What to know:

- Traders are taking on nine-figure leveraged bullish bitcoin positions, exposing the market to sharp downside risks if prices reverse.

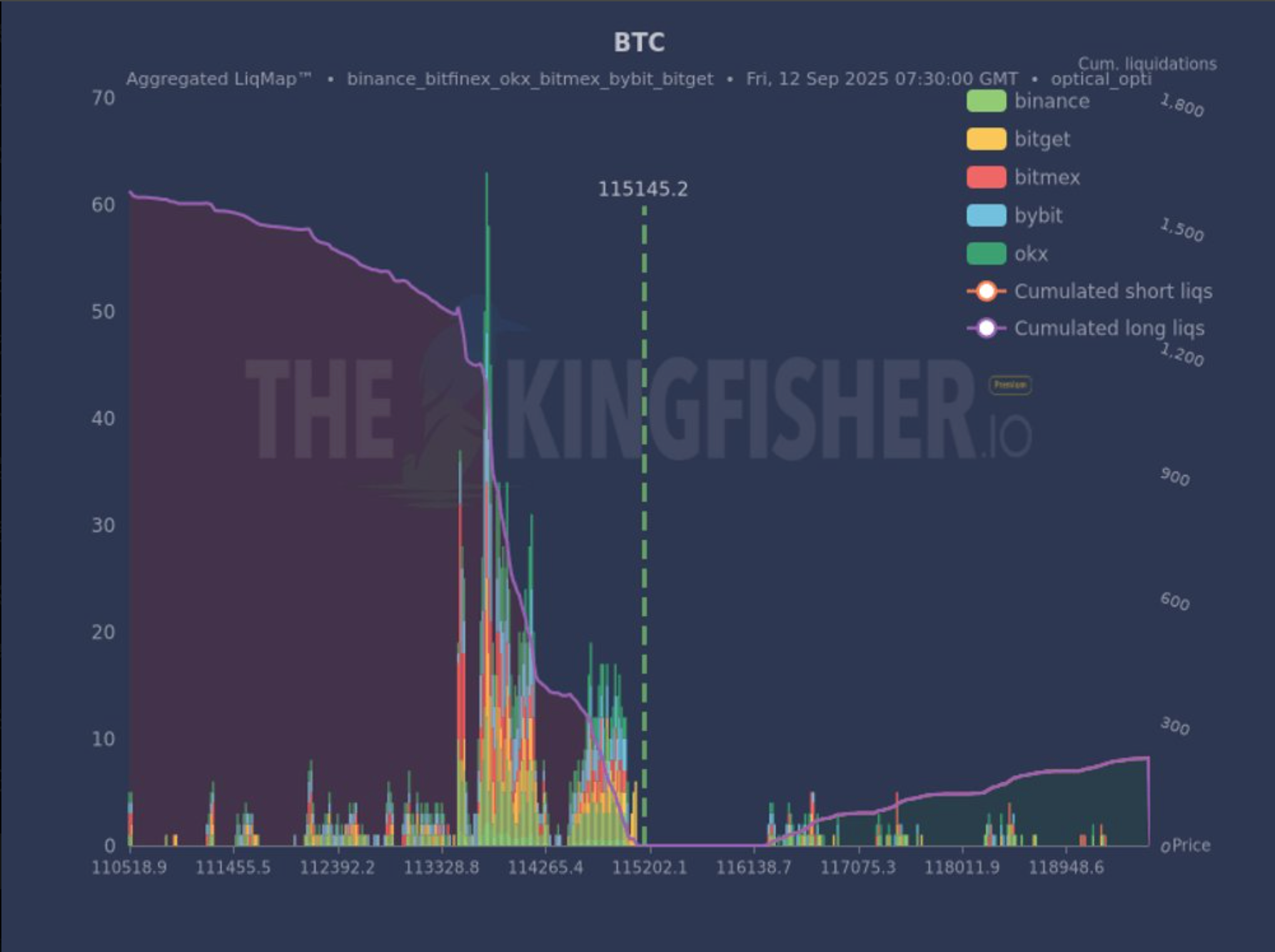

- Data from The Kingfisher shows a cluster of liquidation levels between $113,300 and $114,500 that could spark a cascade back to $110,000 support.

Investors are increasing their use of borrowed funds (leverage) with the aim of boosting Bitcoin’s value up towards previous record peaks. However, this aggressive strategy generates a situation fraught with risk, as a decline in price could trigger a reversal or unwinding of these derivative contracts if trends begin to reverse.

Market analyst Skew advised the trader eager to initiate a large long position, worth hundreds of millions, to “perhaps hold off until the market price takes the buying burden, thus avoiding potentially harmful trading volumes.

For potential large investors considering purchasing Bitcoin, it might be wise to hold off until the spot market takes up the buying, avoiding potentially harmful price movements in the process.

— Skew Δ (@52kskew) September 12, 2025

The bears are also employing strategies that involve increasing their bets, as a specific investor is now dealing with an unrealized loss of $7.5 million after shorting Bitcoin for approximately $234 million when its price was around $111,386. To keep their position, this trader has invested an additional $10 million in stablecoins. The current point at which they would be forced to exit (liquidation) is set at $121,510.

However, it’s important to note that a significant risk of margin calls or liquidations lies on the downside. This is based on information from The Kingfisher, indicating a substantial amount of derivatives could be forced to liquidate between roughly $113,300 and $114,500. This event might trigger a domino effect of further liquidations back towards the $110,000 level as potential support.

As a crypto investor, I recently came across a chart that underscores where traders have over-extended their leverage. This chart serves as a sort of ‘pain map’, indicating areas where price is likely to be drawn towards to liquidate positions. By utilizing this information, we can avoid finding ourselves on the losing end of significant market movements.

Right now, Bitcoin is hovering steadily near the $115,000 mark, experiencing a phase of reduced price fluctuations. It hasn’t managed to burst through its current price range for over two months.

Read More

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- Crypto prices today (18 Nov): BTC breaks $90K floor, ETH, SOL, XRP bleed as liquidations top $1B

- Travis And Jason Kelce Revealed Where The Life Of A Showgirl Ended Up In Their Spotify Wrapped (And They Kept It 100)

- Will there be a Wicked 3? Wicked for Good stars have conflicting opinions

- My Favorite Coen Brothers Movie Is Probably Their Most Overlooked, And It’s The Only One That Has Won The Palme d’Or!

- Decoding Cause and Effect: AI Predicts Traffic with Human-Like Reasoning

- Games of December 2025. We end the year with two Japanese gems and an old-school platformer

- ‘Veronica’: The True Story, Explained

- Mayor of Kingstown Recap: Talk, Talk, Talk

2025-09-12 17:38