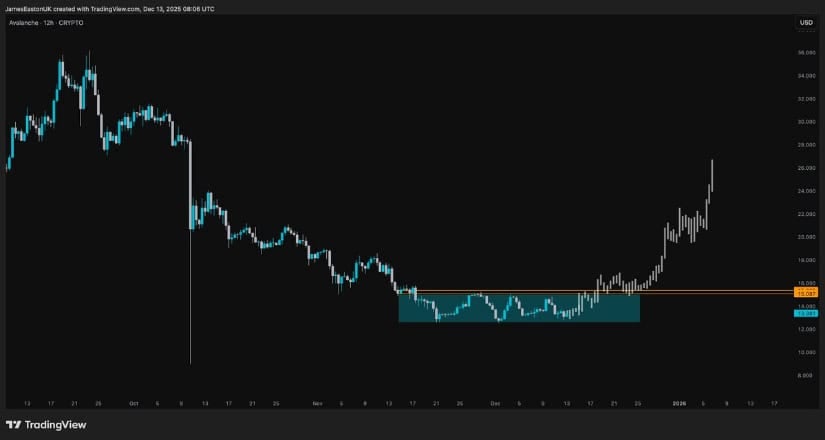

Behold, a chart from the esteemed James Easton, a man whose analysis is as sharp as his taste in waistcoats. He presents AVAX consolidating with the precision of a Swiss watch after its recent decline. The $15 level, he notes, is the threshold of destiny, a break above which could herald a seismic shift in market structure. One can almost hear the gasps of the crowd as the tension builds. 🎭

Easton, ever the optimist, frames the current base formation as one of absorption rather than distribution, with the price respecting support while compressing beneath resistance. Should buyers reclaim $15, he posits, upside momentum could accelerate with the speed of a gossip spreading through Mayfair. The lack of heavy resistance above that level only adds to the intrigue. 🧐

The Long-Term Charade: AVAX in Discounted Disguise

From the lofty heights of the weekly chart, Brotoshi Nakamoto, a name that rolls off the tongue like a fine brandy, presents a structural view that places AVAX in what he dubs “extreme discounted territory.” His descending channel, a masterpiece of technical analysis, shows the price holding near the lower boundary, a position as precarious as a tightrope walker without a net. 🕸️

Brotoshi’s Fibonacci levels, those mystical numbers, suggest a move towards the top of the range could imply a staggering 160% upside, targeting $24 and then $30. While he stresses this is a structural roadmap rather than a short-term forecast, the chart whispers of potential riches, provided the stars align and the trend improves. 🌟

