The specter of a bubble, that old familiar ghost, has returned to haunt not just Bitcoin but the stock market as well.

The AI Bubble’s Wider Fallout: Stocks Join Bitcoin in Decline

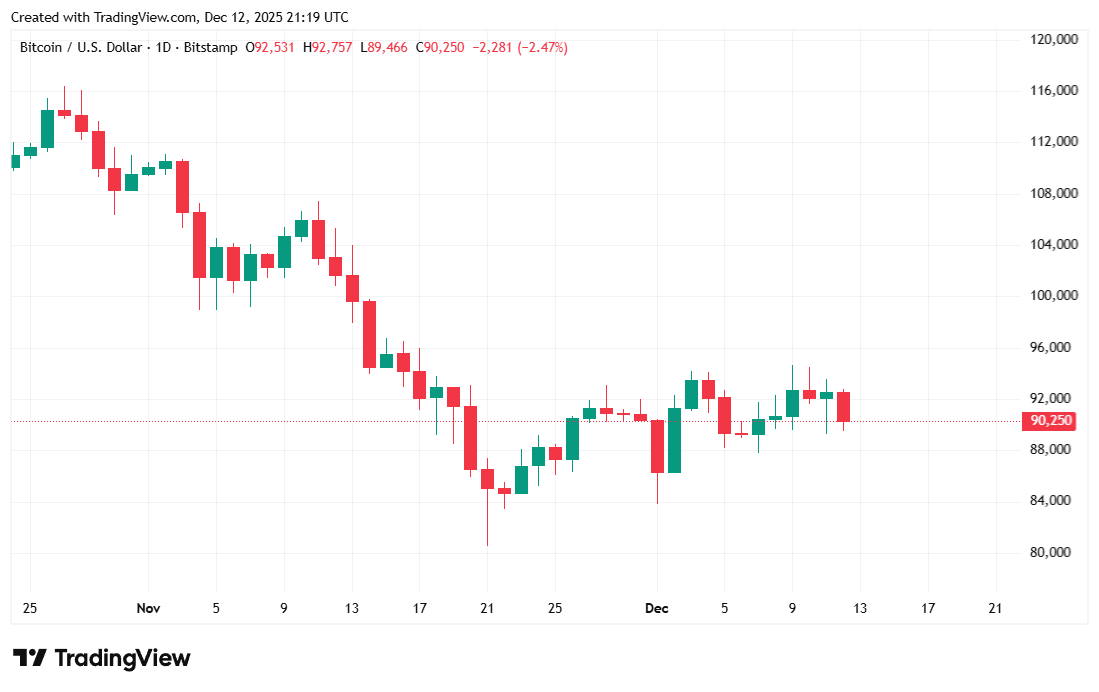

When the stock market sneezes, Bitcoin, ever the timid soul, catches a cold. This adage, though trite, aptly captures the enigmatic dance of Bitcoin’s price over the past eight weeks. Billions in institutional capital, favorable crypto legislation, and acceptance by several trillion-dollar money managers all failed to trigger a year-end rally for the cryptocurrency. And now stocks may meet a similar fate, with many blaming AI hype for the bearish retreat. One might say the market has a case of the Mondays… in December.

There are two predominant theories connecting the AI bubble to bitcoin’s price decline. One says investors are cycling out of the digital asset into hyped-up tech stocks such as Nvidia (Nasdaq: NVDA). A classic case of “hot potato,” one suspects.

“ Bitcoin started the year as the hottest investment narrative,” said Alex Thorn, head of firmwide research at Galaxy, in a November note to clients. “But AI, hyperscalers, gold, and the Magnificent 7 have absorbed capital and attention that might otherwise flow into BTC.” A poetic injustice, really.

