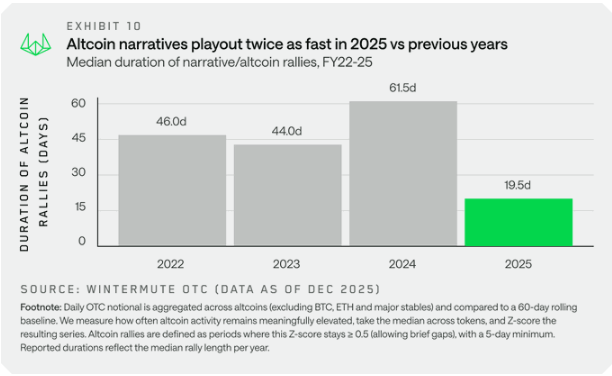

Pray tell, dear reader, have you heard the latest lamentations from the world of digital currency? According to the ever-so-informed Wintermute, in their 2025 Digital Asset OTC Markets report, the altcoin rallies of late have been as fleeting as a society ball’s gossip-lasting a mere 19 to 20 days, a far cry from the 60-day frolics of yore (2024, to be precise). 🕊️

Market flows, it seems, have tightened their stays, and smaller tokens have seen their gains vanish quicker than a debutante’s blush at a scandalous remark. The result? Capital, ever the fickle suitor, has returned to the arms of the established-Bitcoin and Ethereum-where liquidity is as deep as Lady Catherine’s disdain. 💃

Altcoin Open Interest Drops: A Tale of Woe and Deleveraging

One cannot discuss this tragedy without mentioning the fateful day of October 10, 2025, when a sharp deleveraging sent retail traders scurrying like mice at a cat’s approach. Open interest in altcoin futures contracts plummeted, with some reports noting a 55% decline since that ominous October. 🧨

Trading desks, those bastions of wisdom, lament that lower liquidity has made sustaining rallies as difficult as convincing Mr. Darcy to dance at a ball. What once were multi-month affairs have been reduced to mere flings of a few weeks. 💔

Major Coins Reclaim Their Thrones: A Return to Propriety

Institutional flows and product structures, those quiet orchestrators of fate, have played their part. ETFs and other channels have funneled funds toward Bitcoin and Ethereum, narrowing the market’s attention like a corset on a lady’s waist. 🏰

Where once narratives propelled dozens of tokens into the spotlight, capital now clings to the top tier. Traders, ever practical, prefer assets where orders can be filled without causing a scene-no dramatic price movements, thank you very much. 🎭

Short, Intense Moves Replace Long Trends: The New Fashion

Wintermute’s analysis reveals a shift in momentum, as tactical maneuvers replace broad, lasting narratives. Memecoin pumps and exchange-themed rallies burn out as quickly as a candle in the wind, leaving traders to describe these moves as “hair-trigger events”-swift rises followed by equally rapid falls. ⚡

Liquidity bands have tightened, and stops are hit sooner than in past cycles, leaving one to wonder if the market has developed a rather short temper. 😤

Market participants whisper that a sustained altcoin season now requires a perfect alignment of stars: renewed retail interest, clearer institutional support for smaller tokens, and calmer macro markets. Otherwise, rallies will remain as brief as a curtsey at a tea party. 🌟

Execution desks report that when big buyers reappear, a token may run fast, but maintaining that momentum without deeper market participation is as likely as Mrs. Bennet keeping a secret. 🤐

The report and market commentary suggest that a broader crypto rebound in 2026 hinges on several factors: interest from institutions, shifts in macro rates, and retail’s return to risk-on strategies. Should these elements align, rallies might last longer than the paltry 19-20 days seen in 2025. If not, the pattern of quick, sharp moves into the majors will persist, leaving altcoins to sigh in envy. 🌤️

Until then, dear reader, let us observe this drama with the detached amusement of a Jane Austen heroine, for in the world of crypto, as in life, the only certainty is uncertainty. 🌪️

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- NBA 2K26 Season 5 Adds College Themed Content

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Every Death In The Night Agent Season 3 Explained

- 2026 Upcoming Games Release Schedule

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

2026-01-16 12:07