Network Activity: The Unseen Hand of Progress

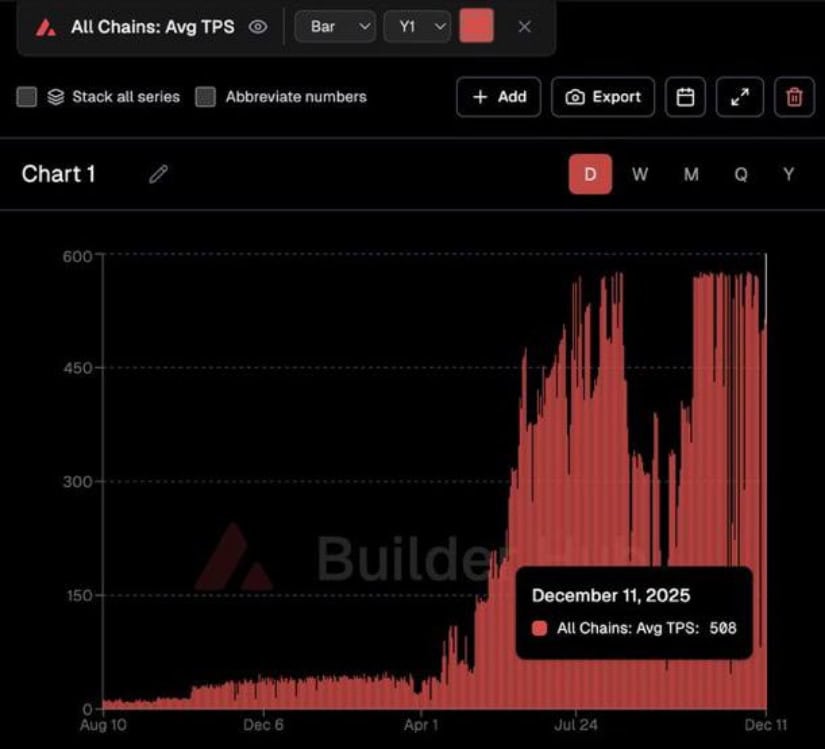

Beyond the price action, CW8900, a name as enigmatic as it is numerical, points to a surge in Avalanche’s network activity. A 1,100% increase in average transactions per second (TPS) over the past year, with the network now handling a robust 500 TPS, is nothing short of remarkable. This on-chain renaissance, my dear reader, is the unsung hero of AVAX’s story, a testament to its growing infrastructure and maturity. 🏗️

While network growth does not guarantee immediate price appreciation, it provides a supportive backdrop during accumulation phases, particularly when the price trades near historical lows. Think of it as the quiet strength behind the scenes, the butler ensuring everything runs smoothly. 🧑🎩

Downtrend Resistance: The Final Act

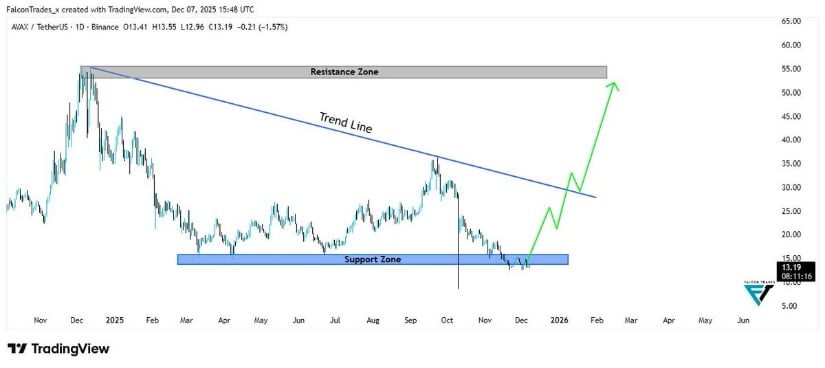

Falcon Trades, a name that evokes images of soaring heights and strategic precision, offers a technical perspective that frames AVAX’s structure around a support-and-resistance model. His chart shows AVAX consolidating on a major support zone while pressing against a long-term descending trendline, a battle as epic as any Wagnerian opera. 🎼

A confirmed breakout above this trendline, Falcon Trades declares, would mark a structural shift, with a longer-term upside target projected near $55. Until that break occurs, the current phase is one of preparation, a rehearsal before the grand performance. 🎭

The Grand Finale: Where Does AVAX Waltz Next?

In conclusion, the AVAX price prediction landscape is a tapestry of technical intricacies and fundamental strengths, a market at an inflection point as dramatic as any Wildean plot twist. The price holds firm above long-term support, volatility compresses, and both technical and on-chain signals whisper of accumulation rather than distribution. A move above $15 remains the key to unlocking bullish confirmation, while failure to hold $12 to $13 could delay the recovery, leaving us in a waiting phase, a moment of suspense worthy of a Shakespearean tragedy. 🎭

Should broader market conditions stabilize and liquidity improve, AVAX, that digital phoenix, may rise from the ashes of its discounted levels. As always, confirmation, not anticipation, will be the deciding factor. Until then, my dear reader, let us observe this crypto tightrope walker with a mix of fascination and amusement, for the show must go on. 🌟

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- All Itzaland Animal Locations in Infinity Nikki

- Gold Rate Forecast

- Brent Oil Forecast

- NBA 2K26 Season 5 Adds College Themed Content

- James Gandolfini’s Top 10 Tony Soprano Performances On The Sopranos

- Super Animal Royale: All Mole Transportation Network Locations Guide

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

2025-12-14 23:15