On Tuesday, Bitcoin’s spot price slipped more than 5% against the U.S. dollar, wiping out over $7,000 in value since the day’s first trade. The drop hit miners right in the hashpower-revenues tanked to levels they haven’t seen since April 8, 2025, leaving many rigs humming just to stay alive. If this were a rom-com, someone would’ve just said, “I’m not crying, you’re crying!” 😭

Bitcoin’s Falling Hashprice Puts Squeeze on Mining Margins

As of 2:30 p.m. Eastern time, bitcoin has been on a wild ride, swinging between $100,175 and $107,302 per coin while sliding 5% against the greenback. On some exchanges, like Bitstamp, bitcoin dipped below the $100K mark. It’s like watching your neighbor’s overpriced Tesla depreciate faster than their patience for your yard gnomes. 🚗💨

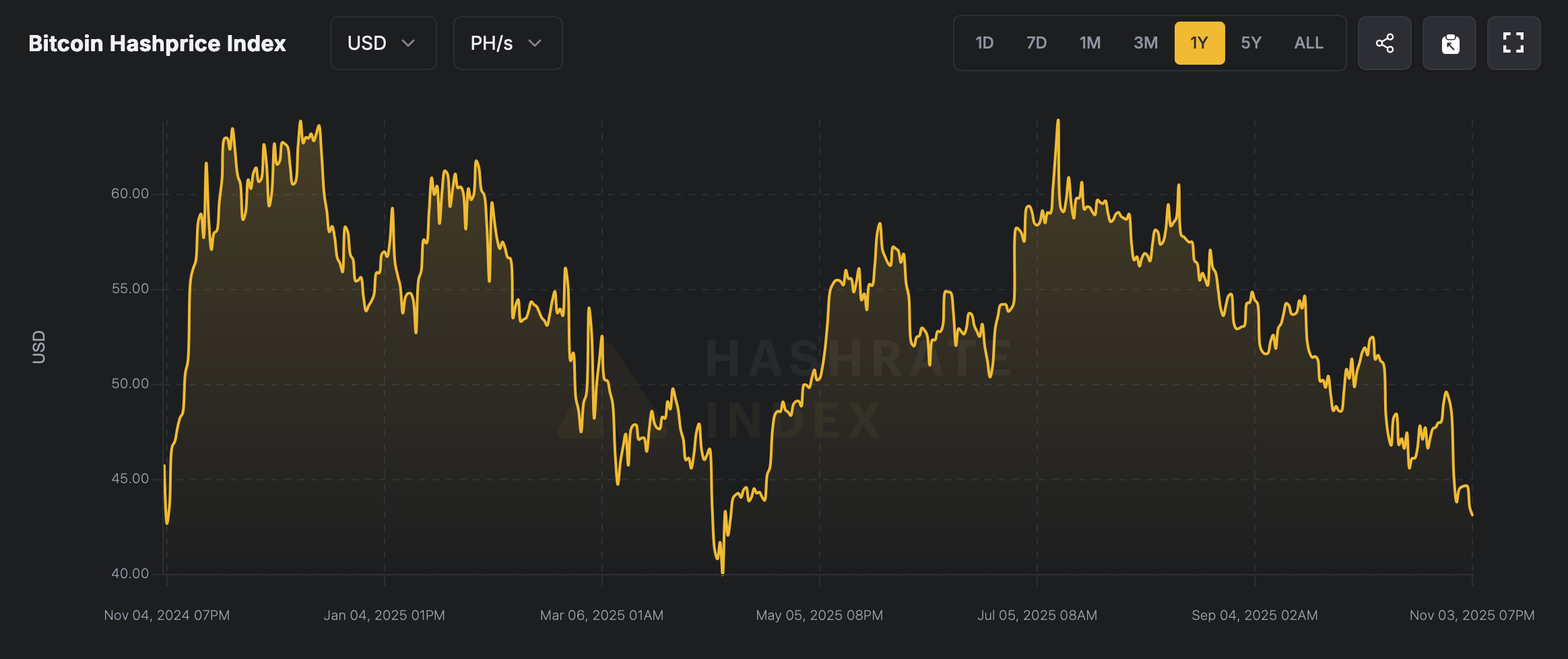

Data from hashrateindex.com shows bitcoin’s hashprice-now a paltry $40.85 per PH/s-down 17.66% from just eight days ago. Miners are feeling this like you’d feel if your morning coffee habit suddenly cost $50. Back in July, the hashprice was $63.92 per PH/s. Now? It’s 36.09% less, which is about the same amount of joy I derive from my in-laws’ holiday sweater collection. 🎄🧣

It’s hardly a dream week for bitcoin miners watching value melt away, but this slump has been brewing since July. Back on July 11-116 days ago-the hashprice clocked in at $63.92 per PH/s. Fast forward to Nov. 4, 2025, and miners are pocketing 36.09% less for the same hashpower. Even with hashprice slipping, bitcoin’s network is still flexing some serious muscle-cranking out over a zettahash, or more than 1,000 exahash per second (EH/s). It’s the hashpower equivalent of a group of confused squirrels trying to build a skyscraper. 🐿️🏗️

At press time, roughly 1,111.99 EH/s are securing the chain, keeping things humming along. Block intervals remain near the 10-minute sweet spot, and for now, difficulty projections for Nov. 12 suggest barely a blip of change. If prices keep dipping while difficulty stays high, miners could be staring down a profitability crunch-especially those running older rigs or paying steep energy rates. It’s like telling your gym membership to stop existing while still expecting abs. 🏋️♂️💸

The combination of lower hashprice and unrelenting hashrate could force smaller operations to shut off machines, consolidating power among industrial-scale farms. On the flip side, a rebound in bitcoin’s price or a difficulty adjustment easing the strain could turn the tide. Cheaper energy, more efficient hardware, or renewed market optimism might help miners breathe again-but for now, it’s a waiting game in a high-voltage business. Just don’t ask me how to fix it; I once tried to mine cryptocurrency with a toaster. 🔌💥

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- These are the 25 best PlayStation 5 games

- The MCU’s Mandarin Twist, Explained

- Gold Rate Forecast

- Mario Tennis Fever Review: Game, Set, Match

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- All Songs in Helluva Boss Season 2 Soundtrack Listed

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

2025-11-05 00:58