Cardano’s native token ADA has dusted off the snooze button and wandered back into the sunlight, creeping up almost 10% today to trade around $0.27 after a bruising flirtation at $0.22 earlier this week. The sharp recovery has stirred cautious optimism among investors and prompted fresh chatter about whether ADA is primed for a bigger rally-perhaps with a side of popcorn.

Institutional & Whale Buying Boosts ADA Confidence

One of the catapults behind this revival is a reawakened appetite from institutions. Grayscale, the big-splash investment firm juggling over $35 billion, has quietly boosted its ADA stash.

The firm nudged Cardano’s weight in its Smart Contract Fund from 18.55% to 19.50%, which is exactly the sort of numbers that make spreadsheets gasp in admiration and investors think it’s all wonderfully serious.

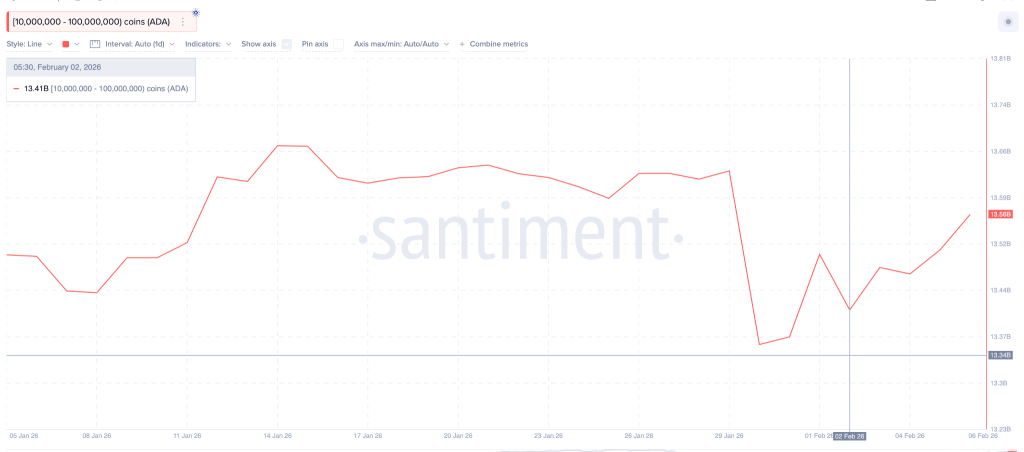

Data from Santiment shows the big players scooped up bargains. Wallets between 10 million and 100 million ADA crept up their collective bags from about 13.41 billion to 13.56 billion ADA since early February, an accumulation of roughly $40 million worth of tokens-enough to make a small asteroid blush.

More crucially, these mid-sized whales did not sell their snacks during the crash. Their holdings remained stubbornly steady even when prices briefly wandered down to $0.22, as if they were guarding a fragile teacup from chaos.

Big Milestone Ahead: ADA Futures on CME

Adding to the buoyant mood, Cardano futures are due to launch on the CME exchange on February 9. The regulatory-backed contracts will grant professional investors a sanctioned route to trade ADA. CME will offer both standard contracts of 100,000 ADA and smaller micro contracts of 10,000 ADA.

This forthcoming launch could spruce up liquidity and coax more professional players into the Cardano market, which is basically the financial equivalent of inviting a grown-up guest to your treehouse.

Cardano ADA Price Outlook

On the weekly chart, ADA has been treading water for ages after its last heroic peak. The price is carving higher lows near the $0.26 support zone, suggesting a polite but determined level of buying interest. ADA is also testing a long-term resistance line that has previously blocked rallies taller than a very small bookshelf.

A weekly close below $0.20 would undermine the bullish structure and invalidate the current setup. That level serves as the bulls’ main line of defense, like a velvet rope at a trendy club.

However, if momentum gets its act together, analysts whisper of a mid-cycle dash toward the $2 to $3 range-because sometimes the universe likes to remind us that gravity is optional until it isn’t.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- These are the 25 best PlayStation 5 games

- The MCU’s Mandarin Twist, Explained

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- Gold Rate Forecast

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Mario Tennis Fever Review: Game, Set, Match

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- What time is the Single’s Inferno Season 5 reunion on Netflix?

2026-02-07 12:36