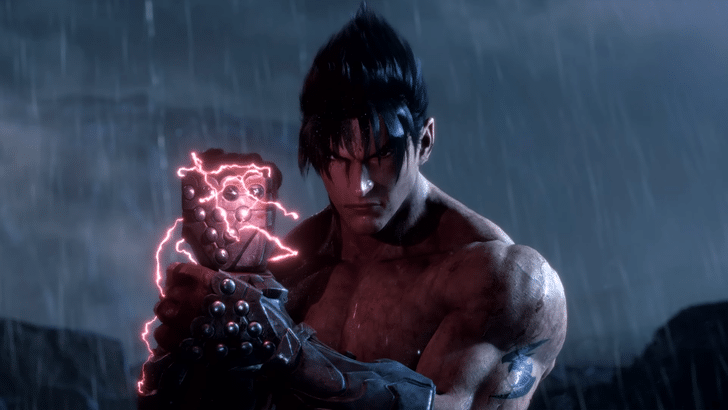

Tekken 8 Reviews Plunge Into ‘Overwhelmingly Negative’ Territory – What’s Going On?

The launch of Season 2 for Tekken 8 hasn’t lived up to the developers’ expectations, with a wave of negative feedback from players on Steam. Many have expressed their dissatisfaction, as evidenced by the overwhelming number of unfavorable reviews. A user named mizukirii put it simply: “Ninety-four percent of reviews since season 2’s release have been negative.” The overall sentiment echoes a broader displeasure among the gaming community, who have criticized aspects ranging from game balance to stability issues, and some even lamented changes or removals of certain features. This backlash isn’t just a temporary hiccup; it seems to reflect deeper concerns about the game’s direction and the perceived gap between what players want and the decisions made by the developers.