In the grand bazaar of digital folly, Ethereum has once again ascended to the giddy heights of the 50-week exponential moving average (EMA) against Bitcoin, a feat as predictable as a socialite’s scandal. This technical trifle, we are assured, heralds the dawn of a bull run-or so the soothsayers of the cryptosphere would have us believe. 🌍✨

At the hour of this scribbling, ETH stands at a modest $3,530, with a trading volume that would make a Rothschild blush-nearly $38 billion in a single day. A 2% uptick in 24 hours and 5% over the week? One might as well celebrate a sneeze in a hurricane. 🌪️💸

ETH/BTC: A Dance Above the Abyss

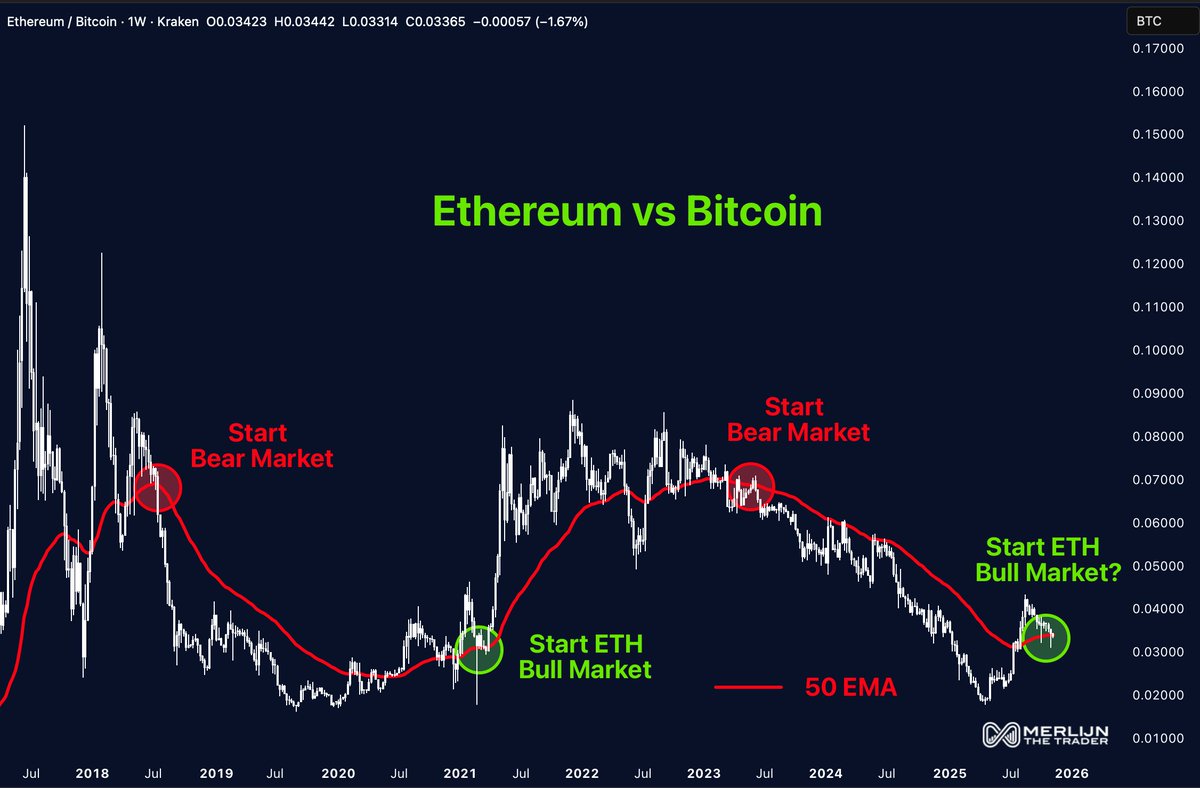

The cognoscenti, ever keen to divine meaning from the chaos, note that Ethereum’s reclaiming of the 50-week EMA is a harbinger of bullish bliss. History, they insist, repeats itself-or at least stutters convincingly. The same pattern, we are told, preceded the 2021 rally to Ethereum’s all-time highs, a moment of such grandeur it might as well have been painted by Rubens. 🎨📈

Merlijn, that modern-day Merlin of charts, observes that previous breakdowns below this sacred line in 2018 and 2022 were followed by declines so prolonged one might have mistaken them for a Waugh novel. “A bullish retest here… and it’s game on,” he declares, with the gravity of a man announcing the end of the world-or at least the end of his lunch hour. 🧙♂️🎯

Meanwhile, Ethereum’s recent plunge from $4,960 to a shade over $3,000 is likened to its 2020 dip, a comparison as apt as it is tiresome. CryptoPotato, ever the chronicler of such trivialities, assures us that this is but a prelude to another grand ascent. 🥔📉

Ethereum’s Base: A Range of Ridiculous Optimism

Marzell, another of our chart-wielding oracles, points to a long setup forming between $3,336 and $3,400, a range as narrow as a Victorian corset. Fibonacci retracement levels, those mystical numbers beloved by technicians, align with this zone, adding a veneer of legitimacy to the proceedings. 🧵📏

Targets, should this setup prove correct, include $5,982, $6,738, and $7,200-figures as arbitrary as they are ambitious. The condition? That ETH remains above $3,000, a threshold as precarious as a tightrope walker’s balance. A long-term breakout from a downtrend line is also noted, though whether this is a cause for celebration or mere wishful thinking remains to be seen. 🪜🔮

Short-Term Breakout: A Rally or a Ruse?

Joe Swanson, ever the optimist, identifies a falling wedge pattern on the 4-hour chart, a breakout near $3,560 that has ETH trading slightly above said level. The measured target? A modest $4,415, with a potential move by mid-December. “A decisive move could trigger a 25% rally,” he proclaims, with the confidence of a man who has never met a bear market. 🐻📅

“A 25% rally,” indeed. One might as well predict the weather by consulting tea leaves. 🍵☁️

The 200 EMA, lurking near $3,790, may serve as the next resistance level, though whether it will prove as formidable as the Maginot Line remains to be seen. 🛡️⚔️

In a development as intriguing as it is inscrutable, 413,000 ETH has been withdrawn from Binance in a single day, the largest outflow since February. Long-term holding behavior, we are assured, though one might equally attribute it to a sudden outbreak of collective paranoia. 🏦🚪

And so, dear reader, we leave you with this: Ethereum’s dance with the 50-week EMA is but the latest chapter in the grand farce of cryptocurrency. Whether it marks the beginning of a bull run or merely another episode of market mirth, only time will tell. Until then, we shall watch with the detached amusement of a Waugh protagonist, cocktail in hand, as the drama unfolds. 🍸🎭

Read More

- How to Complete the Behemoth Guardian Project in Infinity Nikki

- Chimp Mad. Kids Dead.

- ‘John Wick’s Scott Adkins Returns to Action Comedy in First Look at ‘Reckless’

- Oasis’ Noel Gallagher Addresses ‘Bond 26’ Rumors

- Marvel Studios’ 3rd Saga Will Expand the MCU’s Magic Side Across 4 Major Franchises

- The Greatest Fantasy Series of All Time Game of Thrones Is a Sudden Streaming Sensation on Digital Platforms

- Gold Rate Forecast

- 10 Worst Sci-Fi Movies of All Time, According to Richard Roeper

- ‘The Night Manager’ Season 2 Review: Tom Hiddleston Returns for a Thrilling Follow-up

- New horror game goes viral with WWE wrestling finishers on monsters

2025-11-13 14:33