The other theory simply posits that concerns of an AI bubble on the verge of bursting have made investors retreat from risk-on assets such as bitcoin into stores of value like gold and silver, both of which are currently trading at near all-time highs. Investors, it seems, have turned their backs on Bitcoin, seeking refuge in gold and silver-those time-honored stores of value, now trading near all-time highs. One might almost admire the irony. 🤡

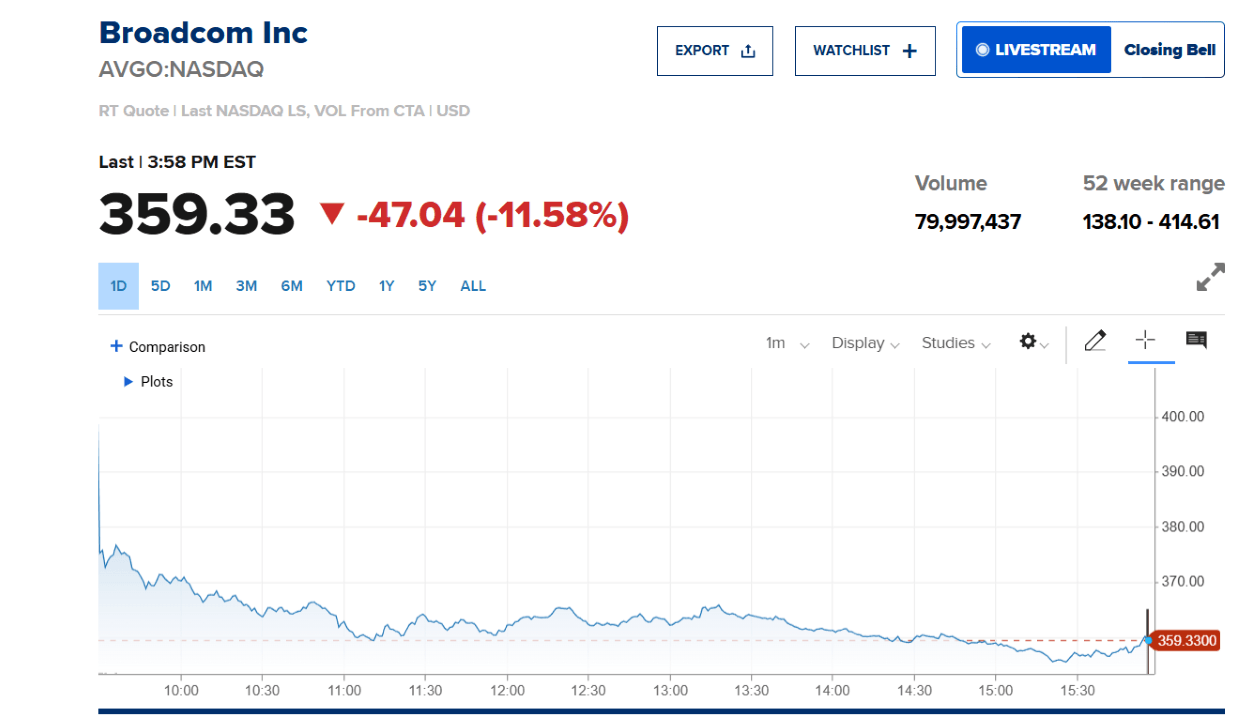

But just as traders became wary of bitcoin eight weeks ago, perhaps due to a combination of the October 10-11 liquidation event and AI-driven overexuberance, investors are also starting to sour on AI stocks, even when those companies are doing everything right. California-based chipmaker Broadcom (Nasdaq: AVGO) announced its fourth-quarter results on Thursday, and they were stellar. The company blew past analysts’ expectations, raking in more than $18 billion for the quarter, up 28% from last year. Broadcom counts Google, Meta, Bytedance, and Anthropic among its biggest clients, and CEO Hock Tan expects the firm’s AI chip sales to double in Q1 2026. Yet despite such impressive financials, the company tumbled nearly 12% on Friday. A reminder that in the theater of finance, even the best actors can’t save the play. 🎭

“Frankly, we aren’t sure what else one could desire as the company’s AI story continues to not only overdeliver but is doing it at an accelerating rate,” Bernstein analyst Stacy Rasgon wrote in a report, echoing the same sentiment bitcoin analysts have been expressing since October. “It seems that AI stock angst is continuing with Broadcom’s shares trading down,” Rasgon added. A masterclass in understatement. 🤷♂️

Overview of Market Metrics

Bitcoin was trading at $90,308.12 at the time of reporting, down 2.33% over 24 hours but up 0.93% for the week, Coinmarketcap data shows. The digital asset’s price has been fluctuating between $89,532.60 and $93,554.27 since Thursday afternoon. A rollercoaster ride in slow motion. 🎢

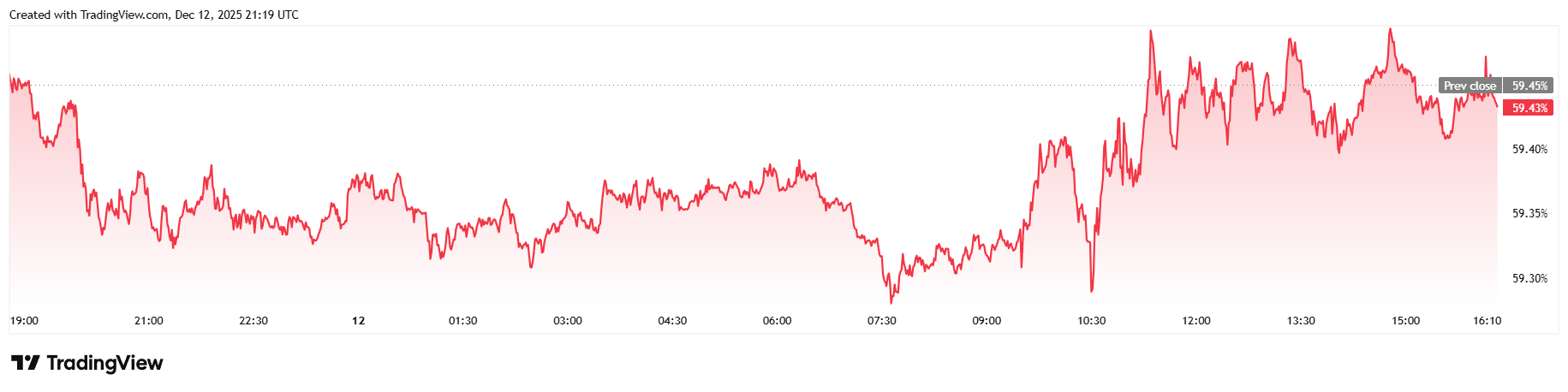

Daily trading volume climbed 34.61% to $82.08 billion, but market capitalization fell to $1.8 trillion. Bitcoin dominance remained flat over 24 hours at 59.43%. A stubborn child refusing to grow up. 🧸

Total bitcoin futures open interest edged lower, dipping 1.61% to reach $59.12 billion, according to Coinglass data. Friday’s liquidations fell to $101.88 million, a figure mostly consisting of losses from long investors who saw $77.85 million in liquidated margin. The $24.03 million remainder represents liquidations from bearish short sellers. A game of musical chairs with higher stakes. 🎵

FAQ ⚡

- Why are bitcoin and stocks both struggling right now?

Investors fear the AI trade may be overextended, prompting a pullback from risk-on assets like bitcoin and tech stocks. The crowd’s applause has turned to boos. 👏➡️😡 - How is the AI bubble linked to bitcoin’s recent weakness?

Some capital rotated from BTC into AI stocks earlier, while broader bubble fears are now driving risk aversion across markets. A classic case of “the grass is always greener… until it isn’t.” 🌾 - Why are strong AI companies still seeing their shares fall?

Even stellar earnings, like Broadcom’s, aren’t enough when sentiment turns against crowded AI trades. The market is a fickle lover, it seems. 💔 - Does this mean a year-end rally is off the table?

Rising caution around AI and macro uncertainty have poured cold water on what might have been a late-year rebound. The champagne is corked, and the confetti’s been recycled. 🍾🚫

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Gold Rate Forecast

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- NBA 2K26 Season 5 Adds College Themed Content

- Mario Tennis Fever Review: Game, Set, Match

- The Abandons: Netflix Western Series Disappoints With Low Rotten Tomatoes Score

- EUR INR PREDICTION

- 2026 Upcoming Games Release Schedule

- Train Dreams Is an Argument Against Complicity

2025-12-13 01:39